Podcast transcript from Climate Positive: Integrating emissionality into the Greenhouse Gas Protocol

Chad Reed: I’m Chad Reed.

Hillary Langer: I’m Hillary Langer.

Gil Jenkins: I’m Gil Jenkins.

Chad: This is Climate Positive.

Faraz Ahmad: I think fundamentally, we need an accounting system that reflects the grid emissions is dependent on both time and location, and that every unit of electricity does not have the same emissions impact.

Chad: More than 90% of Fortune 500 companies report their emissions under the Greenhouse Gas Protocol (GHGP), which supplies the world’s most widely used greenhouse gas accounting standards. But despite significant advances in data analytics around emissions measurement, it’s been nearly a decade since the GHGP was last updated. Thankfully, the NGOs that manage the GHGP recently kicked off the update process, soliciting feedback from stakeholders across the spectrum.

In this episode, HASI Strategic Advisor Brendan Herron and I speak with Faraz Ahmad, Head of Net Zero Grid for Amazon. Faraz dives deep into the efforts of the Emissions First Partnership, a consortium of companies working together to reduce their emissions with the most impactful clean energy projects and to move away from megawatt hour matching and toward integration of an emissions-based framework into the GHGP. Faraz also discusses how underserved regions – both across the globe and within the US itself – could economically benefit from an emissions first approach to the energy transition.

Chad: Faraz, thank you for joining us today. It’s a pleasure to have you.

Faraz: Likewise, Chad. It’s a pleasure to be here.

Chad: Faraz, you’ve spent just about your entire career in energy and/or climate. Tell us about your primary impetus for focusing your career in this space.

Faraz: You’re right. I have spent nearly all of my career. I grew up in northern England, and so my very first job was at a nuclear reprocessing facility. It was the main employment in the area. It’s been with me for a long time, and I’ve always been aware of energy in that way. Fundamentally, I wanted to work on a priority that was important to society, and energy is just one of those priorities that just also aligns with my technical and commercial interest.

The key realization for me was that you just can’t have prosperity without energy. It really is the basis for human civilization. I’ve been working in energy for almost 17 years now, and it’s just amazing to me how it has changed during that time from a topic that no one really talked about, really, when I graduated, to now, something that’s very much top of the societal and political agenda.

Chad: What did you do for the nuclear reprocessing facility as your first job?

Faraz: My first job, essentially, just so everyone will know, is that there is a process called vitrification, which is where you take the nuclear waste and you mix it with glass that’s then stored in cast steel drums and goes hundreds of meters deep around. By background, I studied electrical, electronic engineering. Essentially, they had mechanical cogs, if you could believe it. These are things that were 50 years old that essentially just needed to be replaced with electronic systems, and that was my role, essentially, was to do that upgrade and commission that.

Chad: Wow, that’s fascinating, but you also did spend a number of years on the fossil side of the industry with GE and Baker Hughes, I believe. Tell us more about that experience and how it eventually informed your entry or reentry into renewables.

Faraz: Most of my career has been focused on power, but you’re right, I did spend about five years in the oil and gas business, it was Subsea, LNG and natural gas, and so I had the fortune of traveling around the world. On reflection, I think there were a few things that really stood out for me from that experience. The first is really around energy access, and so I traveled to many regions of the world —Latin America, Sub-Saharan Africa, Southeast Asia. And for most people, really, energy is not really a choice, they need energy to live,

Just to set that global context, there’s 800 million people around the world approximately without access to electricity today, and there’s about another billion people around the world now who have access to electricity, but not the amount that they need so they may have brownouts for four, six, eight hours a day. That’s 1.8 billion people around the world now who lack the electricity that they need. When I talk to investors around the world, I ask them around, “Why is there a lack of investment in these locations?”

It fundamentally comes down to the fact of the risk-reward is just not skewed correctly in their view as well, as well as also perhaps some concerns around the legal and other frameworks. For those people in those locations who are developing coal plants or developing natural gas fields, et cetera, it really just is a matter of survival, and they have to try and develop these resources to develop their civilization in the area. The second aspect as well, which I think is really relevant to this energy transition, is regarding human capital, and we should not underestimate the need for talent.

There’s going to be a need to essentially refocus the skilled workforce that we have into the clean tech climate tech sector, and the oil and gas sector has a lot of technical and project management and other relevant capability as well. I used to work in offshore drilling, and I remember that if you look at the challenges that they’re facing, they’re drilling 20,000ft down beneath the ocean, hitting the seafloor at extreme temperatures, extreme pressures, and that’s similar to the height at which a plane flies above the ground, and they’re drilling one meter by one meter square. Incredible technical position and that’s the talent and capability that we need now to really accelerate the energy transition.

Thirdly, I think from that experience as well, the other aspect that really stood out for me was around how it’s not just change, but it’s the rate of change that matters. I was involved in digitization and on implementing satellite monitoring for offshore oil rigs after the BP Macondo disaster where we needed to get better data and monitoring on these critical assets.

While often there was extreme or very high-level sponsorship from Sea Level and other executives as well, when it actually came to the implementation, it was actually very difficult and very slow as well, because there’s a certain process, a certain culture around doing things that may be very applicable in certain oil and gas context, but not perhaps if it’s just a more simple electronic or software upgrade as well. That rate of change really stuck out to me as something that I felt that that rate of innovation was really the issue, and that’s something also stuck with me from that experience.

Chad: Great. As we try to expand energy access while at the same time accelerating the rate of decarbonization across the world,a very important aspect and driving factor in this is what’s called the Greenhouse Gas Protocol. Now, many folks may not know much about it. Could you talk to us a little about the Greenhouse Gas Protocol or GHGP? Why was it established and what impact has it had with regard to corporate procurement of renewables?

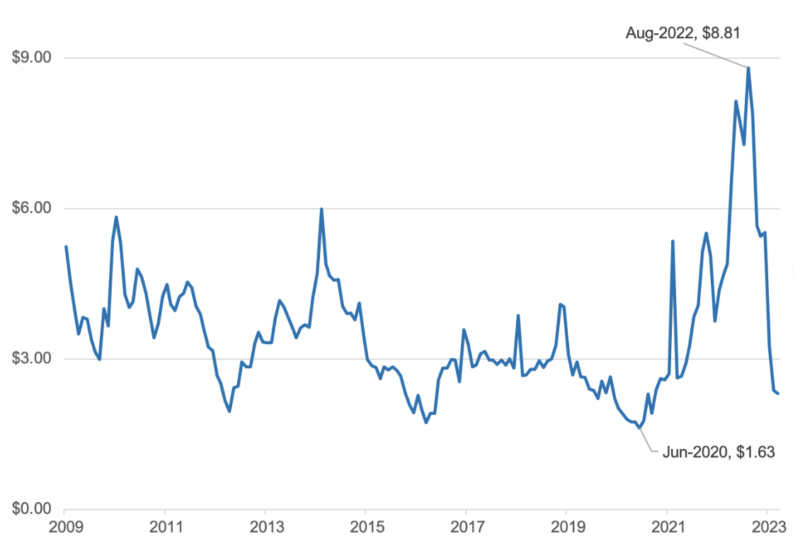

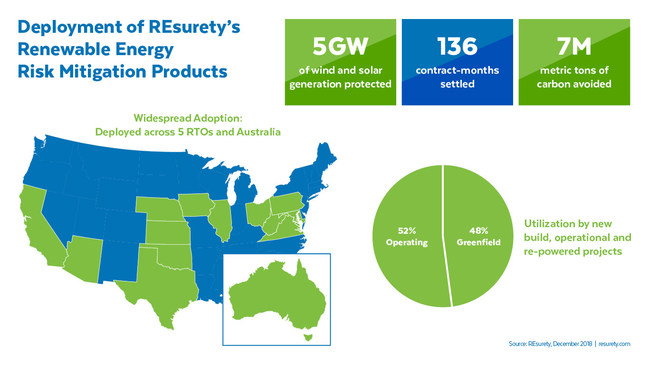

Faraz: The Greenhouse Gas Protocol is essentially a guidance that governs the way how many corporates report the emissions footprint. It’s divided to Scope 1, Scope 2, Scope 3, which we can also discuss and define as well. Essentially, as sustainability is risen up the agenda, it’s very much become the resource that regulators and other entities go to ensure that there’s a standardization or harmonization of reporting. Something quite significant happened over the past 10 years or so, whereas if you look before 2015, the amount of corporate renewables was actually very small, less than a gigawatt cumulatively.

Since 2015, there’s essentially been just an explosion in demand. Now, when you look at Bloomberg data in 2021, there’s over 31 gigawatts of corporate renewable procurement globally that occurred. There may be other things as well that happened. Obviously, renewables has become much more cost competitive. One of the things that has, I think, contributed to that is around the way in 2015 there was an update to the protocol where this introduction of what’s called a market-based method where corporates could actually use their procurement as way to reduce their Scope 2 emissions.

Overall, I think I would just summarize and say it’s just been a huge success story. We want more renewables added to the grid. I’ve heard from sources that I think from CEBA that over 35% or 30% or so of renewables now being added to the US grid is a direct consequence of corporate offtake. It has most definitely been a huge success story.

Brendan: Scope 2, which is where the corporations measure their own electric and usage has clearly been a success as you just stated, but there’s also some problems with it. Maybe you could explain a little bit about what the problems are with Scope 2?

Faraz: Yes, let me try and expand on that. I think one of the key developments is that we’ve got better grid emissions data. I think the protocol can improve because now we can actually better measure emissions, and that’s the objective here.

