Podcast Transcript from the Eight Minutes Podcast with Paul Schuster and Lee Taylor

Paul Schuster: Welcome to Eight Minutes – a podcast about the energy transition. I’m your host, Paul Schuster. I’m joined today by Lee Taylor, the CEO of REsurety, and we’re going to be diving into a topic that’s really of interest out there in the energy transition space in general, and especially as it relates to large C&I customers, who are the commercial and industrial customers, who’ve entered this market and are purchasing renewable energy at scale in a quantity that is really starting to define where the market is going. So what Lee and REsurety have, have done, and some of the partnerships that he’s going to talk about today, are really interesting in terms of how they’re moving that dial, moving that needle, if you will, around how these corporations are thinking about their energy purchases, how they’re thinking about their emissions, and what they can do to reach net zero. So Lee Taylor, very excited to have you on our podcast today.

Lee Taylor: Thank you so much for having me on. Excited to be here.

Paul: Lee and I have known each other for years, so this is gonna be a very comfortable podcast, and I’m hoping that we can dig a little bit deeper than we normally do and get into some of the nuances of what he and his team are doing. But Lee, maybe it would be great if you could start with an introduction as to yourself and an overview as to who and what REsurety does.

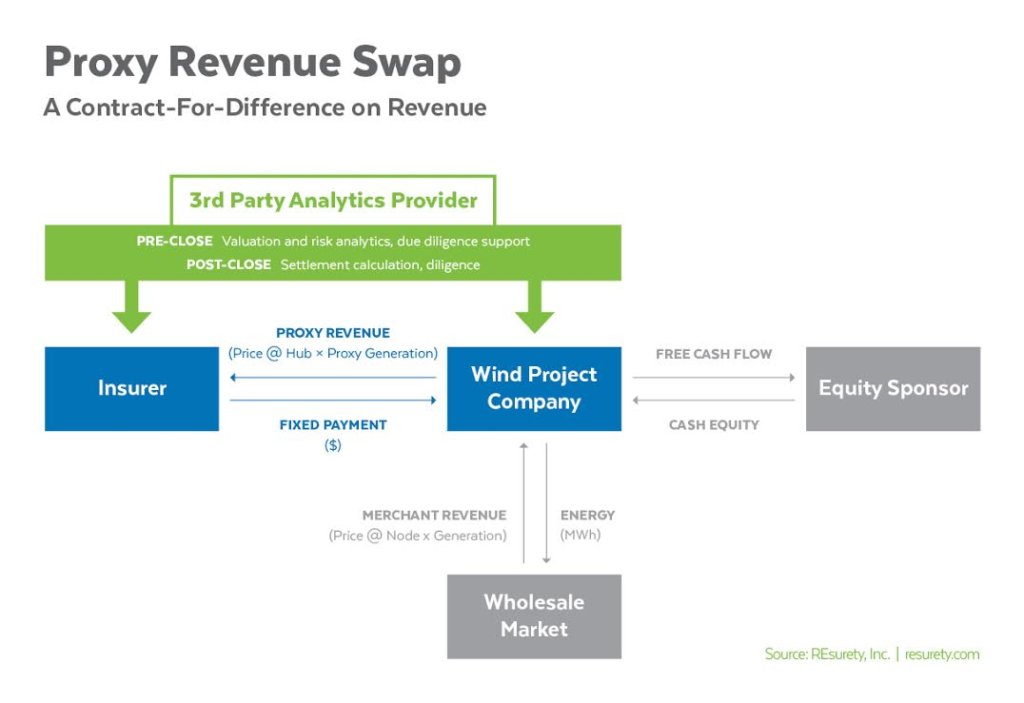

Lee: Perfect, thanks. So I’m Lee Taylor, founder of REsurety, started the company out of business school in 2012. REsurety was effectively my thesis project in grad school, and I started the company – so got to appoint myself CEO and haven’t been fired yet – so kept that title. And in terms of what REsurety does, we’re an information and risk management provider to the energy transition clients. So wind, solar, and storage in principle, and so our customers are investors in assets, buyers of power, buyers of RECs, advisors to those groups, etc. And so we started out REsurety, our initial product was a hedging tool for intermittency. So one of the great benefits of renewable energy is that the fuel is free. And so the traditional risks that were being managed by the energy industry, which is “what’s the cost of fuel that you’re going to burn to turn around and sell power”, which was your main financial risk with renewables – your fuel is free, so that fuel price risk is gone. But when and how much of that fuel shows up in any given hour, day, quarter, or year is variable and uncontrollable. And that was a risk that really wasn’t well understood when we started the company and not managed at all. And so we started REsurety to provide the tools to manage that risk, locking in revenue or locking in cost for the sellers or buyers of renewable energy. And then we have diversified from there into a sort of broader set of information, software products that support all sorts of other workflows, financial planning and analysis, carbon accounting, etc.

