April 24, 2023

Authored by Jennifer Newman, Vice President of Atmospheric Science Research, REsurety

White Paper Executive Summary

An “8760” (sometimes known as a “typical meteorological year,” or “TMY”) is a year-long hourly time series of expected generation for a wind or solar project. As the name implies, an 8760 contains generation values for all 8,760 hours of a year (non-leap year) and captures the typical seasonal and diurnal generation patterns at the site. Despite their widespread use in the renewable energy industry, there are two particular use cases of 8760s that can lead to significant errors in revenue estimation: 1) the pairing of an 8760 with a non-concurrent price time series and 2) the use of an 8760 as an input to a forward-looking price model.

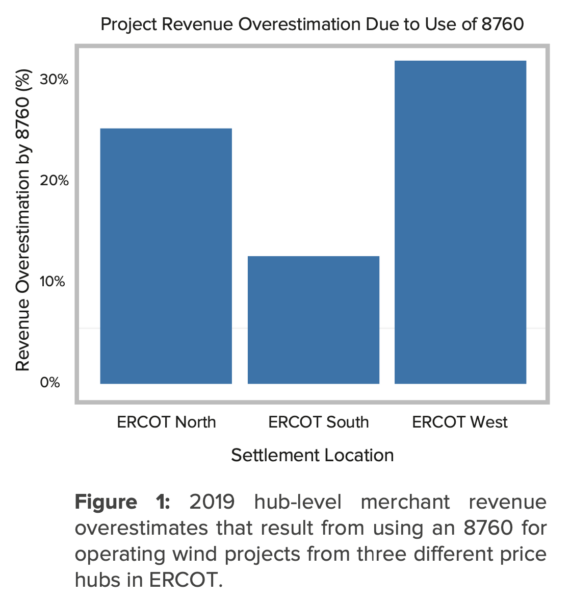

The first, pairing an 8760 with non-concurrent prices, misses the impact of hourly wind and solar generation on market price, which can be particularly significant in markets with high renewable penetration. For example, Figure 1 demonstrates that pairing an 8760 with non-concurrent ERCOT power prices results in annual wind project revenue overestimates that can exceed 30%.

The second use case, using an 8760 generation profile as an input to a pricing model, does allow the user to capture the impact of hourly renewable generation on market price, if modeled correctly; however, the resulting distribution of forecasted prices will only represent the impact of a single, “normal” weather year. In reality, renewable energy projects will experience a variety of weather conditions, with non-typical weather years having an asymmetric and sometimes extreme impact on the price of power.

In this paper, we use observed and modeled data to quantify the impact of using an 8760 for renewable energy project value estimation, with a primary focus on wind generation. We demonstrate that pairing an 8760 with non-concurrent prices results in consistent wind project value overestimates in markets with significant wind penetration. We also show that using an 8760 to drive a forward-looking price model leads to a condensed price distribution that misses extremes and is not representative of historical price distributions.

Please fill out the form below to access the entire white paper.

"*" indicates required fields