Renewable Energy Portfolio Management Toolkit

Part of the REsurety platform, Portfolio Tracker was designed specifically for clean energy buyers and investors to forecast, audit, and explain the financial and environmental outcomes of clean energy projects and contracts.

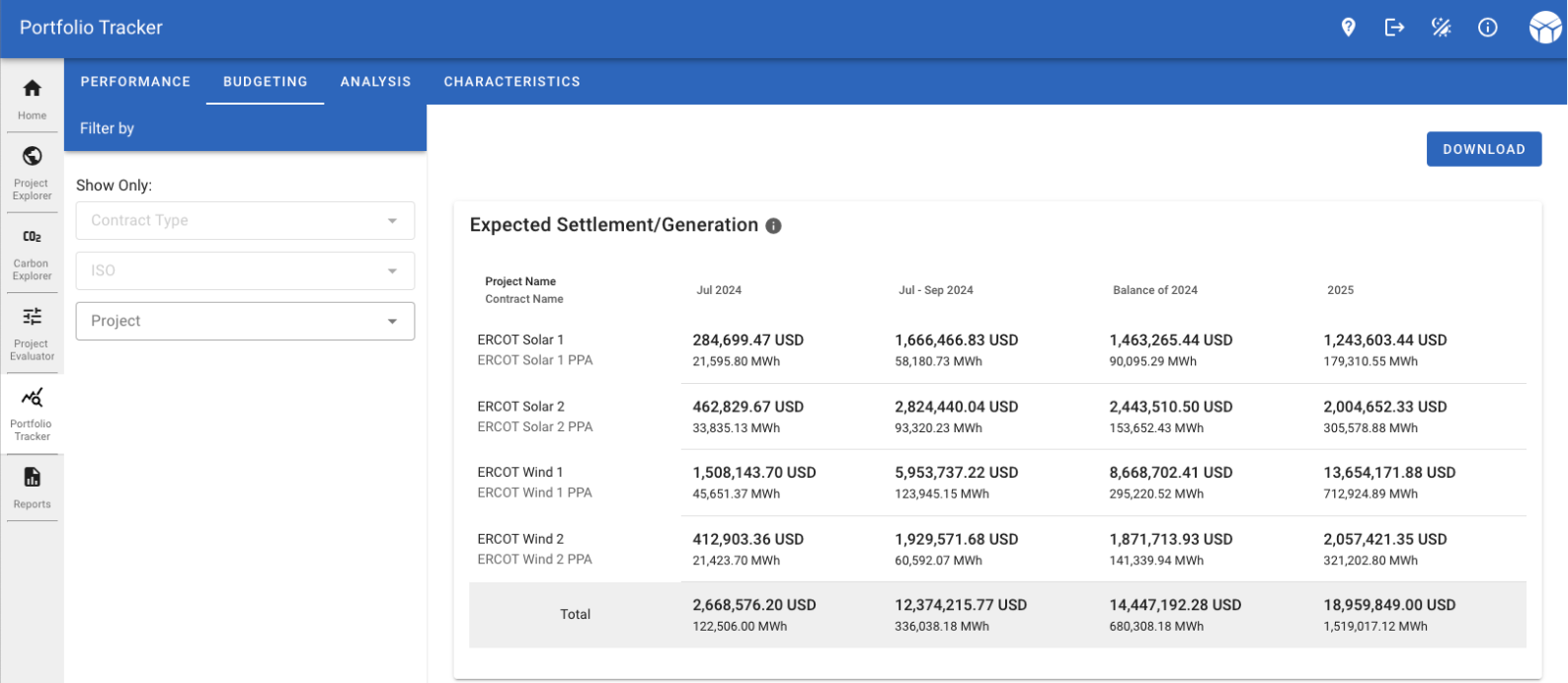

With Portfolio Tracker, you can analyze how wind and solar contracts are performing and what risks they hold; evaluate how settlement is expected to occur going forward; and track project and contract-specific carbon emissions and financial performance. Perhaps most importantly, with Portfolio Tracker, you can confidently explain financial and environmental outcomes to your stakeholders.

Forecast

Forecast settlement over months and years

Audit

Analyze how contracts are performing

Explain

Confidently explain financial and environmental outcomes

Portfolio Tracker Applications and Features

Applications

- Analyze how your contracts are performing and what risks they hold.

- Evaluate how settlement is expected to occur going forward over the coming months and years.

- Measure both project-specific carbon emissions performance alongside project-specific financial performance.

- Easily access forecasted settlement metrics for contracts, including Weather-Smart forecasts for the next month, quarter, the remainder of the current year, and for the following year.

Features

- Harnesses massive project performance and high resolution weather datasets.

- Provides a breakdown of drivers of financial, operational, and carbon emissions performance, both at the hourly and aggregate level.

- Offers high accuracy estimates of project and contract performance long before project data is typically provided.

- Leverages REsurety’s models and makes the insights they enable accessible to corporate buyers or investors through just a few clicks.