Paul: Perfect. And those tools have really evolved to meet some of the demands that your clients are putting on you. It seems as though the energy transition, as it sits, is changing so quickly and in so many different directions. We need those underlying analytics just to understand whether the decisions that we’re making at any given time are having the impact that we want to have. Which kind of brings me to the topic of the day, which is around corporate renewables and how corporate renewables have changed over time, specifically looking at how their decisions are impacting emissions. So, Lee, I’m going to put you on the spot. All right, for a quick history lesson, if you will, going all the way back to 2008 when Walmart signed the first corporate power purchase agreement, and kind of kicked off this long tail of corporate commitments towards net-zero, Lee what’s going on in that market and how has it evolved since over the last 15 years or so?

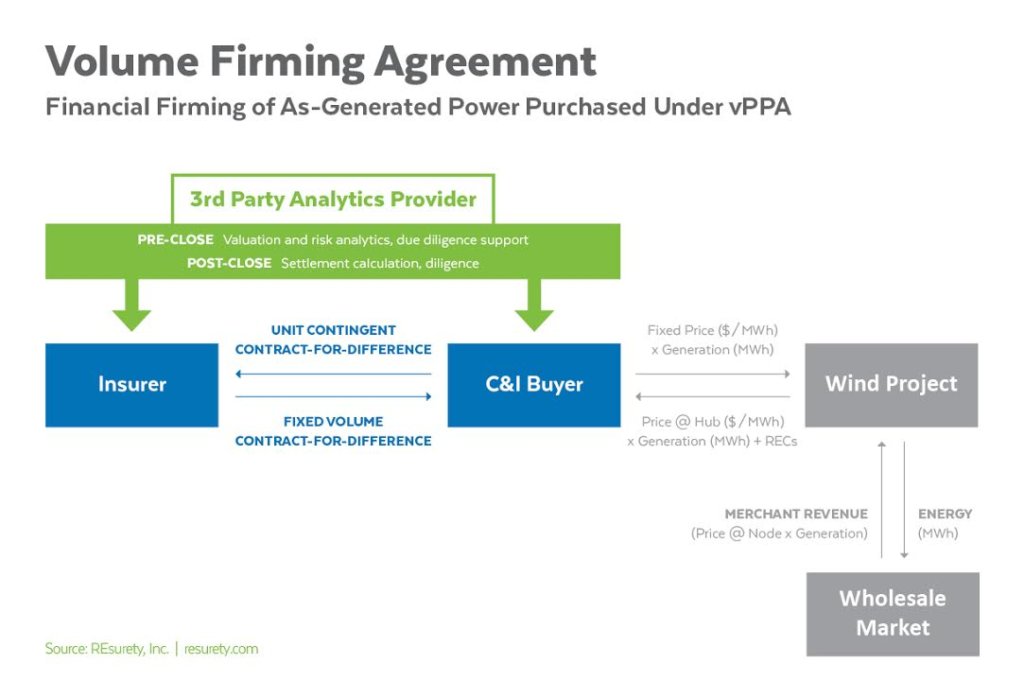

Lee: Yeah, so I think I break down the evolution of this market and sort of the last decade and then the period before that. You talked about Walmart in 2008, and Google was getting active in this space in 2010 and other corporates followed suit, but really before you know 2012, 2013, and 2014, almost all renewable energy purchasing – so the long term contracting for the electricity being generated from a wind or solar project – was almost entirely driven by utility purchases. States had renewable portfolio standards with a requirement for utilities in that state to buy a certain amount of energy from renewable energy. So they would go out and run a request for proposal and then buy power from renewables by mandate, effectively. So they would go for the lowest cost that they could find as part of that RFP, but we were going to buy X amount of wind or solar because they had to by mandate. What started to change, roughly a decade ago, is that corporate purchasers and sustainability buyers started to enter this space in a fairly meaningful way, and started directly contracting with renewable projects for their power, basically for two reasons: The first biggest driver was sustainability goals. So these groups were eager for their customers, their investors, their employees, and other stakeholders to demonstrate that they were drivers towards a net-zero future, and sort of stewards of the planet that they were operating in. They wanted to do that in the form of renewable energy credits, also known as RECs. For every megawatt hour generated by a wind or solar project, the buyer would get a REC that they could count against their emissions, and we’ll get into that in a second, to say we are X percent carbon neutral, or carbon free, or X percent renewable as of this date. The second driver is as a hedge on energy prices. I think there’s a bit of a misconception that a lot of people are trying to use renewable procurement to hedge their day to day or month to month near term energy costs. The reality is the vast majority of corporate purchasers of power, just like the vast majority of residential buyers, have a fixed locked-in cost of electricity for some period – this year, next year, next three years, five years – depending on the utility or retail or market that you’re in. You generally know, when you turn the light on or you turn your factory on, what it’s going to cost you. So buying power in that period is not a hedge. But in the long term, if you’ve got a three year fixed cost of electricity at your plant, and natural