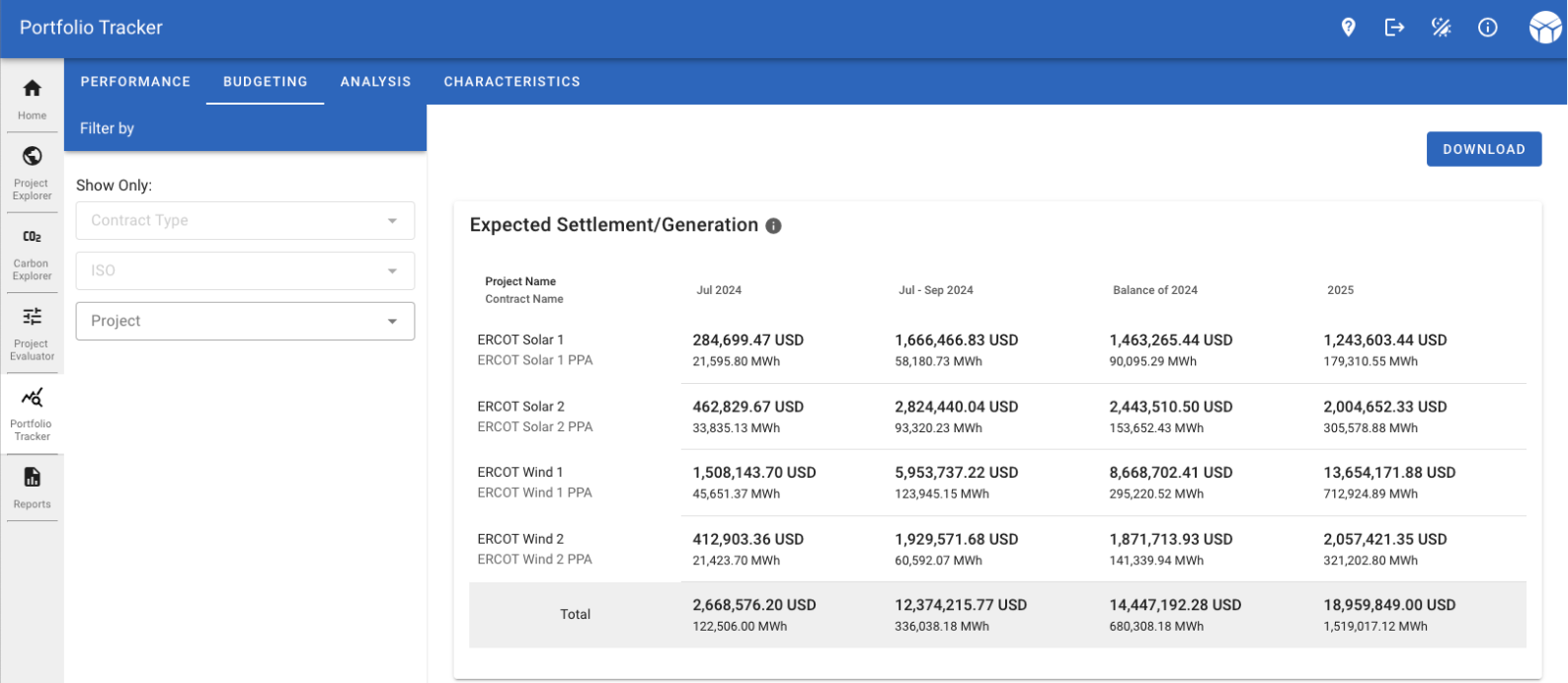

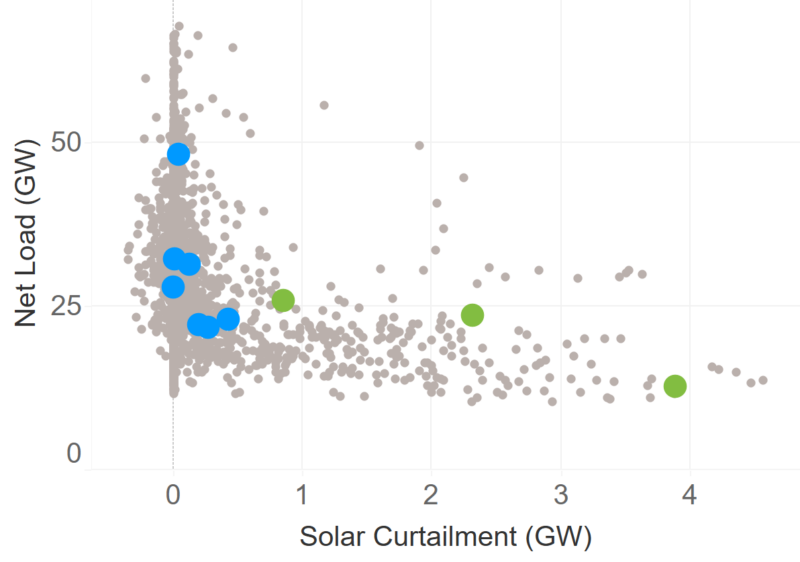

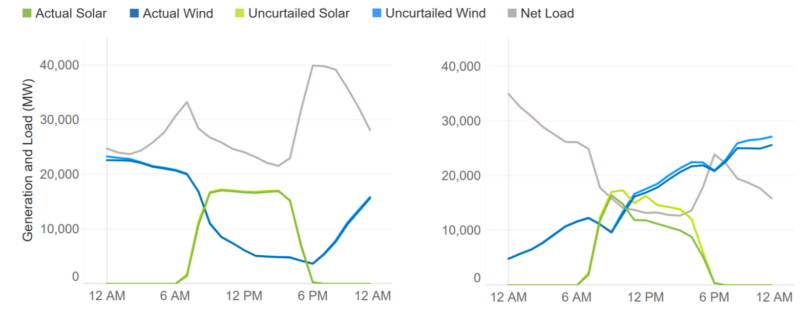

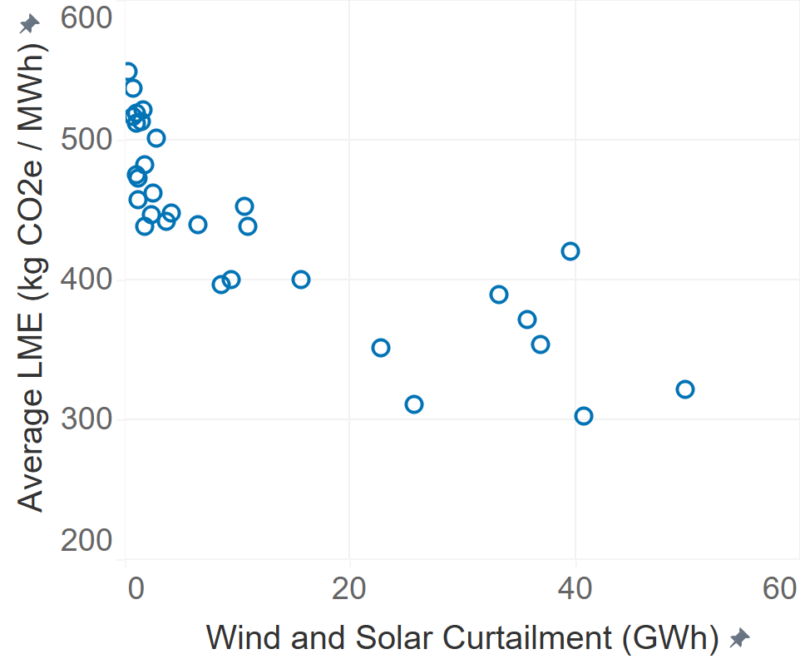

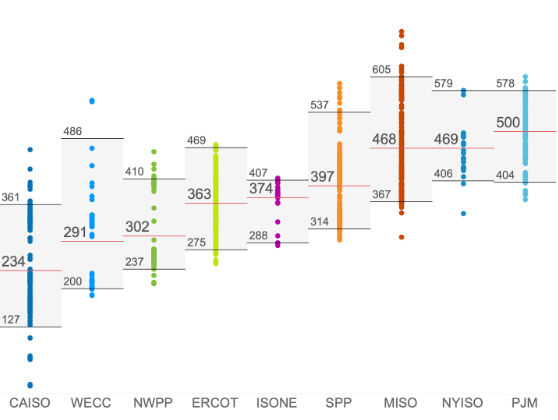

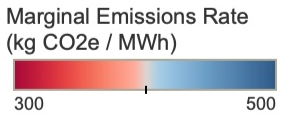

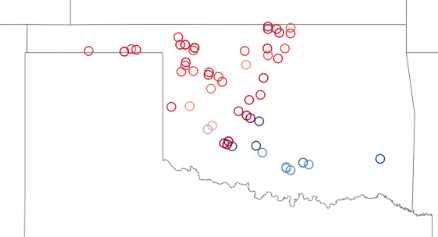

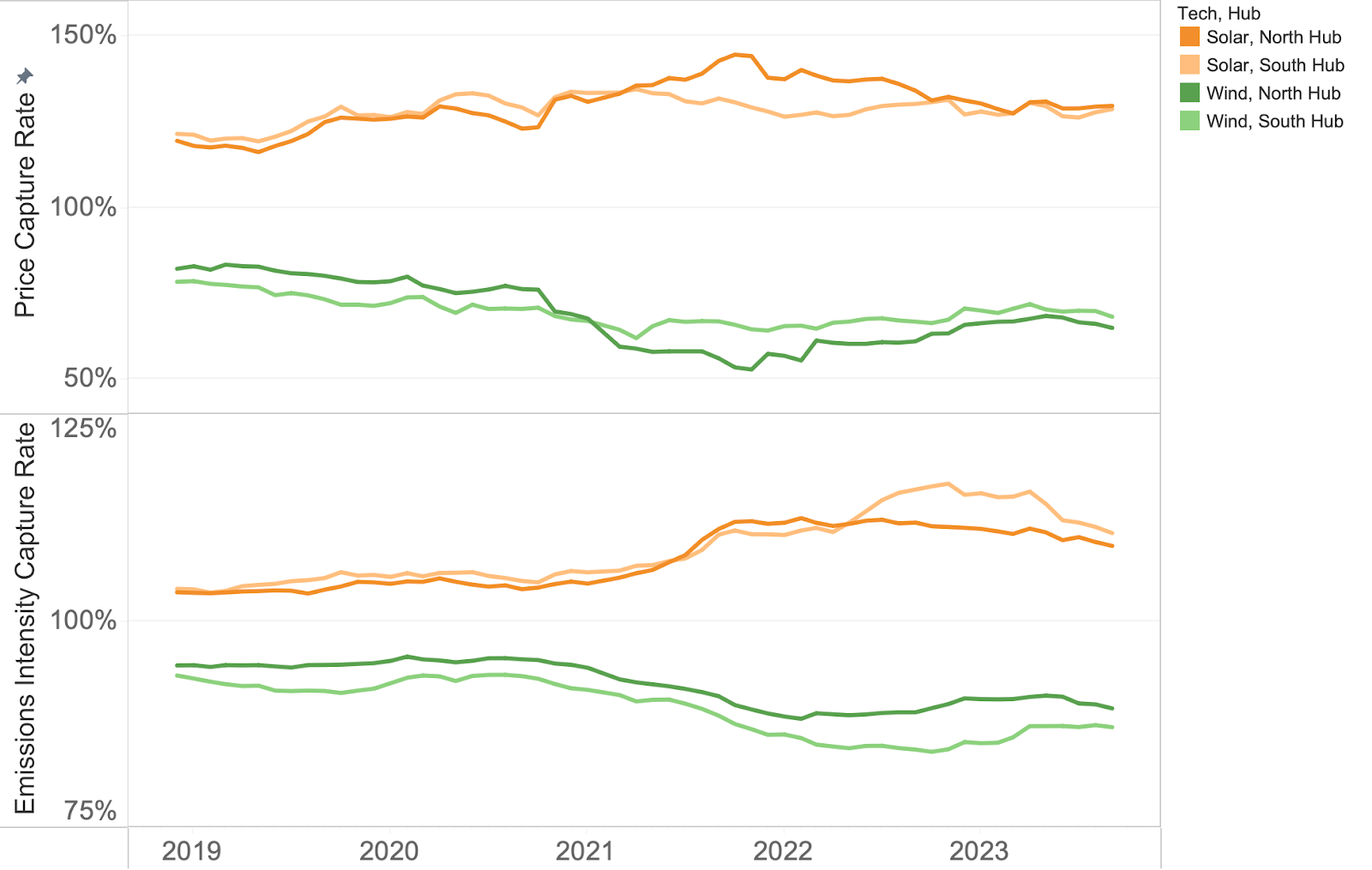

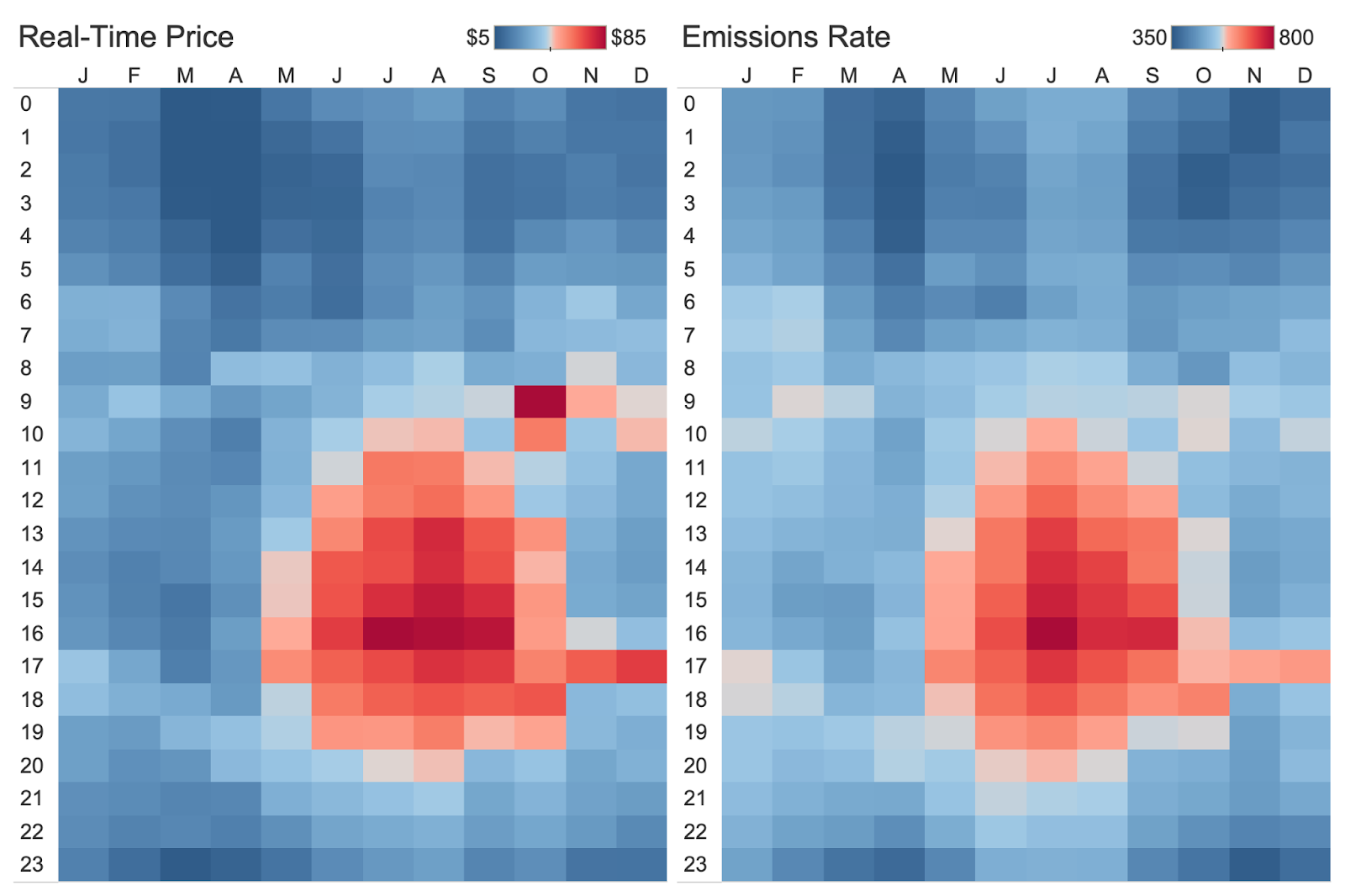

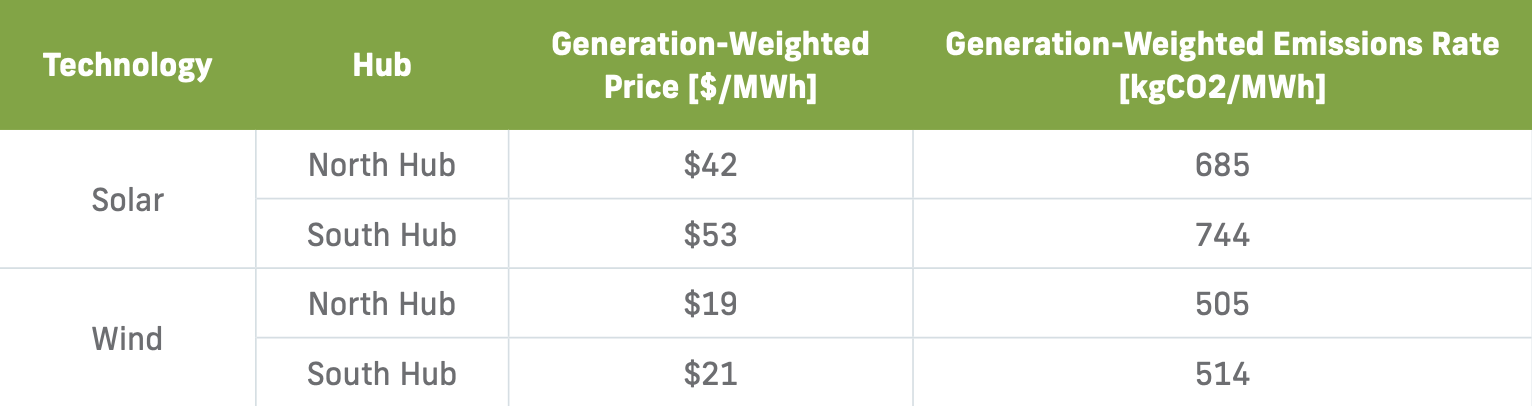

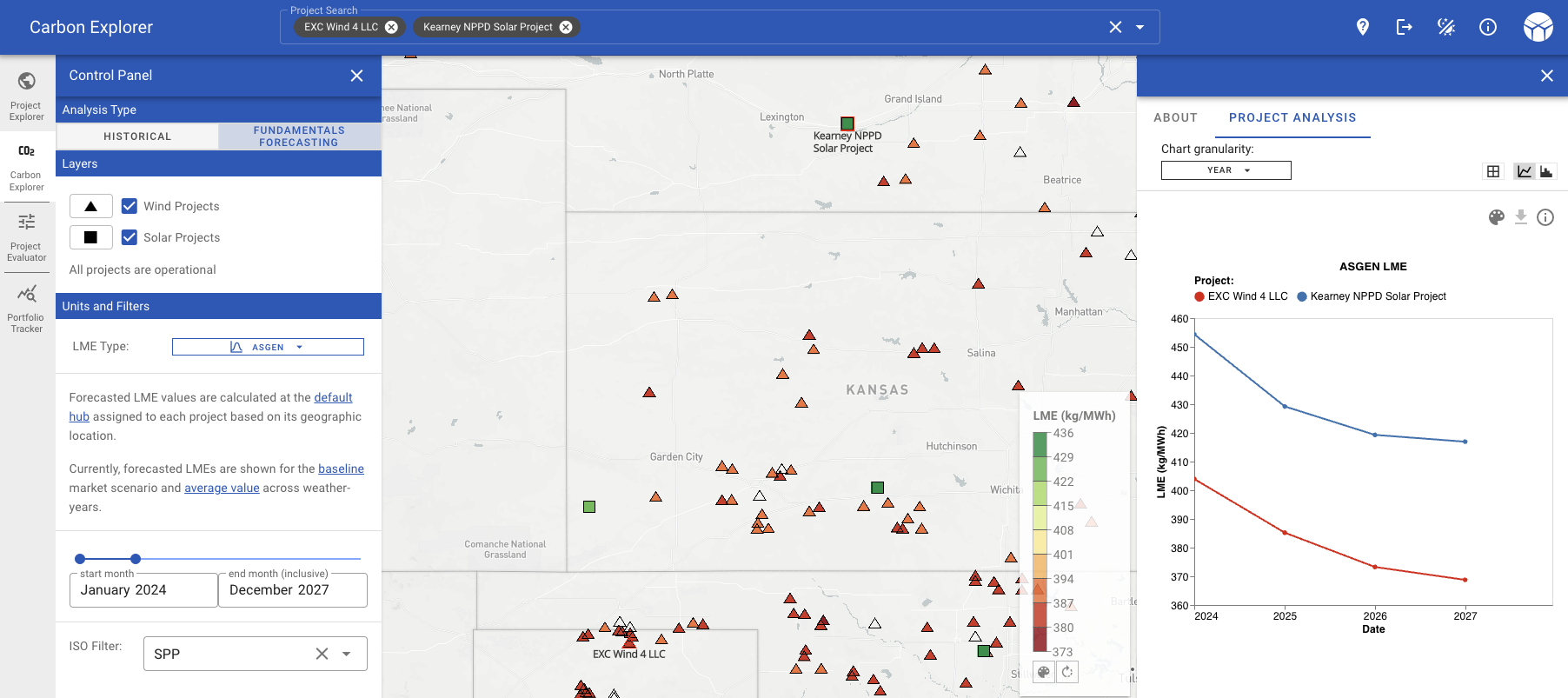

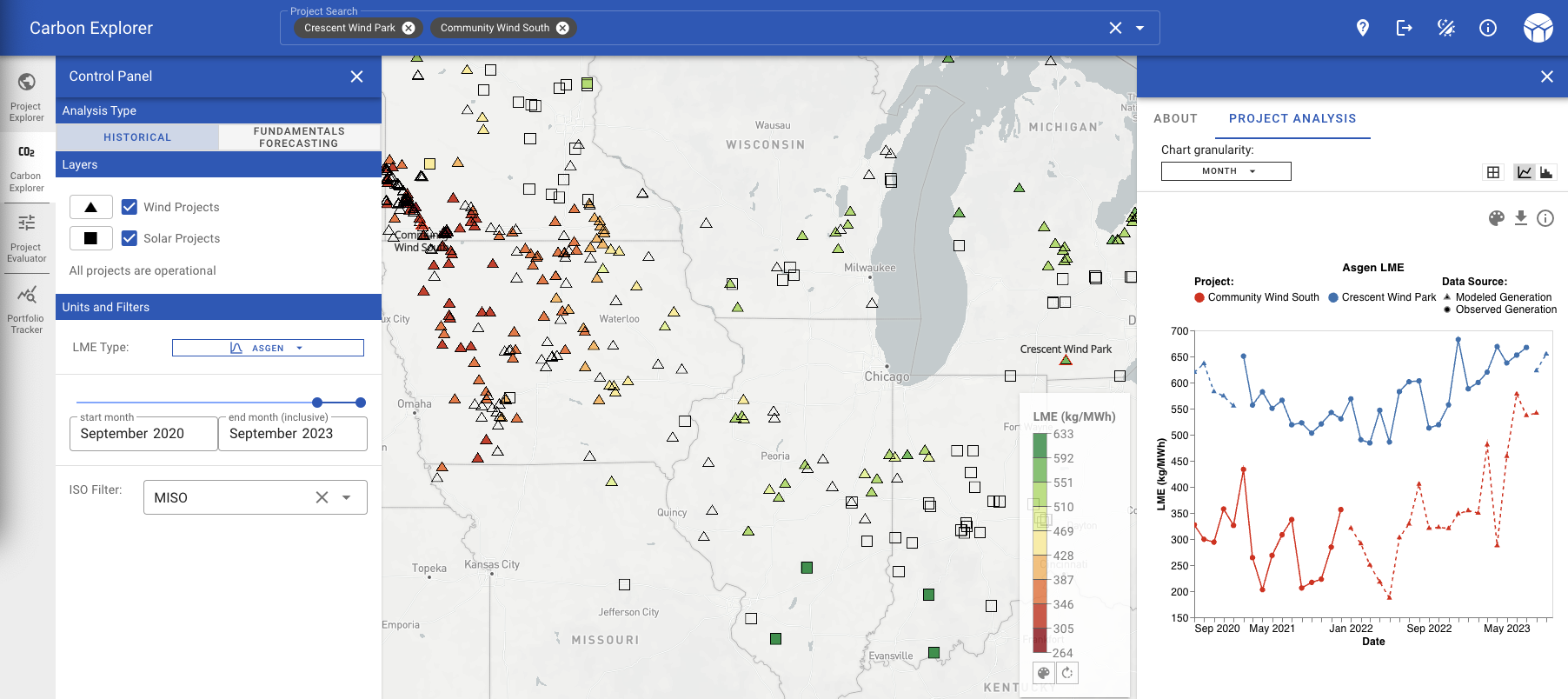

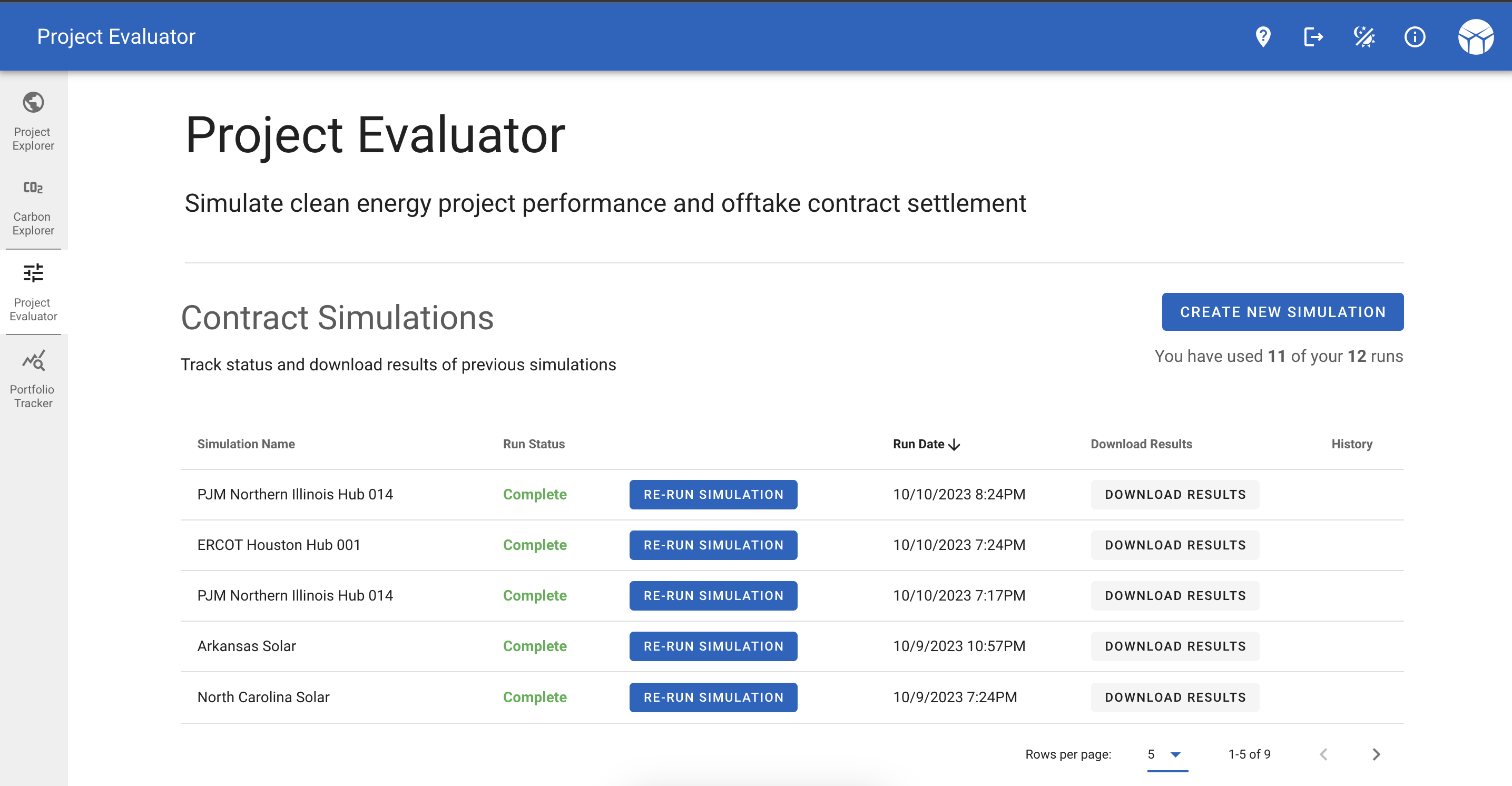

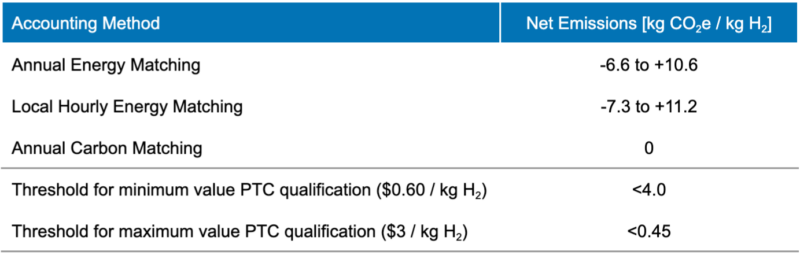

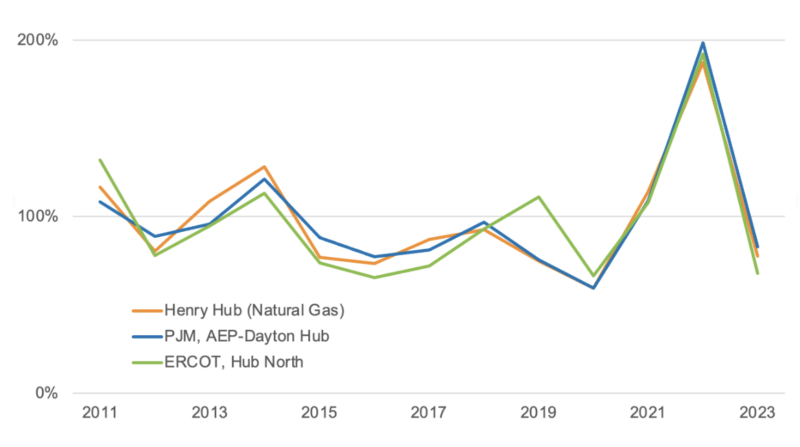

