Authored by Carl Ostridge and Devon Lukas

Executive Summary

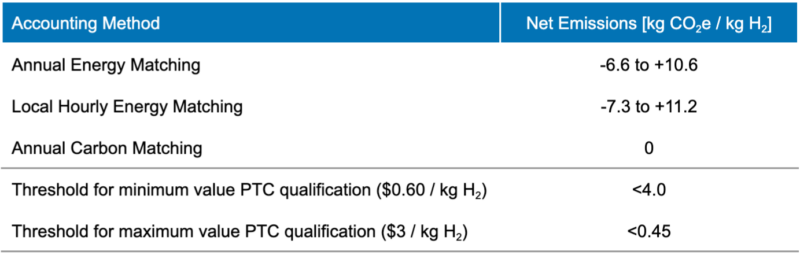

REsurety uses Locational Marginal Emissions (LMEs) data to analyze the effectiveness of the three carbon accounting methods proposed for compliance with new production tax credits available for clean hydrogen under the Inflation Reduction Act (IRA). This analysis considers 32 electrolyzer-renewable project pairs across 3 different grid regions (ERCOT, PJM, and CAISO) using hourly emissions and generation data from 2022. Seen in Table 1 below, the results show that, due to the difference in carbon intensities on the grid based on location and timing, determining “clean” hydrogen using Annual Energy Matching often results in significant increases in emissions despite the procurement of an equivalent quantity of energy from offsite clean energy to match the electrolyzer’s consumption. Further, Table 1 shows that while Local Hourly Energy Matching can help reduce net emissions in some locations, the impact of local transmission constraints often results in significant increases in net emissions even after energy is “matched” by hour. Finally, the Annual Carbon Matching method, using LME data, can ensure low or zero net emissions and qualification for the clean hydrogen production tax credit. The Annual Carbon Matching method also helps to incentivize development of electrolyzers in locations with cleaner grids with lower existing marginal emissions and the procurement of renewable energy in locations with dirtier grids and higher existing marginal emissions, therefore maximizing the ‘greening of the grid’ impact of the IRA legislation.

Fill out the form to access the full paper and accompanying resource.

"*" indicates required fields