gas prices tripled between now and year five, you can be sure that when you reset your retailer utility contract it is going to be much more expensive. So if you have purchased power, where you make money effectively from that PPA, if power prices go up, that increase in value would offset the cost increases as you reset your price through the term of the agreement, which is anywhere from typically 10 to 15 years. That was sort of the secondary goal. I’ll pause there, see if that made sense, and then I do want to push a little bit on the REC accounting point because it’s critical to where this conversation is going.

Paul: Yeah. So let me talk a little bit about that cost perspective and that hedging perspective that you brought up. And I think you bring up a really good point in the fact that many corporates have already signed 2, 3 year fixed price agreements that already hedge them in the short term. But these long term power purchase agreements or virtual power purchase agreements, and I’ll actually direct our audience back a few episodes that I did a few weeks ago around vPPAs and what exactly these are, those are much longer term agreements. We’re talking 12, 15, even 20 year agreements, Lee, correct me if I’m wrong. They really have a much longer life perspective in terms of how to hedge against rising costs of natural gas and those types of things. So to your point, the first real motivator of large corporates is around sustainability and trying to get to 100% renewable energy – I’ll take net-zero as something separate – because we’re talking about their energy supply right now in particular. And then the second motivator, if you will, is around “can we hedge against some of these long term cost risks, such as natural gas prices that rise because Russia invades Ukraine?”

Lee: Correct. How well something works as a hedge from renewable energy procurement really depends on your timeframe. Next year, two years, three years, five years for most corporate buyers, the PPA is effectively a speculative commodity exposure during that period, in exchange for significant sustainability benefits. But in the longer term, it becomes a hedge on your exposure to overall energy costs.

Paul: Perfect. So tell me more about the REC accounting and how this actually plays into some of the pros and cons about the process that we’ve done up until this point around procuring renewable energy.

Lee: Yeah, so when you go back to that early 2010 to 2015 period, during that period carbon accounting rules were being rewritten with the World Resource Institute; the NGO being the primary driver of those rules. It used to be that there was what they called exclusively ‘location-based accounting’ and this is for Scope 2 emissions. Scope 2 is just electricity generation. So there are three different Scopes. When you drive your car to work that’s Scope 1, when you flip the lights on that’s Scope 2, because somewhere else an electricity plant has to generate power to serve that. Scope 2 emissions used to be, prior to I think 2015, purely location based. Where it said, “Well, if you’re consuming electricity in Pennsylvania, or in Texas, or in Nebraska, we’re just going to look at the carbon intensity of that state, multiply that carbon intensity times your volume of consumption, and that is your carbon intensity, or your carbon footprint.”

Paul: So a company located in Washington with a lot of hydro that’s coming down from Canada, may have a much smaller carbon intensity metric than a company in Indiana that’s relying upon coal.