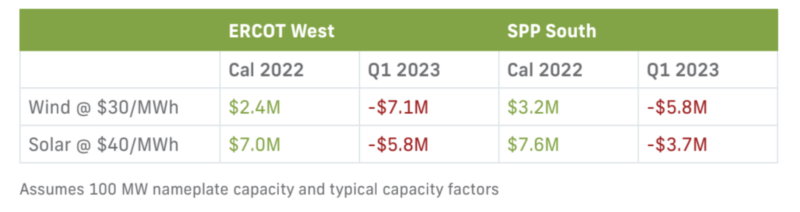

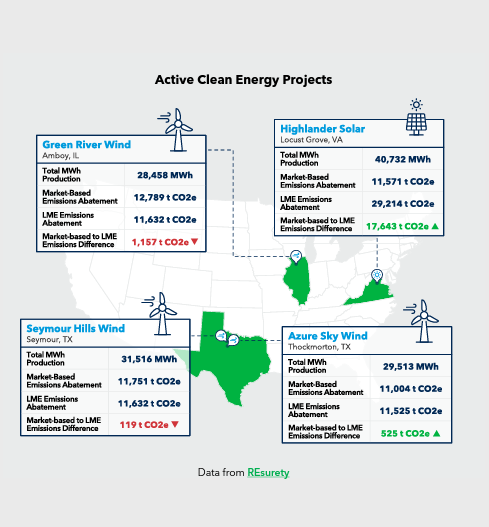

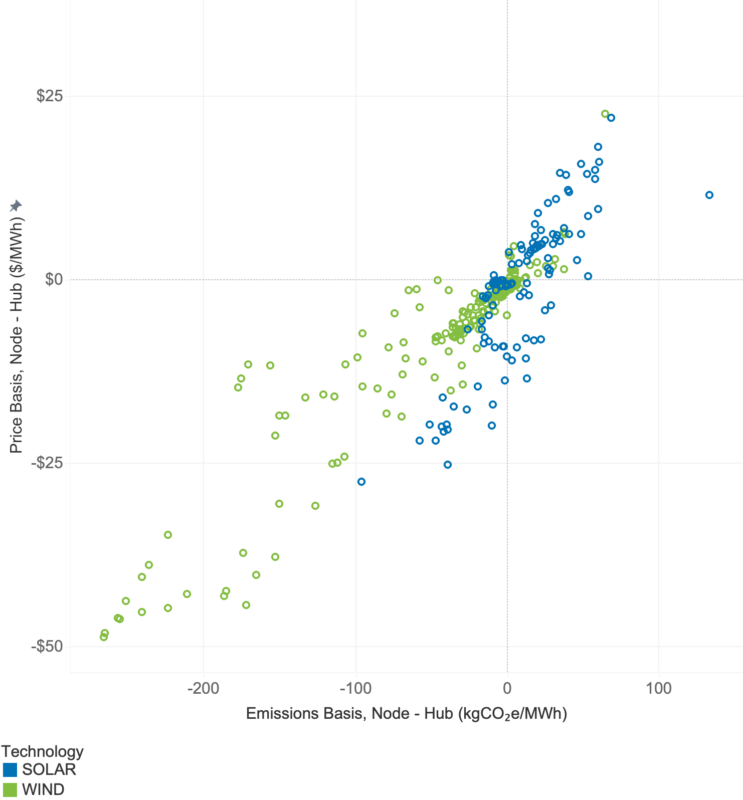

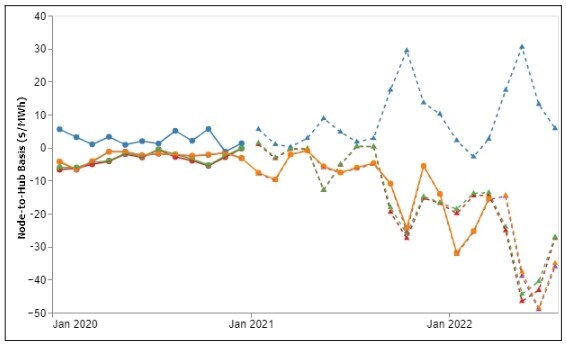

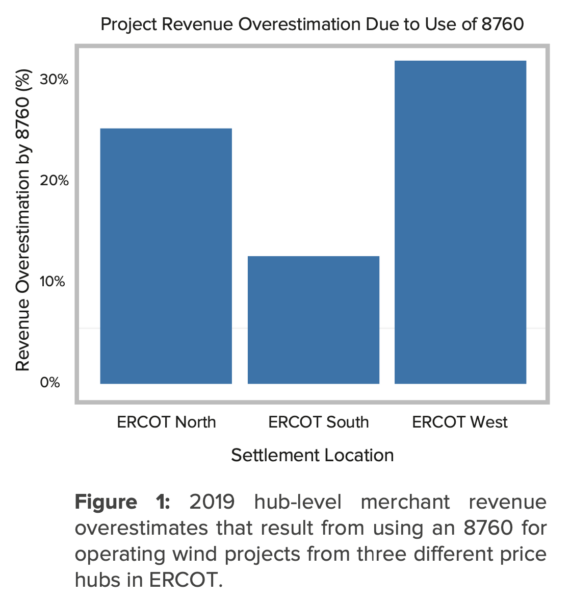

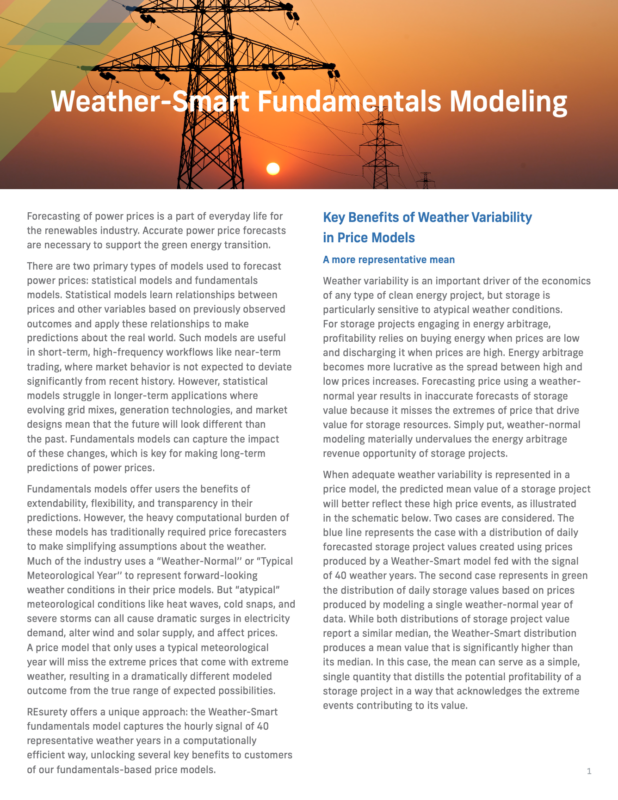

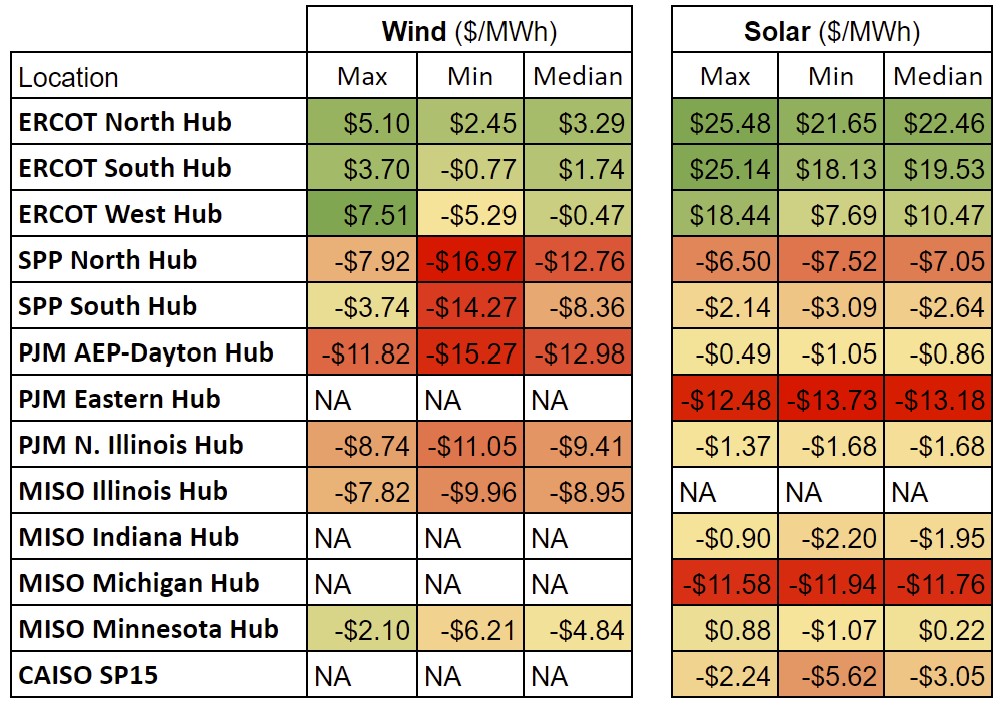

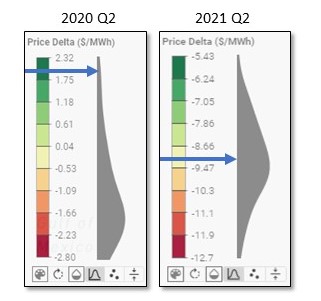

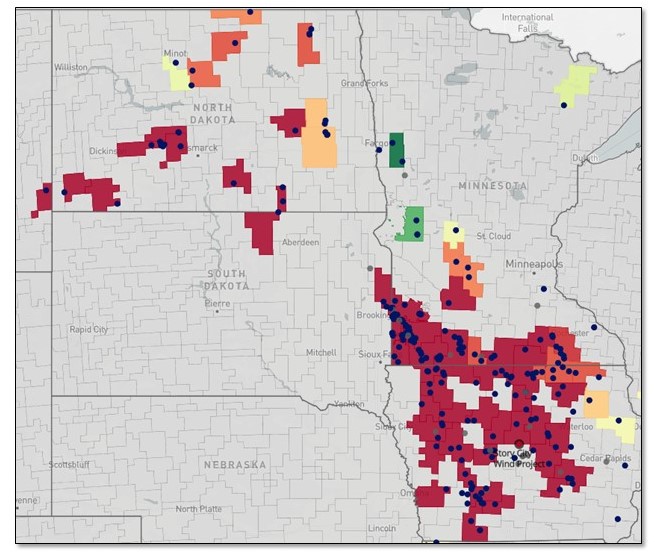

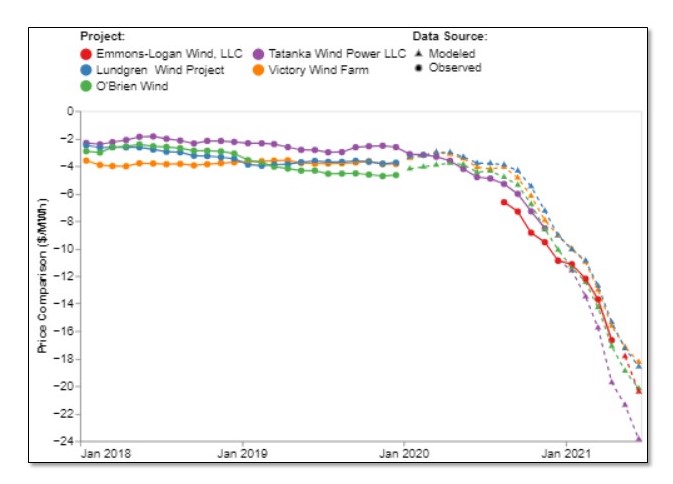

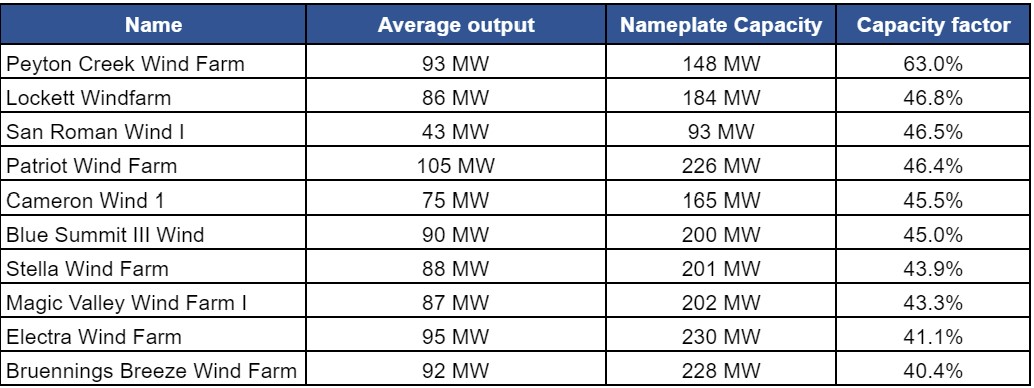

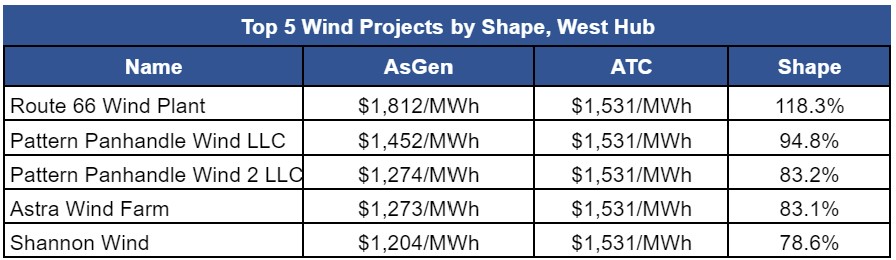

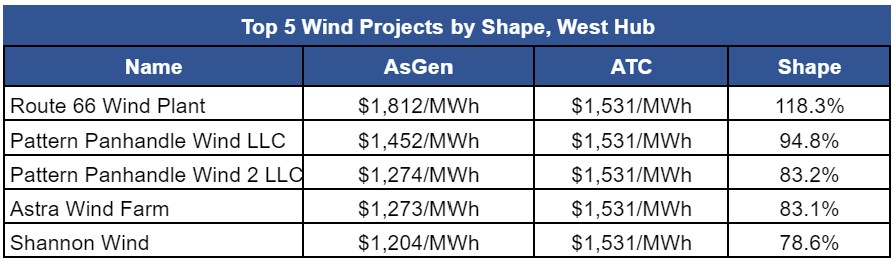

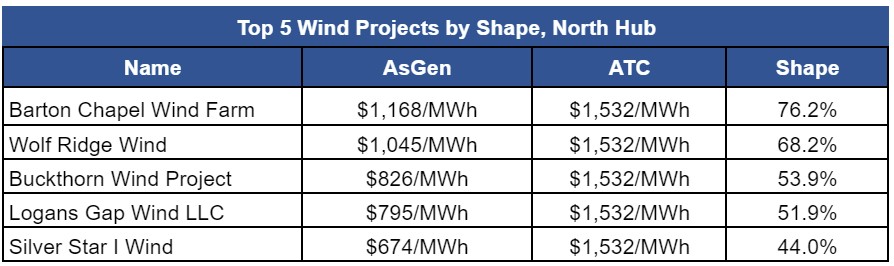

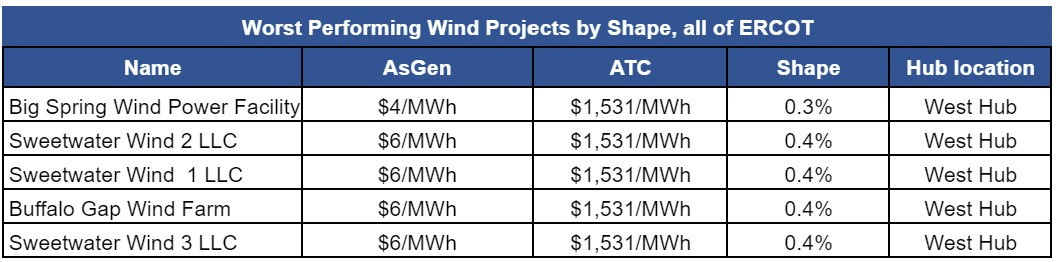

