Director, Customer Success

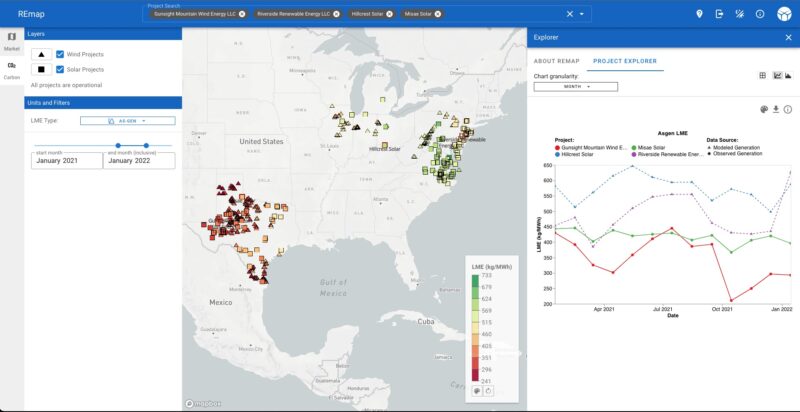

Today we’re announcing the availability of Locational Marginal Emissions (LMEs) data in REmap. With this launch, our customers can now analyze the market value of their renewable energy projects as well as the carbon impact, all in one platform.

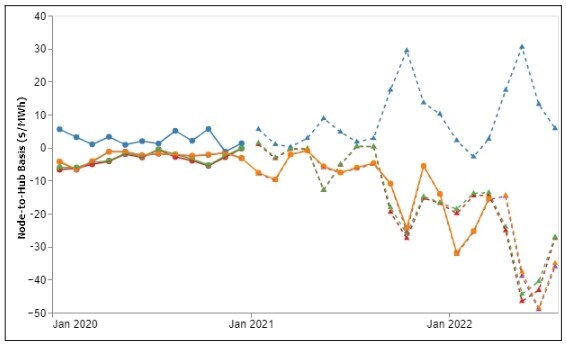

When we spoke with clean energy buyers, investors, and advisors about their biggest challenges, we learned that they need a better way to co-optimize the economic and carbon emissions impacts of their investment or procurement decisions. The economics of renewable energy projects have long been driven by time and location: when and where each MWh is produced determines the market value of that generation. As carbon accounting evolves to be similarly granular, customers want a toolset to help evaluate emissions impacts with the same level of rigor.

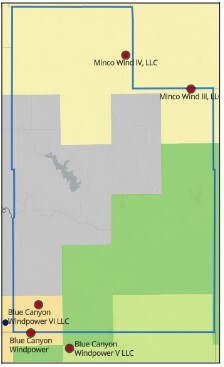

REsurety’s Renewable Energy Market Analytics Platform (REmap) is a map-based web platform that allows users to visualize and access hourly generation and power market data across thousands of locations in U.S. markets. For the past several years it has been valued by customers for its speed, ease of use, and high-quality datasets. REsurety’s nodal LME data, which measures the carbon emissions impact of clean energy generation at each specific location and hour, previously existed as a standalone data solution. We’re excited to integrate LME data into REmap to provide customers with fast and easy access to LME data via the powerful web interface, and enhance the capabilities of the REmap platform.

What this means to customers:

For clean energy buyers: access to LME data in REmap is particularly valuable when developing a procurement strategy or analyzing request for proposal (RFP) submissions for a power purchase agreement (PPA). It identifies the projects with the greatest decarbonization potential or determines which ISOs or regions to prioritize based on potential emissions impact.

For climate positive investors: the ability to see the emissions impact of merger and acquisition (M&A) opportunities alongside project financial performance; enabling accurate analysis of avoided emissions per dollar invested.

For investment banks and corporate advisors: the capability to clearly visualize the emissions and power market data needed to win clients and help set and execute sustainability strategies.

Learn more at http://resurety.com/remap or contact [email protected].

About the author

Blair Allen has extensive experience in energy information services products that support both ends of energy market exposure, from the project development phase to managing merchant generation. Before joining REsurety, Mr. Allen worked at a large energy data and analytics company as the Chief of Staff to their Power business unit, helping to manage, develop, and grow the company’s global portfolio of electricity market products and services. Prior to that he worked as a Senior Market Analyst offering price and congestion forecasts to customers with physical or financial risk in Mid-continent ISO. At REsurety, Blair serves as the Director of Customer Success.

Blair holds a Bachelor’s degree in Philosophy from Bucknell University, with a minor in Economics.

Return to the blog post main menu.