Lee: Correct. Generally speaking, if you’re in a state that relies heavily on hydro or nuclear, next level up in cleanliness being clean gas plants, etc, you’re going to have a relatively low starting point in your carbon footprint on a relative basis, versus Wyoming or West Virginia where you’ve got a very coal heavy footprint. Every time you turn the lights on, more carbon is being emitted just by the set of plants that are comprising the fleet in your state. Under those location-based accounting rules, the only way to reduce your carbon footprint was either to move to a cleaner location or to reduce your consumption. It didn’t give anybody the opportunity to use market-based forces to go out and directly buy things that they wouldn’t otherwise do, namely vPPAs, etc, to reduce their carbon footprint. So the rules changed in 2015 to introduce what are called ‘market-based accounting’ methods, that says that you can effectively use the renewable energy credits from direct procurement of renewable energy elsewhere in the grid or anywhere in the country, in many cases, to potentially reduce your carbon footprint. So if you are in state X, and let’s say you consume 100 megawatt hours of power in a given year, if you go and buy power from a solar project that produces, on average, 100 megawatt hours of solar a year, you’re receiving 100 RECs, and when you retire those RECs, those entirely offset in market-based accounting, your 100 megawatt hours of consumption. So you can state, under those rules, that you are effectively carbon free, because of your purchase of 100 units of renewable energy, even if that isn’t anywhere close to your location, or the timing of your consumption, in order to match up megawatt hour for megawatt hour renewable energy with your consumption.

Paul: So I’m going to pause here for two seconds because I’m worried that we might be losing part of our audience in terms of why they are purchasing. A company located in Wyoming is now purchasing power again down in Texas, versus the power that they have to use to put their lights on up in Wyoming. I don’t want to get too deep into the details around how that contracting can work, but there are financial instruments that allow you to shift the power purchase to that Texas solar facility, if you will, so that you’re not double purchasing power, you’re still paying for power once, if you will. But by shifting it to that solar facility in Texas, you’re getting the added benefit of these RECs, which you can then retire and claim that you’re purchasing renewable energy. Right?

Lee: That’s correct.

Paul: That may be a huge oversimplification. I’m certain that a lot of the bankers or whatnot that are listening to the show are probably banging their heads against the table saying, “Wow, you just made my entire career sound really, really simple.” But the important thing is that this is not a duplicate purchase, it is still one purchase but now you’re purchasing renewable energy rather than what the utilities provide to you.

Lee: Correct. And it sounds like you cover this in more detail in your vPPA episode, which I think folks should listen to because it is a simple in concept and very complex in practice world, but the virtual power purchase agreements are really the backbone of a lot of the sustainability strategies of many, many of the Fortune 100 and so it’s a critical piece to understand.

Paul: Alright, so apologize for the tangent there. Lee, back to some of the REC accounting and especially around this annual 100 megawatt hour perspective – how is that played out? And how has that changed over time as well?

Lee: Right. So when the rules changed for market-based accounting, that was one of many reasons that drove a lot of corporate purchasers to get increasingly active in the vPPA space. And the success has been phenomenal since then. So it’s something like 110 gigawatts have been procured by corporates globally directly of renewable energy. And for your audience to put that into perspective, that is 20 or 30% more than the entire US operating nuclear fleet. So this is an enormous amount of energy that is being directly purchased by corporate entities for sustainability goals. To a degree that process has been a bit of a victim of its own success, however, and so there’s a fairly broad call today to move towards the sort of 2.01 version of decision making in carbon accounting; to move beyond the sort of annual REC accounting that we just went through – 100 megawatts bought anywhere at your locations anywhere in the US. If you buy 100 megawatt hours of RECs, or you receive them as part of your vPPA anywhere else, at any other time in the US during that year, you’re carbon neutral. And the reason is that the carbon intensity of each megawatt hour is wildly variable. If you are in the middle of the day, in Southern California, you are talking about incredibly clean electricity, because of the amount of solar there. If you’re talking overnight in West Virginia, you’re talking almost exclusively to coal plant serving that. If you are consuming power, based off of where you are consuming it and when you are consuming it, that is dirty power, since it’s being driven by a coal facility or a less clean gas plant or whatever. Really any thermal asset will have a significant carbon emission. Then you are buying power from a location that is already fairly clean. So the panhandle of Oklahoma and Texas already have an enormous amount of wind, big parts of California have enormous amount of solar, etc. Adding more wind and solar in those locations that already have a significant amount, has a much lower carbon benefit than building those plants somewhere that there aren’t already an enormous amount of projects. We as an industry have built wind and solar in huge volumes where we have for a good reason. It was cheapest to build in those locations so you were able to offer the lowest price to customers to buy there The challenges and the concern of many, and this is sort of the birth of this Emissions First Partnership Principles that was announced by a large group of corporates right before Christmas last year, is really driven by “how do we drive decision making towards the highest impact projects and activities as measured in units of carbon, rather than megawatt hours.” So we are seeing a call, now that we’re seven, eight years into the carbon accounting regime that incentivized procurement of renewables and the RECs associated with them, roughly a decade ago, to something that is a bit more of a scalpel and less sledgehammer for the next decade, to make sure that capital is flowing towards the highest impact solutions on offer.