Under the current guidance, a megawatt-hour (MWh) of renewable electricity counts toward reducing a MWh in the same market of an organization’s electricity consumption, regardless of the time or makeup of the grid where the renewable electricity was generated. Therefore, there is not a common way to account for where new renewable-energy projects will have the greatest impact. If, on the other hand, we measure emissions data, we can account for the emissions that are displaced by a renewable electricity generation and create more of an incentive to invest in emission reduction measures where they’re most acutely needed. Without this more granular data, organizations will tend to procure renewable electricity in areas where it’s easy to transact.

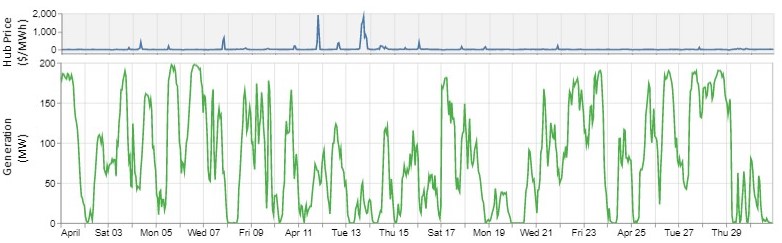

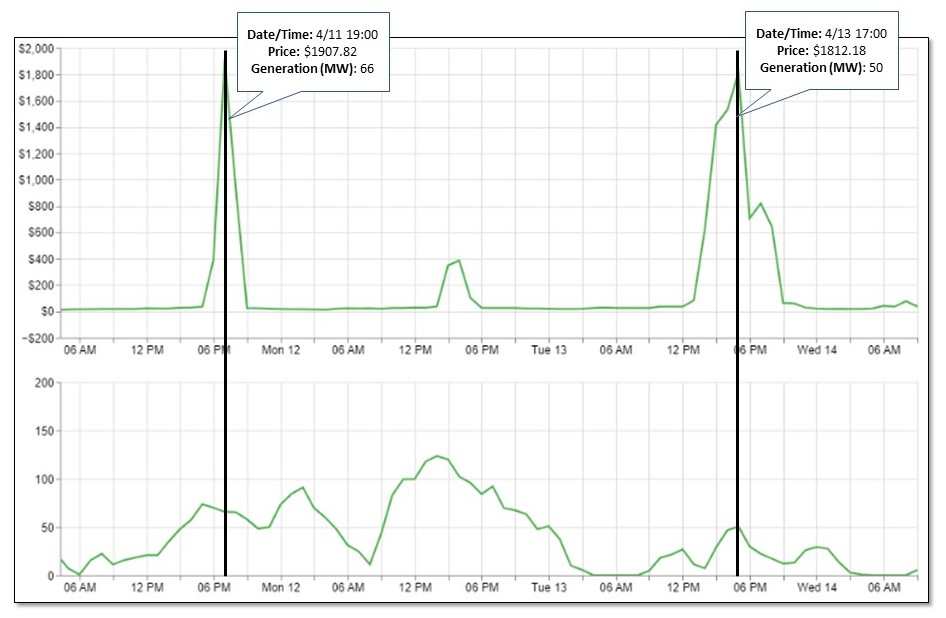

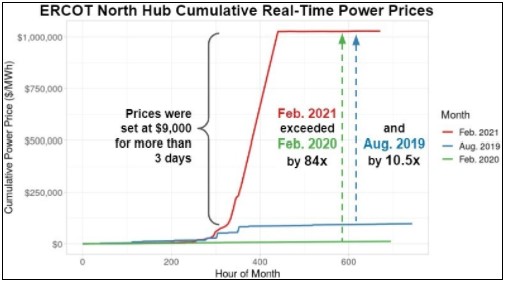

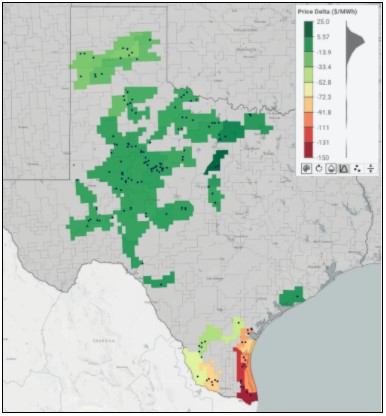

That results in oversaturation of renewables in certain markets, that reduces the amount of avoided emissions, and it underinvest in markets that most acutely need the renewables. I think fundamentally, we need an accounting system that reflects the grid emissions is dependent on both time and location, and that every unit of electricity does not have the same emissions impact.

