SVP of Software Solutions

Here at REsurety, we know how important accurate forecasting is. We know that our customers need credible, explainable predictions of the expected value and upside/downside risks of the value of clean energy in order to make long-term investment or procurement decisions. And for that reason, for the better part of the last ten years, our team has been developing and improving upon long-term power price and renewable generation forecasting models. Up until now, however, those forecasts have relied on machine-learning methods and have only been available on a limited basis to customers via our Advisory services. We’re excited to announce that as of today, we have released a new fundamentals forecasting model, and are making it available across all of our product and service offerings including our SaaS platform, REmap.

REsurety developed our latest fundamentals forecasts in order to give our customers unprecedented ease of access and confidence about the future value of their clean energy projects. With these newly released forecasts, you can:

- Develop an optimal portfolio: simulate portfolio performance under a range of outcomes to develop/manage your portfolio.

- Calculate project-specific forecasts: all of our forecasts are natively calculated using project-specific hourly generation, so you can calculate the expected performance of your project with one click in REmap.

- Stress test: gain visibility into downside risk driven by weather variability or changes in market dynamics, e.g. increased storage penetration, a hot summer/winter, or the impact of high renewables build out.

The Importance of Weather Variability

The most distinguishing characteristic of REsurety’s forecasts is that we don’t just model a single weather-normal year (e.g., an 8760), because we know that models based on 8760s will likely overestimate value for renewables, underestimate value for storage, and underestimate variability across all projects. Instead, we simulate ~40 years of representative hourly weather – and the impact that has on every project and load center on the grid – to develop a thorough distribution of possible weather outcomes. Importantly, this means that hourly project-specific generation is an input into our model, as opposed to being calculated after the fact.

This extremely data-intensive and compute-hungry approach is designed to give customers the answers that they need about the future. Users can: run sophisticated portfolio simulations across projects and markets using realistic and consistent weather inputs; confidently calculate the value of storage, where profitability is highest during periods of extreme weather and market volatility; and calculate the expected value and downside risk in their PPAs for accurate budgeting.

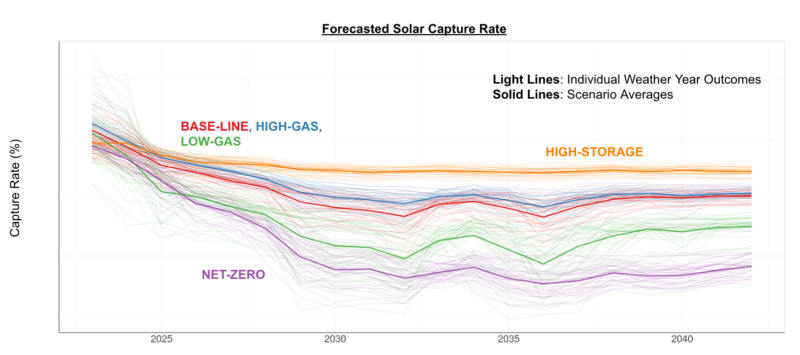

Unlike traditional forecast providers, REsurety’s fundamentals-based forecasts realistically take into account a range of possible weather conditions and the impact that they have on each project in order to solve for power prices in each hour. The plot below shows the value of the approach: for each of the five market scenarios, 40 representative weather-years (represented by thin lines) are simulated in the model. We’re calling this realistic approach to weather variability “Weather-Smart.”

“We’re excited to bring together our strengths in Atmospheric Science and Power Market Analytics in this model release,” said Adam Reeve, SVP of Software Solutions at REsurety. “Traditionally, those two fields have been separate in the industry, limiting the ability for customers to apply forecasts to their clean energy projects or portfolios. This Weather-Smart approach gives users a much more robust way of forecasting the value of clean energy.”

Why A Fundamentals Model?

REsurety’s newest forecasts leverage an hourly production cost model that accurately represents the operational and market design complexities of the power markets. It takes into account the physical power flows, hourly generation from each renewable plant, hourly load, and future market conditions inputs to solve for hourly power prices. As an example, this means that, in each hour, we model the generation at every renewable plant on the grid (based on localized wind speeds / solar irradiance, turbine / panel type, etc.) as well as production costs for dispatchable generators. We also model load in each hour, as well as the transmission limitations of the grid and other market-specific characteristics. Given these inputs and constraints, we then solve for power prices in the same way that a system operator (such as ERCOT) would.

After years of creating advanced models, we’ve learned that such a rigorous approach has a number of advantages over machine-learning (ML) models. Specifically, ML models struggle to make accurate predictions about a future that may look very different from the recorded history – such as predicting price formation in a market with a rapidly changing installed base of grid-scale storage. Results from ML models are less interpretable, making it harder for customers to understand why a certain price was produced – and by extension whether it is reasonable or not. Lastly, ML approaches are less capable of accurately simulating how changes to market rules or regulatory policies will impact prices. For these reasons, REsurety has invested in the latest fundamentals-based model that we’re excited to release today.

REsurety’s Weather-Smart fundamentals power price forecasts are currently available in ERCOT, with CAISO available later this year and full market coverage by mid 2023.

To learn more, please visit http://resurety.com/remap or email [email protected].

Return to the blog post main menu.