Paul: I love your reference to corporate renewable purchases being a victim of its own success, because back in 2010-2011, all the way all the way to maybe five years ago or so, any sort of investment in a renewable project was a good thing for the grid, where we’re bringing new renewable energy online, and probably not investing those same dollars that could have gone to a natural gas plant. So what we’re doing is we’re replacing these fossil thermal power units with renewable energy that’s cleaner and beneficial. So even if we’re just “truing” things up on an annual basis, there was a net positive associated with this. And now as you’re saying, because you’ve got locations such as California and Texas, which already have a substantial amount of renewable energy being generated there already, any additional wind projects that you put into Texas or any additional solar project that you put into California isn’t going to be as impactful as placing that same project in say, West Virginia, or Wyoming, or something like that. Is that fair?

Lee: It is. I think I’d make two qualifications on that. One is that on a binary basis, one more wind or solar project anywhere is going to have a positive benefit. It’s just a question of how big of a positive benefit. It’s really just what is the bang for your buck when you are the investor or the buyer of power, enabling that project to exist. And it’s not just state by state, it’s often very specific to the locations. If you’re building a wind farm, right outside Houston or Dallas, you don’t have the transmission congestion issues that are causing projects in the panhandle of Texas to curtail each other, which means that basically, when it’s really windy, and you don’t have high demand in that location, or you basically have more wind power than can make it through the transmission network to demand, projects are effectively shutting each other down. In places where you have overbilled behind a transmission network that can’t get it out of that location, you can have projects that are shutting off their plant for 30 or 40% of the megawatt hours they could have produced in a given month, because there just isn’t enough local demand or transmission to get it out. So adding another wind or solar project to that specific location is going to do nothing but add to the amount of electrons that are basically evaporating into the air and are unused and curtailed because there isn’t transmission. Whereas building it somewhere where you’re not constrained, and where you are closer to demand, and where you’re going to be effectively competing with a coal plant or a gas plant, more frequently on an hour by hour basis as a participant in the power market – that’s where you’re going to have the most impact. And I think that one of the things that makes that really interesting is that it also broadens the spectrum of technologies and solutions that are considered carbon valuable, meaning they will reduce carbon and so on a REC-based method where you can look at how many RECs did you buy from a wind or solar project, building a transmission line or building a storage project had sort of limited marketable value on your impact on carbon emissions. But for example, building a solar project, excuse me, a storage project somewhere where every time it’s windy projects are curtailing themselves, and then coal is coming back online, when the wind dies, a storage project in that location can sop up the wind that would otherwise have to be shut off, wait for the wind to die, and then discharge into the grid and compete with a dirty thermal plant. The view there is that when you shift towards carbon-based impact instead of megawatt hour-based impact, you not only drive decision making towards the highest impact solutions, but you broaden the number of solutions that quote unquote, count, and we really are moving towards a carbon free future is not a silver bullet of just more wind and solar. We need more wind and solar, but we need more transmission, we need more geothermal, we need more storage, we need more demand response, we need more of a lot of things that aren’t associated traditionally with the RECs that are used in market-based accounting.

Paul: So this is interesting because it seems to me that we’re bringing up two different issues around how to measure and qualify and quantify to a point, how successful we are in terms of making those impact decisions, right. One of which is, in the past, we had RECs which were kind of easy to understand – one REC equaled one megawatt hour worth renewable energy – but you don’t necessarily get RECs off of a new transmission line and increasing that pipeline of flow from the panhandle of Texas, in your example, through to a load center in Dallas or Houston. It seems like we first need some way to measure and quantify what that impact is. We can make some comparisons around whether we put in a new wind facility, whether we put in a new transmission project, whether we put in a new storage asset. And then the second point is “how do you start to determine the impact between these different locations?” How do you start to quantify what that difference is between placing a wind facility in West Virginia versus placing a storage facility in the panhandle of Texas.

Lee: That’s where we come in.

Paul: Did I queue you up enough on that one?