Brendan: Today we’re measuring emissions reductions by the megawatt hour. You’re trading off a megawatt hour renewables versus a megawatt hour of conventional power usage. What you’re saying would work better would be to move to emissions-based version so that we’re measuring the emissions of the conventional power and the emissions reduction of the renewables and matching those up. Is that what you’re saying?

Faraz: Yes, it’s essentially a new dimension. I think the best way to describe this is just with a couple of examples. Going back to my point on how time and location matters. Under the current protocol, a business that consumes electricity in Wyoming can sign a PPA, Power Purchase Agreement in Texas to match the electricity consumption. If that volume of electricity procured in Texas equals the amount consumed in Wyoming, then they are assumed to have the same emissions impact. Now that the data landscape has matured, we now have data showing that in reality there are significant differences in emission intensity of the grids between these geographies.

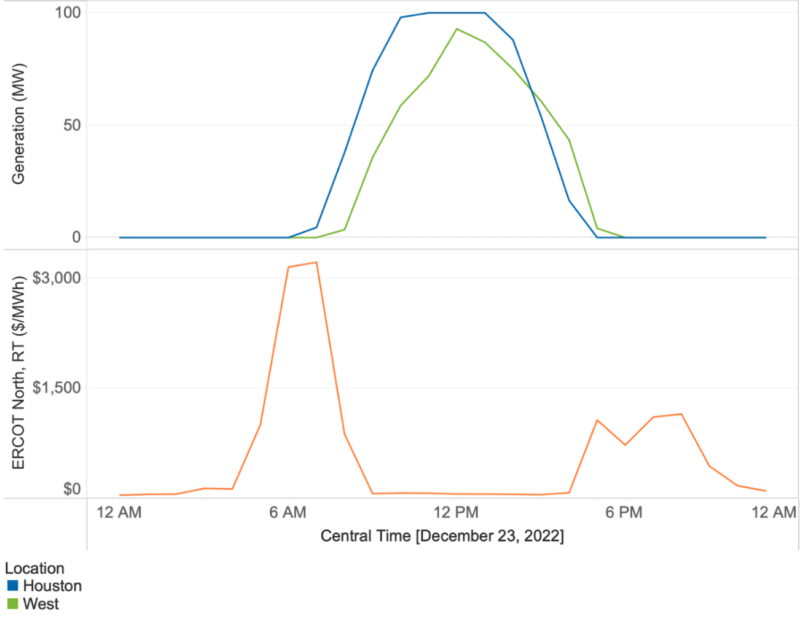

Secondly, in terms of time, as an example, under the current protocol, a business that consumes the majority of the electricity during the day can report a market-based emissions total of zero by purchasing an equal volume of renewable electricity from a local wind project in the same market that produces its electricity at night.

Really the emissions impact of the consumption and generation differ throughout the day even in the same market and therefore, that should be accounted separately. To your point, Brendan, right, if you think of dimensions, you’ve got dollars megawatt-hours. By having a third dimension of emissions now and understanding and measuring their emissions impact of that consumption and the procured generation, we’re having a better understanding of the impact that we’re having.

Chad: Also, to summarize, not every megawatt-hour is equal, right?

Faraz: Right.

Chad: They have different emissionality or emissions profiles. To address this issue, Amazon, HASI, a number of other leading corporates have formed what’s called the Emissions First Partnership. Faraz, you were instrumental in bringing this partnership together. Can you talk to us about what it’s trying to achieve?

Faraz: Absolutely. First, just an overview of the Emissions First Partnership. It’s really a coalition of corporates who are really advocating for an emissions-based framework for Scope 2, and it’s specifically from organizations who are actively involved in this, who are actually practitioners and are active in the market there and who understand the challenges related to it. The objectives really are to make sure that we want to give electricity users and stakeholders the most accurate view of the emissions impact of electricity.

This, in turn, should allow electricity users to make really clear, high-impact, demand-side emission reduction decisions, whether that’s how to operate in cleaner grids, investing energy efficiency, load shifting, or optimizing the charging of EV fleets. That should be a scalable framework that’s flexible enough and future-proof enough that can work for any sized company across geographies, across any type of technology as well.

Secondly is also we want to make sure we give clean energy buyers the best possible data to maximize the emissions reductions impact of their procurement, prioritizing action where and when it matters most and making sure that every dollar spent is having the maximum impact.

Thirdly, we want to give stakeholders confidence that emission reduction claims made by organizations are really accurate and impactful, and that will incentivize a much wider range of corporate actions across, not just procurement, but also load management and other methods to effectively address emissions.

Brendan: Those goals sound like the right goals. How do we make the changes that are necessary in order to move from the current system today to a better system?

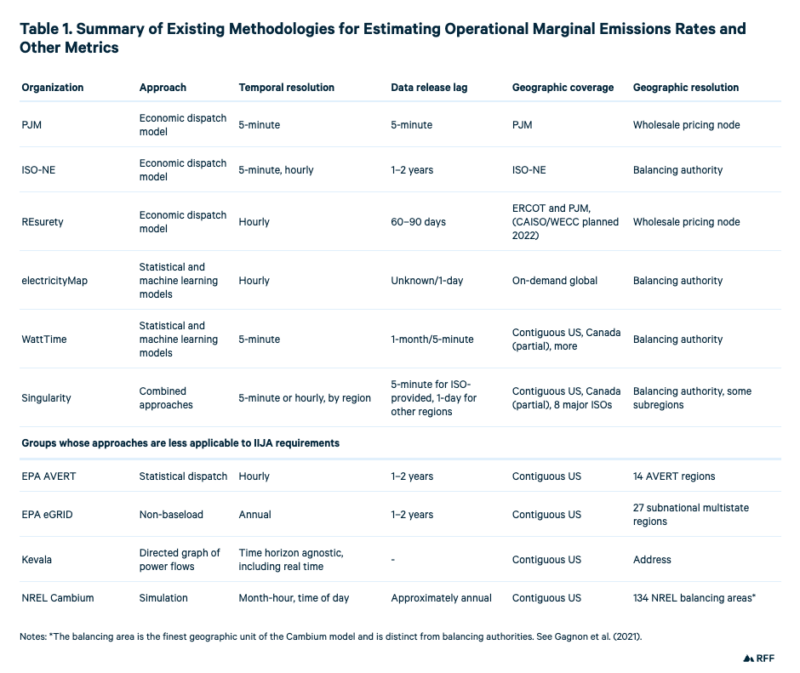

Faraz: Right. This is how do we actually make it happen, and that’s important. I think, first of all, we need to ensure there’s consistency in methodology, and we can talk a little bit around some of the metrics and data to do that. One of the principles that I think about as well is that we don’t want to constrain ourselves with the data that we have today. We want to define the outcome we want to achieve and then fill in the gaps that we need to achieve that outcome. I think data is definitely one enabler for that, but I think the first aspect is making sure that we can actually begin to measure the marginal emission rates by time and location for every bit in the world.

We can get there in stages as well. We might, first of all, just want to make sure we cover geographical coverage and at least do it on a countrywide level. I know the UN and others publish marginal emissions factors on an annual basis. We want to make sure that multiple data source providers are using the same methodology, so there’s an inconsistency that way. We want to ensure that we’re not penalizing buyers as well, who’ve done actions in their past as we migrate to an emissions-based framework as well.

I think there’s multiple factors,Brendan. I also do think that we need to get a wider ecosystem involved, grid operators being one. They know exactly what plant is on the margin and what’s the marginal plant is that’s serving that load and should be able to give feedback on how we can actually have emission signals in the same way as we have price signals in power markets.

Brendan: How do we implement this change because people may set goals today based on an average annual and taking advantage of the lowest cost, for example, renewable, not necessarily the one that best matches their emissions? How do we, in the future, make a transition so that corporations are seen as actually doing the right thing and making progress as opposed to just trying to hit an old goal that maybe is outdated.

Faraz: Yes, I think maybe it’s first worthwhile just to take a step back and, for the benefit of the listeners, just try to elaborate in some of those definitions on average and marginal and why that’s useful in this framework. Think about it this way. If you were wanting to report your historical emissions for your home, your average emissions rate is just simply saying what is the total emissions and the total amount of power consumed on the grid, and there’s a ratio of that. You can multiply that by your particular electricity consumption and come up with an average emissions figure. It’s very useful for historical reporting.

The marginal construct is really very relevant for when you’re making a decision or an intervention. Think about a case study where you’re about to charge your electric vehicle. At any point in time, when you charge your electric vehicle, there’s an extra load, an extra consumption put on the grid. An extra plant on the grid has to essentially serve that, and that could be a gas fund ramping up to meet that load. For every unit or megawatt hour of electricity that we’re incrementally adding, there’s an incremental amount of essentially emissions being created. That’s therefore the marginal signal. Similarly, we have marginal prices in wholesale markets.

Chad: I want to drill in to the comparison to pricing here because I think that will make it very clear to people as well. Some people have utility rates where they pay a single price for any hour of the day that they consume electricity, whereas other folks have signed up for time of day or time of use pricing where their price varies depending on the time of day. If demand is very high, let’s say at 4:00 PM, their prices will go up, which incentivizes them to use less electricity unless they want to pay more than they otherwise would.

Similarly, with emissions on a marginal basis versus an average annual basis, you’re actually getting that very granular view as to when the emissions are occurring and the location that they’re occurring. Is that a good analogy for folks to use here, Faraz?

Faraz: It is and absolutely. The only thing I would just add as a caveat is, don’t confuse the marginal versus the time granularity. You can have a marginal signal over, say, an annual year, which would be very simple for a small business to report on. Let’s take the annual consumption, multiply it by that marginal emission factor. There is a slight difference, but you absolutely essentially you want a signal that’s telling you if I’m adding load onto the grid, how much extra emissions is being created? Another way to think about it from a renewables point of view is, if there’s a renewable project that’s generating electricity, for every unit of electricity that’s being generated, it’s essentially pushing off a fossil fuel plant.

There’s an emissions avoidance because had that unit of electricity not being produced, there would have been a gas plant or something else that would have ramped up to meet that load. It’s always comparing to a counterfactual, but essentially that’s why the marginal framework works because you’re looking at what’s the incremental impact of an incremental action, if that makes sense.

Chad: Absolutely. We were talking about how do we get to this better place where we are measuring the marginal emissions of every megawatt-hour consumed and produced and matching that with consumption and supply accordingly. You were talking about data infrastructure. Tell us a little bit more about what data infrastructure may need to be in place and then about a transition period that we might need, if any, to get there as well.

Faraz: With the data, I think there’s a few things we want to get as granular as possible in terms of time and location. As I said, we may have to just do that in stages. First cover geography and then going more granular by that. I think the key point is making sure that we’ve got a consensus on the operating signal, whether it’s the marginal emission signal is that actually the right signal that we’re doing, because you’re trying to compare with what would have happened had that, say, renewable electricity not being generating.For a grid operator, they should be, in my view, have a pretty good idea of that to make sure that there’s consistency in those calculations and data provision. That’s one thing on the data.

I think in terms of the transition period, I think it has to be some sort of transition period because we’re creating now an extra method for organizations now who are trying to align themselves to this emissions framework and there may be other organizations who are still continuing on. There has to be a recognition that different organizations are at different points in their journey and that by allowing scope for that ambition, while not penalizing other organizations who are still in that journey.

Chad: If we were to have this new data infrastructure in place and an appropriate transition period for people to access it and potentially act on it in alignment with previous commitments and new commitments that might make, how would this impact particularly corporate behavior?