Lee: That was great. I appreciate it. It’s important to point out it’s not that five years ago, everybody just ignored data that was in front of them, that building one more project in the Panhandle of Texas was going to have half the value of a project outside Houston from a carbon perspective. The data just didn’t exist. So until very recently, when you did any sort of carbon analysis, at best you had regional data. In some places it’s just country level. In the U.S. we had more independent ISO level. So in the Mid Atlantic, the Midwest, California, you had the electrical grid level. But even within that, you wouldn’t be able to tell the difference between one part of West Texas and another part of West Texas on either side of a transmission constraint. And that was what we started working on two years ago, initially with Microsoft, and the group has expanded significantly since then, to create and publish data that’s called Locational Marginal Emissions. Any of my fellow power market nerds on the podcast will recognize that sounds a lot like ‘locational marginal price’. So every hour at every of the electrical nodes, which are all of the locations where basically demand and supply clear in any grid every 5-15 minutes or hour, depending on what grid you’re in. Texas, for example, has hundreds and hundreds of electrical nodes. Each one of those can have a different price printed every single hour, based off of supply and demand that location, transmission congestion, etc. As a result of that, each one of those nodes can also have a very different carbon impact. Because if you are, again, one of the nodes on the side of a transmission constraint that is swimming in solar power, the price of electricity is going to be zero, or maybe even negative, because there’s more electricity being generated at a cost of zero because the fuel is free. And as a result of that, the carbon impact of an additional megawatt hour at that location is zero, because you’re not competing with a coal or a gas plant in that hour, you’re competing with just another solar project. Go to the other side of the transmission constraint, and you’re in an electrical node. If you inject one new megawatt hour of solar power in that location it’s going to cause a gas plant or a coal plant somewhere else in the grid to back off by one megawatt hour, which is how the grid works to balance, and you’re going to have a very big carbon impact. So we started publishing that location level, hour level, carbon intensity data that is needed to do things like measure. If you’re an energy storage project, and you charge when solar is on the margin and you discharge when coal is on the margin, your activities have a huge carbon reducing activity. Whereas if you charge when coal is on the margin and discharge when gas is on the margin, you’re actually increasing carbon emissions every time you do a round trip charge of your asset. It can potentially be the same location, same asset energy storage, but when it chooses to charge and discharge at that location can have dramatic impacts on its impact from a carbon emissions perspective. We sell that data directly, we work with partners who are piping it into their systems in order to support all forms of different decision support, long term procurement of vPPAs, people making 10, 12, 15 year decisions around where to buy power from wind or solar projects, all the way down to that example I just gave, which is storage projects trying to use it to figure out hour by hour what’s the carbon intensity of their activities and what can they do to reduce those. Meta and Broad Reach Power made some announcements at the end of last year about how they use our data to do exactly that as sort of early movers in that space on energy storage, for example.

Paul: That was where I wanted to go next. This sounds like fascinating analytics that’s occurring, you said, every hour, across hundreds of nodes across the US or maybe 1000s, given how many different clearing points there are within the electrical grid in the US. How are your customers using it now, and who are your customers who are taking up this type of analysis to make better decision making?

Lee: In terms of who is using it today, I would say the direct or ultimate customer – we have some partnerships who are serving the same customers too and they bring a piece to the puzzle that we don’t have, and we bring the carbon data – but the end customer at the moment is almost always a buyer of renewable energy. So the corporate purchasers we’re talking about now, or the developer of a project, investor of a project, or energy storage. So if you’re building or owning wind and solar projects, you’re a potential customer. If you’re buying power from those projects, you’re a potential customer, or if you’re an energy storage developer or operator, you’re a potential customer. And each one of those has a slightly different workflow use case. So as an example, if you are a buyer of renewables, your goal is measure and maximize. Those are the two ways you’re going to use our data. On a maximize, you’re trying to make decisions based off of that. So if you’re looking to buy a PPA, and you’re looking at three different projects, so on paper, let’s say you ran our request for proposal, you got 15 bids, you narrowed that down to three that you like and on paper are, for all intents and purposes, expected value, etc., development risk. Let’s say they’re a toss up between the three – you’re then going to look at that and say, “okay, well, this one is at a location that has been abating two tenths of a ton of carbon per megawatt hour, this one has been abating six tenths of a ton per megawatt hour, and this one’s been abating four tenths of a ton per megawatt hour.” And those are all potentially same fuel, same grid, and that plus/minus 50 or 100% is the scope we’re talking about. We’re not talking about on the margin differences. There can be very large differences in the carbon intensity of these projects, even with the same fuel, if you’re talking Texas solar or PJM wind. The first decision is “how do I ensure that I’m making my next procurement decision to maximize the carbon impact of that procurement?” So that’s the maximize side, and then there’s the measure side, that is once that project is up and running, month by month, year by year, you’re going to be tracking, given how much power that project generated and the carbon intensity of each hour that those electrons/megawatt hours hit the grid, what was my actual carbon impact? And in some cases, groups are using that to try to make their voluntary carbon disclosures using that more accurate data, because current carbon accounting rules, which are in the process of being considered to be rewritten, don’t require you to use these more granular, more accurate methods. You can still use REC-based accounting. Other groups are tracking it in parallel with a REC-based accounting, because they’re saying, “well, I’m making 15 year commitments with this procurement and these ESG rules are being written every year. If I’m going to be in this contract for 15 years I want to know how big is the gap between what my carbon accounting is using REC-based methods and what it would be if I am encouraged or required to use more granular data in the future.” How do I maximize my impact and how do I measure my carbon footprint as a result of it – those are the two ways a buyer is using the data. If you’re thinking about an investor, almost all investors in this space have their own ESG metrics, and they’re doing that same measure element. But another big part of it for them is the self interest, right? Which we applaud. They’re buying projects in order to sell the electricity and sell the RECs, and potentially in the future sell the project to someone else. As ESG metrics, not just in renewable energy but globally – the scrutiny around ESG to figure out where’s the meat from the fluff and the requirements around going more accurate and more granular – as that movement pushes forward, groups are saying, “well, if I think this is the way that carbon accounting or REC valuations are going, I want to make sure I’m the one who’s investing in or buying or owning the plants that are top quartile or top decile in the carbon impact space, because those are going to be the most valuable megawatt hours, the most valuable RECs, and most valuable projects, because they’re having the highest impact and carbon reduction is a metric of success.”

Paul: So maybe it’s again far too much of a simplification to think about it this way, but in similar ways that banks or lenders will think about loaning or investing in an individual due to their credit rating and giving a different perspective around that, what you’re saying is that there’s a carbon rating if you will – an emissions rating – for each of these different projects that we need to account for in some way, and you guys have brought a methodology to the table that hopefully people will be able to adopt and use in some fashion to make better decisions. Especially even if it’s not today, these are 15-20 year agreements, 5, 6, 10 years down the line you’re going to want to have some perspective about the impact that you’re having on emissions, not just on price, and not just on RECs.

Lee: Correct.

Paul: So you mentioned it earlier in the podcast, this Emissions First Partnership, and I was hoping you could talk a little bit about that because this is a group of companies and firms such as yourselves who’ve really embraced this idea of focusing investments on emissions impact and not simply on putting a new renewable project in place or trying to maximize RECs and devalue their lead. Tell me a little bit more and help put the right words in my mouth around what Emissions First is all about.

Lee: Yeah, so we are supportive of it, and I’ll go into how, but we are actually not ourselves part of the Emissions First Partnership. It’s the Emission First Partnership and you have to have many, many billions dollars worth of assets to be part of that partnership today.

Paul: You guys haven’t gotten there yet, huh?

Lee: Yeah, next year. Right. But yeah, so the Emissions First Partnership, which was announced right before the holidays in December of last year, in 2022, are 10 public companies who primarily buy renewable energy, or in some cases invest in it. The leaders who sort of pulled the group together – Amazon, Meta, Salesforce, and Hannon Armstrong – sort of kicked the group off. And then it also includes Akamai, GM, Heineken, Intel, Rivian, and Workday. So those are the 10 companies that came together to publish. If you go to emissionsfirst.com, that’s their website. And they publish a set of principles where their primary goal there is to advocate for this switch in mindset from thinking about success in number of megawatt hours and thinking about success in tons of carbon. And so it really just comes back to the conversation we’ve just had about how do you incentivize the highest impact projects? How do you incentivize behavior that doesn’t create RECs, necessarily, storage, dispatch, etc, load shifting, to really accelerate our path towards a zero carbon future. That was their group and I think the primary aim of their announcement was really lobbying towards some of the NGOs – I think World Resource Institute, in particular – to really pay attention to that movement; the shift from megawatt hour-based to tons of carbon-based success metrics, as the Scope 2 carbon accounting rules look to be potentially rewritten in the in the years ahead.

Paul: How difficult is this going to be for the next wave of corporations? You mentioned all of those that are involved in Emissions First, and those are big companies that have the resources to invest behind getting this right. How difficult is it going to be for the next wave of corporations to come in and use your data or other types of accounting principles to measure on an emissions first-basis versus a megawatt hour-basis?