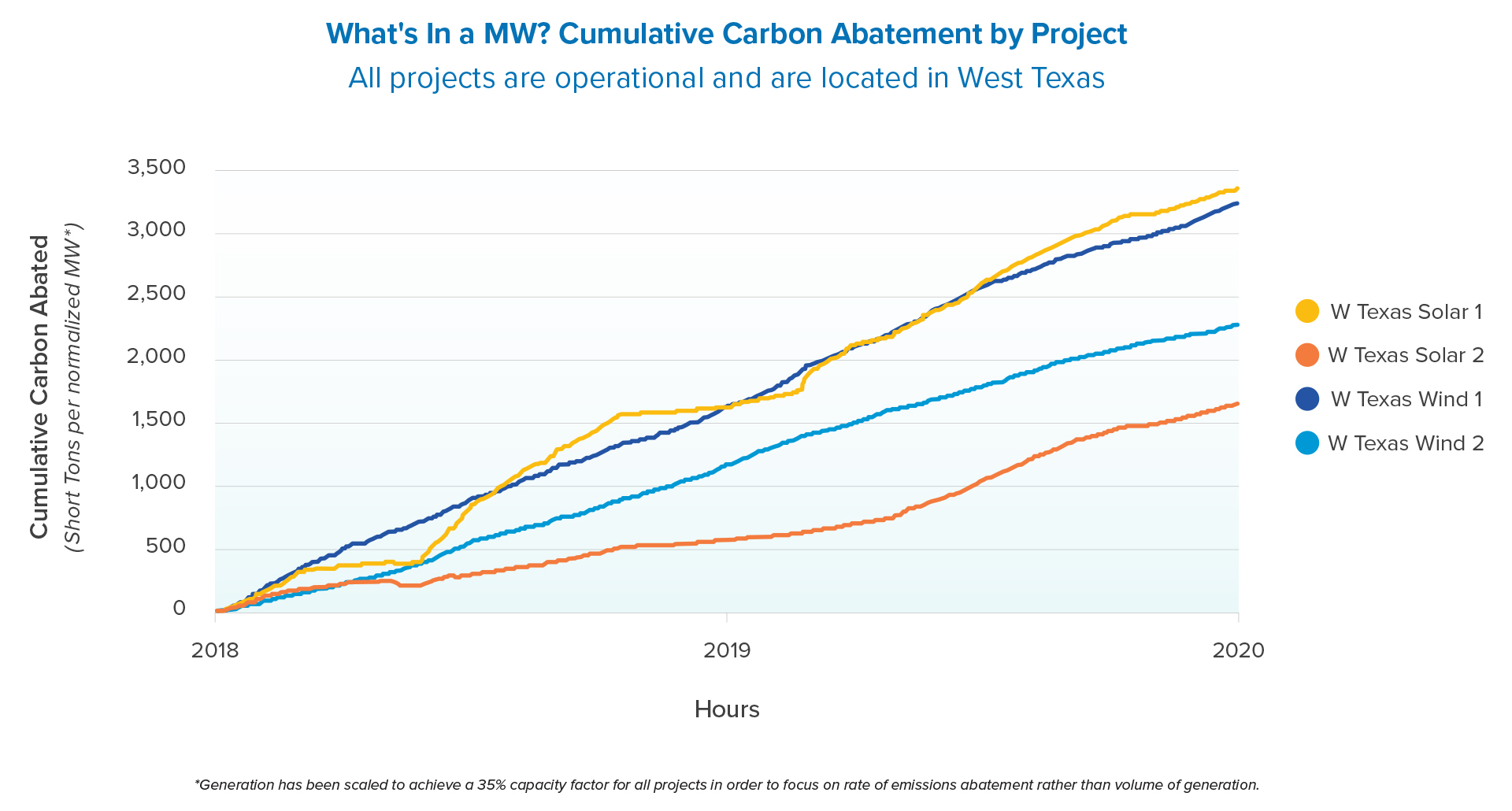

Faraz: I think there’s a few ways. A lot of focus has been on procurement, but also the simplicity of this framework is that you’re measuring both the consumption and the procured generation side. There’d be incentive, for example, to shift load to cleaner times of day, for example, or for example, enable clean electricity generation in the most emission intensive regions of the grid. You’re maximizing the emissions avoidance.

That’s something that right now I don’t think is really being contemplated to the full extent. If I come back to the objective of making sure that we’re trying to maximize the decarbonization impact, I think it’d be very valuable to have that data to optimize those decisions because back to my point that we mentioned at the beginning, I think the problem is not decarbonization but the rate of decarbonization.

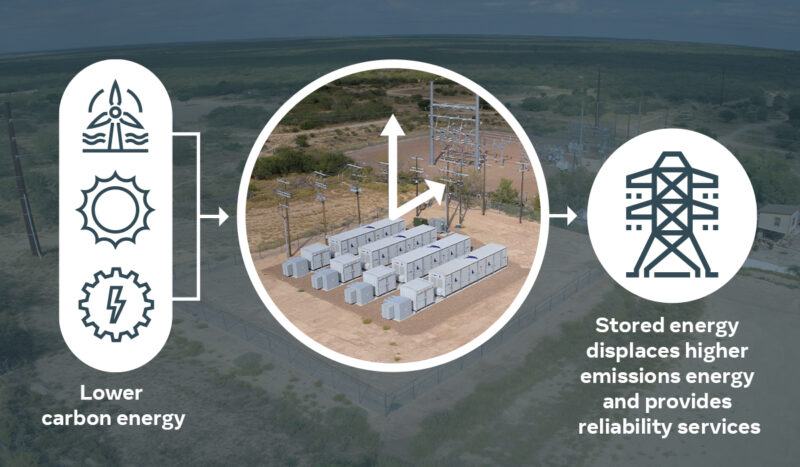

Given that organizations and individuals, we’ve got finite time, finite resources, we want to make sure that we’re always having the biggest bang for the buck essentially. We should give the right signals for the actions in the right times and the right locations, as well as also applying it to all technologies or energy storage and batteries, for example, would be very useful in this context because you could charge when marginal good emission rates are low and then discharge when good emission rates are high.

Chad: Climate Positive is produced by HASI, a leading climate investment firm that actively partners with clients to deploy real assets that facilitate the energy transition. To learn more please visit HASI.com

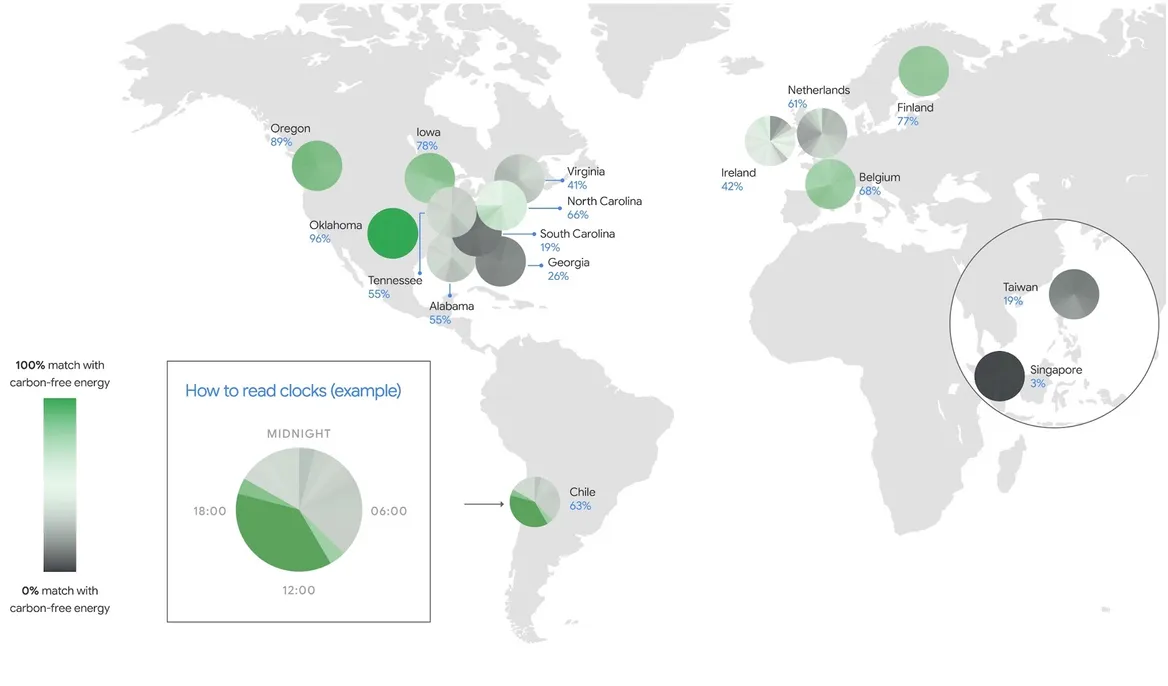

Chad: Folks out there may be familiar with what’s called a 24/7 approach to addressing this issue. There are certain companies that have committed to sourcing all of their electricity consumed at a certain time and location with renewable resources that are roughly proximate to that area and to the shape of their consumption or load curve. How does this approach that we’re talking about that’s more emmissionality-based, how does that either, you know, have similarities with the 24/7 approach or differ or how should we think about that?

Faraz: Yes, look, ultimately, everyone is trying to get to the same destination, a net zero grid. If everyone in the grid had exactly matching load and supply with carbon-free electricity, then essentially, we reached the same destination point. I think the question is, how do we get there from where we are today? I go back to my point of dimensions is, historically, we’ve had dollars and megawatt hours and essentially now with an emissions-based framework, we’re trying to add this third dimension of emissions.

The load matching or 24/7 framework, I view as an extension of the current paradigm. There is nothing essentially wrong with that, but my viewpoint is that we want to try to be measuring the emissions impact of that. Just as a case study, back to the fundamental principle of this time and location, in that, I think everyone instinctively understands the time dynamic when it comes to renewables, and other sources, and trying to match this time dimension with 24/7. What’s not perhaps immediately apparent is the location or the geography.

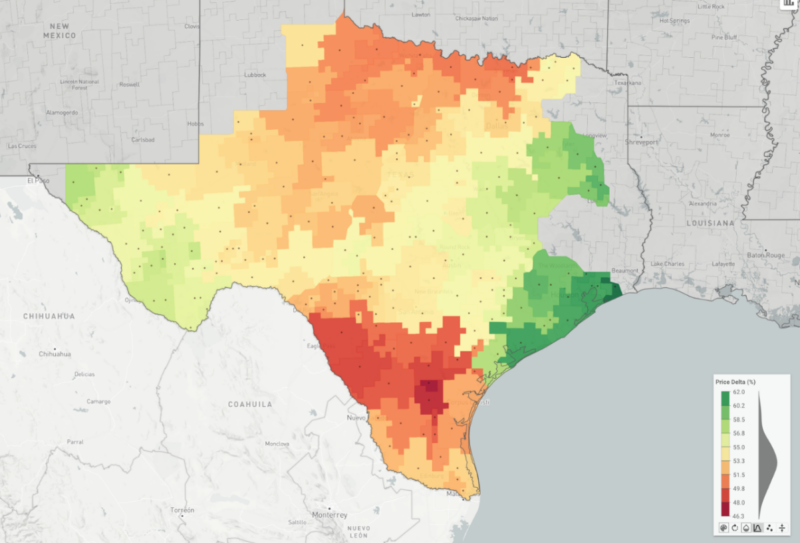

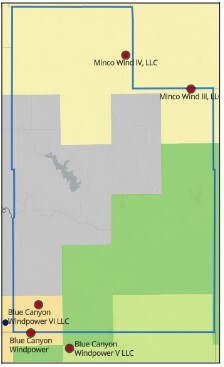

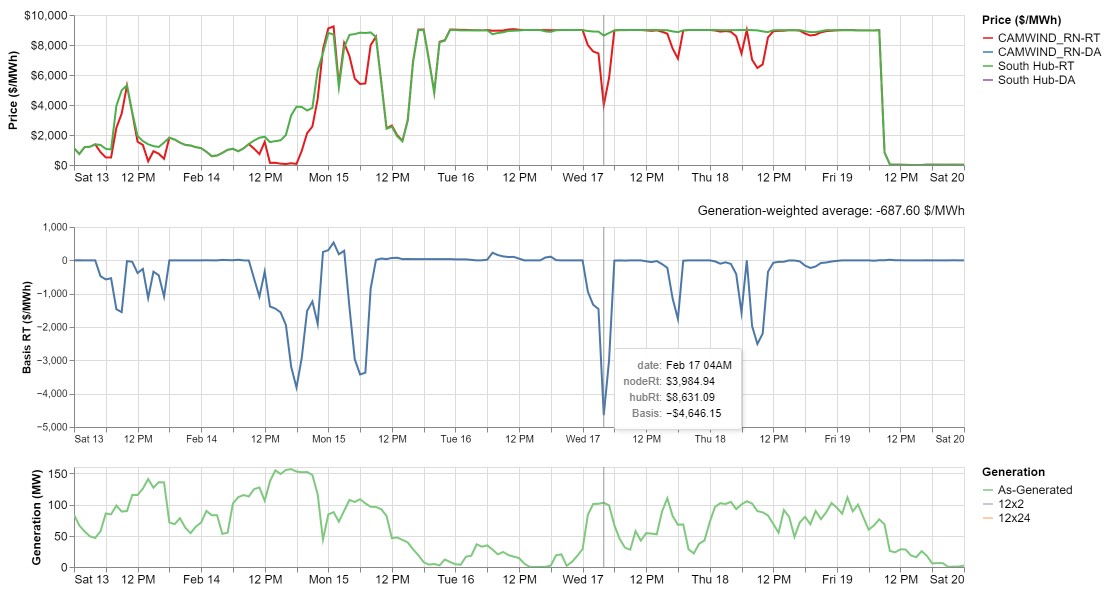

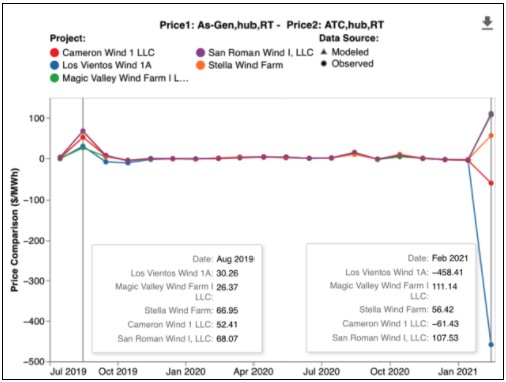

I often use the example of, you may have some consumption or load in Houston, Texas, you may have a lot of wind projects in West Texas. Even though you are exactly matched on a time basis, there is a location difference. Because there’s a location difference, we also know the physical reality that there’s also transmission constraint as well. There has to be a gas plan that’s to ramp up to serve that load of consumption in Houston.