Lee: So if we do our job correctly, and we do our job the way I hope we will, it shouldn’t be any harder, right? Because at the end of the day, there’s a lot of complicated power markets math that goes into backing out what is the Locational Marginal Emission at node X and hour Y. The end user doesn’t have to know that or do that work, they just have to know that when they buy power from something that has data connected to it, at the end of the month they get a report that says, “Well, your settlement from your PPA last month was positive or negative a million dollars and you received 100,000 RECs, and a result of that you abated 600 tonnes of carbon.” Now, that math probably didn’t work out in my head, but the idea is that the end result is if you are coming to this market ready to procure energy and at the end of the day if you’re signing a vPPA, you are providing financial certainty to the project around the price that they are actually going to realize after the settlement at PPA in order to get built. And so if you’re a corporate buyer, who has the financial appetite and credit support and all the things that are needed to participate in a large energy transaction, more accurate carbon data is a feature you should get without noticing it as opposed to something that requires a new set of brain damage.

Paul: But it also sounds like this is something that can go well beyond a vPPA use case as well. As I think about what you’re laying out here, this is the first instance of where we as a grid and as as a consumer base are starting to think about the energy that we purchase not based off of price or based off megawatt hours, but based off of the emissions that it creates in the first place, right. And when we start thinking about such actions, such as demand response, where a company or an individual could receive a signal saying, “hey, prices have risen in your area because of a lack of supply or an overabundance of demand, and based off that pricing, or we’re asking you to reduce your thermostat, or to turn off a couple lights, or maybe shut down a couple of computers that you’re not using right now.” That demand response signal could shift away from a price signal, and more to an emission signal, given the fact that, like in California, it’s very sunny during the day, lots of solar, very clean, but at night maybe not as much so. Lee, it seems like there are opportunities here to expand your use case beyond the 15 year vPPA as well.

Lee: That’s exactly right. And I think that you point out one clear example around folks’ homes with thermostats. We have a partnership with a group called WattTime, a subsidiary of Rocky Mountain Institute or RMI. And they provide real-time signals around regional and sub-regional carbon intensity to exactly that – thermostats. The providers of smart thermostats who can typically, without the user ever noticing; like if you’re at your house, and he’s like, “well, we’re going to shut off your air conditioner for 10 minutes, and then fire back on because these are particularly dirty 10 minutes”, you’re not going to notice the difference, but you’ve given us the right to sort of optimize, so long as your comfort isn’t changed for carbon reduction. This is a big area of opportunity for the EV makers. For example, you plug in your car and it says, “Do you want to charge right now? Or do I, the car, get to choose at some point in the next 12 hours when to charge? Because I’ll look at the grid and I will wait until the grid is cleanest and I’ll charge then. And if it switches back to being carbon intense at any moment I’ll pause the charging.” So you can get in your car in the morning, and it says “hey, because you gave me the flexibility to charge following a carbon signal, you emitted X lbs or kgs of carbon less as a result of that.” And so the goal is that this sort of data drives decision making down to that potentially very granular level, all the way up to a 10 year, 250 megawatt power purchase agreement. It’s the decision support that’s enabled by that carbon signal throughout the energy ecosystem.

Paul: Hey, nobody ever said the energy transition was going to be simple or easy to get through. And in the future, 50 years from now, when the entire grid is renewable, we’re not going to need analysis like this. But in order to get to that point, and in order to maximize the impact that we’re having today, both in terms of the types of projects that we’re putting into place, whether it’s storage, transmission, solar, wind, any sort of renewable project, whether it is the demand side decisions that we’re making around EV charging, whether load shifting or demand response, Lee, it sounds like this analysis and kind of shifting to an emissions first, and I’m going to borrow that as phrase-ology because it’s so perfect, an emissions first mindset is the way to go. Lee, fascinating, fascinating work in terms of what you guys are doing. It sounds very complex, but it sounds like it’s very, very needed right now within the energy transition.

Lee: We’re definitely excited about it, so if any of your listeners want to learn more, we’re at resurety.com. I hope they’ll pay us a visit and reach out. I’d love to hear from potential partners, customers, team members – all the above. It’s an exciting time.

Paul: Perfect. Lee Taylor, CEO of REsurety. Thank you very much for joining us today.

Lee: Thanks Paul.