Even though you may be matched exactly well on 24/7 on the same grid, you’re not actually at a net zero-emissions footprint, right? I think that’s a nuance that’s often lost even when you’re on the same grid, is that there is a difference between grid nodes on that same grid, and that does have real-world implications, which comes back to the point of we have better data now, and as we have the better data, we’re able to now to measure emissions in a way that we couldn’t perhaps 10 years ago. Measuring the emission impact should then actually help us drive towards most optimal decisions.

Chad: Thankfully, the various organizations that run the Greenhouse Gas Protocol are in the process of soliciting feedback on how they can improve it. I know obviously, the Emissions First Partnership, Amazon in general, HASHI as well, many other corporates and various organizations have submitted comments on how the framework can be improved, especially with regard to Scope 2. Can you talk to us a little bit about what specifically should happen to the mechanics of how it’s reported today and how it can be improved and how this process is playing out?

Faraz: In terms of your point today, there’s two methods currently. There’s the location-based method and market-based method. This comes back to the discussion we’re having around different emission factors. I’m sure now, there’s a lot of people really now, touching their heads on emission factors on the talk around it. The thing about the location-based method is it essentially just does not consider anything related to what you’re contracting. It’s taking your consumption, it’s on annual basis, it’s multiplying by average grid emission factor, and you get your location-based method. It’s purely a function of where you’re physically plugged in.

The market-based method as it were, is essentially looking at what you’ve contracted with. Brendan, you were mentioning this before, we got your consumption, your volume of that, you’ve procured, say from a renewable energy project, it subtracts the two, you get a remainder. It’s multiplied by what’s called residual emission factor. It’s saying, “Hey, what’s the emission factor of the grid when you take out the renewables?” Right?

In the market-based method, it’s essentially looking at what are you contracting. Because there’s that volumetric piece, a lot of organizations are then able to then go and essentially procure electricity in an effort to reduce their Scope 2 footprint. With this, essentially, you could add another method, the emissions-based method, which would is still saying actually, how do we actually begin to measure the emissions impact of both our consumption and our procure generation and see the net impact of that?

Brendan: At HASI, we measure what we call CarbonCount, which is the emissions reductions per dollars spent. It sounds like what you’re proposing in measuring emissions will effectively do that because you’ll be able to see what the corporation, for every dollar they spend, they hopefully, will be investing in the most impactful emissions factor versus at least just a matching or the least impactful is maybe it’s happening today because of transmission constraints or things. Today a dollar spent in a transition congested area doesn’t have the same carbon benefit as a dollar spent in an area where there’s higher emissions because of coal plants or whatever. What you’re proposing sounds like it will help you move to offsetting the higher emissions factors, whereas today it’s just whatever the lowest cost is. Is that a good way to think about it?

Faraz: Yes, I think it goes back to the point that I think Chad said as well that every unit of electricity is not exactly the same. We know that in Wyoming is a higher grid emission intensity and a clean unit of electricity there has a higher impact. We can essentially get better data of how do you get better impact from all of these actions and the renewable electricity or other actions that are being taken?

What that will lead to is essentially you’re maximizing the impact per dollar spent, which is really what we’re trying to get to because we are in a race against time and so we have to accelerate the grid decarbonization. If everyone was to essentially focus on those areas or times during the day when the grid was more emissions intensive, that should be a more optimal way to drive out emissions.

Chad: If others are interested in the Greenhouse Gas Protocol update process, I hope they are after this very in-depth discussion, how could they get involved? How could they learn more and/or make their views heard?

Faraz: There is a website emissionsfirst.com and in that those principles are really clearly laid out. I’d encourage everyone to read those. Then there is a contact us form as well. Please get in touch. We’d love to hear feedback on these thoughts, on these principles around some of the concerns that people may have. Again, I think the intention is really a noble one, which is how do we actually give confidence that these emission reduction claims are accurate and impactful and accelerate the grid decarbonization while also allowing I think investment in areas of the world or in parts of the geographic areas that traditionally don’t get investment.

If you were to begin to measure emissions, can that incent capital market to drive capital to where it has the biggest impact rather than where it’s easy to transact? That’s applicable even in the US as well because there are certain regions of the US that tends to get more of the renewable investment.

Brendan: I think the other thing that fascinates me, what I’ve heard about you guys is you have data centers and places where you can’t actually impact the grid. They don’t allow you to, and it would be better to in those areas actually invest in the global south or something as a way to help the world.

Faraz: I think we could talk about, look out of the 31 gigawatts, 29 gigawatts or something are in Europe and North America. Why is it that those corporate optic investments is not happening elsewhere? Partly is because the reasons that we described in terms of risk-reward but partly is because there’s not an extra essentially emissions incentive and the Greenhouse Protocol essentially saying they should do where your consumption is, it’s essentially creating it in those particular regions.

If we were to try and treat this as a global problem and loosen the constraints of market boundaries and allow then investment and offtake to where it could have the biggest impact, then corporates would have more incentive to, for example, do an offtake in a grid like India or Germany rather than a relatively clean grid-like France, which is already very clean because of its nuclear fleet.

That could be something we can address. I think one of the things that’s often confused is you can do an emissions-based framework at different levels. You don’t need to release these constraints or market boundaries. It can work within a grid or within a location or within a country or globally. The impact of loosening these constraints is that hopefully, you should get capital, in my view, to where can have the biggest impact or there should be more of an incentive because you’re not just looking at dollars or megawatt hours, you’ve got an extra dimension of emissions.

Chad: Even within the US context, this is valuable because the most carbon-intensive parts of the US grid are often in areas that are lower GDP per capita, maybe parts of Kentucky or parts of Appalachia.

Faraz: Wyoming.

Chad: Wyoming. Getting capital two parts of the middle of the country that otherwise wouldn’t see that investment is not only good for the environment but it’s also good for local economies and job creation.

Faraz: Yes, absolutely.

Chad: I’ll also note before we move to the hot seat, that part of the reason this is also very important right now is that the SEC here in the US is considering a final rule on how and whether publicly traded corporations should report their Scope 1, 2 and maybe even 3 emissions. If we don’t get the reporting of Scope 2 right along the lines of what we’ve discussed, mandating corporations to report the wrong thing could have negative consequences environmentally, especially for years to come. It’s important that we get this right now and that we encourage the SEC two as well.

Awesome. Well, Faraz, thank you very much, very substantive discussion. We’re almost done here, but first, the hot seat. We ask for your immediate reactions to the following statements. The hardest decision I’ve ever made is–

Faraz: To emigrate. I’ve moved nine times in my career, maybe even more, but still that was very hard.

Chad: One thing I changed my mind on is–

Faraz: The need for technologies beyond wind and solar. I would emphasize that this is my personal view and not of any of the organization, but I’ve just come to realize that you cannot achieve a net zero grid without firm, clean power and that is going to require a range of solutions beyond wind and solar. This issue of the rate of change is such that I struggle to see how we can decarbonize the power sector fast enough and expand the grid to the extent needed, without the quantity of electricity coming from a set of technology solutions that will fill the need for firm power.

Chad: Butyou don’t regret leaving your first job. Is that right?

[laughter]

Faraz: It’s funny how you always have to look forward and you never quite realize how what you’ve done in the past can help you in the future.

Chad: The person I’ve learned the most from is–

Faraz: I don’t think there’s a single person but there are a few people throughout my career that I’ve learned a tremendous amount from. Brian Landrum, who’s the CEO of Nextera who I worked for, I really admire his ability to balance the strategic with operational priorities. At GE, [unintelligible 00:31:26]. He was my manager directly. He was just outstanding at building and developing teams, something I’ve really thought of as I’ve got older, and thinking about how do you ensure that you get the most out of people.

Another leader I really admire is Cory Nelson. He was working with me doing a startup venture at GE Distributed Power, where we try to build solutions that could provide power at the point of use in emerging markets. Whenever you do a startup, there’s always lots of assumptions and validating and trying to understand how you can build quickly and solve the problem.

It’s something that he used to always say to me that’s really stuck to me, which is like, “Get out of the building,” which is basically like you can do all the research and everything else, but you actually go out, speak to people, travel there, go and actually see the problem, the situations that you’re actually dealing with. That’s something that’s also stuck with me.

Chad: Great lessons. When I need to recharge, I–

Faraz: I do my daily exercises. I do my reading. I try to hang out with my kids. Nothing special, but I think that helps me just get my mind onto that recharge focus.

Chad: As a parent of two kids, I want my kids to know–

Faraz: That really I focused my career to preserve and enhance the environment and that I did everything possible to really contribute, to provide the energy that we’ll need. I think that really is the one single theme throughout my whole career. I’ve worked all across the energy sector, both broad and deep in emerging markets, and developed markets, and it’s really about how do you enhance the environment while at the same time providing the energy that society needs?

Chad: You are a resident of Houston. I haven’t spent much time there myself. Houston’s biggest hidden treasure is–

Faraz: The restaurant scene. I was just shocked at the amount of food options available in Houston. My wife is a very big foodie. I think there’s a great restaurant scene no matter what kind of cuisine you’re into. On the climate tech side, I think Greentown Labs is a really important institution that I’m involved with, they’re incubating a lot of entrepreneurial and agnel investor and other activity. That’s really encouraging to see because I think traditionally, VC has been really concentrated on the East and West Coast. Developing that fintech or climate tech entrepreneurial system in Houston has been really great to see.

Chad: Amen to that. The most insightful book or article I read recently is–

Faraz: Recently, I read a book called Superpower: One Man’s Quest to Transform American Energy by Russell Gold. It really talks about the grid, which is a pretty wonky thing to read about, but it talks about all the challenges related to permitting and building grids. It’s just fascinating to hear the story of the challenges and all the different decision-makers of ecosystem of people that have to be engaged during that process. That’s been really eye-opening for me, I think, really very relevant as we try to decarbonize the grid because we need to continue to expand and try to do de-bottleneck with these constraints.

Chad: If you enjoyed this wonky podcast, you’ll definitely enjoy this book. [chuckles] Finally, to me climate positive means–

Faraz: A holistic approach. That means that we are leaving the planet and the environment better for the next generation.

Chad: Excellent. Well, Faraz, this has been a great conversation. Thank you again for your time. Always great to chat with you.

Faraz: Likewise. Thank you so much, Chad. It’s been fantastic.

Brendan: Thanks, Faraz.

Chad: If you enjoyed this week’s episode, please leave us a leave a rating and review on Apple and Spotify. This really helps us reach more listeners.

You can also let us know what you thought via Twitter @ClimatePosiPod or email us at [email protected]

I’m Chad Reed.

And this is Climate Positive.