The Energy Storage Solutions Consortium will develop a first-of-its-kind methodology to quantify the greenhouse gas emissions benefits of stored energy usage.

Sept. 14, 2022 (Menlo Park, Calif.) – A group of leading organizations, including Meta, REsurety, Broad Reach Power and others, has announced the formation of the Energy Storage Solutions Consortium, a consortium to assess and maximize the greenhouse gas (GHG) reduction potential of electricity storage technologies. The group’s goal is to create an open-source, third-party-verified methodology to quantify the GHG benefits of certain grid-connected energy storage projects, and to ultimately help add a tool for organizations to create credible progress toward their net zero emissions goals.

Once approved by the third-party Verra through the Verified Carbon Standard Program, the standard would be the first verified methodology to quantify the emissions benefits of large-scale energy storage facilities, and would provide valuable guidance such as when to deploy stored energy to deliver maximum emissions reduction benefits.

“At Meta, we are committed to accelerating the transition to the carbon-free grid of the future, and large-scale energy storage is a critical part of that transition. Having achieved 100% renewable energy for our global operations, we are now looking to help move the energy storage industry forward by addressing next-level challenges and opening pathways that will help drive high impact emissions reductions on the grid,” said Peter Freed, director of energy strategy at Meta. “We are excited to launch this consortium in partnership with these industry-leading organizations, who will bring diverse perspectives and experience to the development of a robust, transparent methodology.”

“We need to decarbonize the grid as quickly as possible, and to do that we need to maximize the emissions impacts of all grid-connected technologies – whether generation, load, hybrid or standalone storage,” says Adam Reeve, SVP of software solutions at REsurety. “Enabling this sort of decarbonizing activity is the exact reason why we invested in developing high-resolution Locational Marginal Emissions. Energy storage is a technology that has huge potential, and we’re delighted to partner with industry leaders in this forward-thinking and collaborative effort to develop a global standard for energy storage benefits.”

“Battery storage will play an increasingly important role in delivering reliable and affordable power to homes and businesses as we move toward a 100% renewable energy grid. As the leading utility-scale battery storage platform in the U.S., we’re looking forward to working with other industry leaders to be able to quantify the important GHG reduction benefits of large-scale energy storage facilities and help organizations take climate action,” says Paul Choi, EVP of origination at Broad Reach Power.

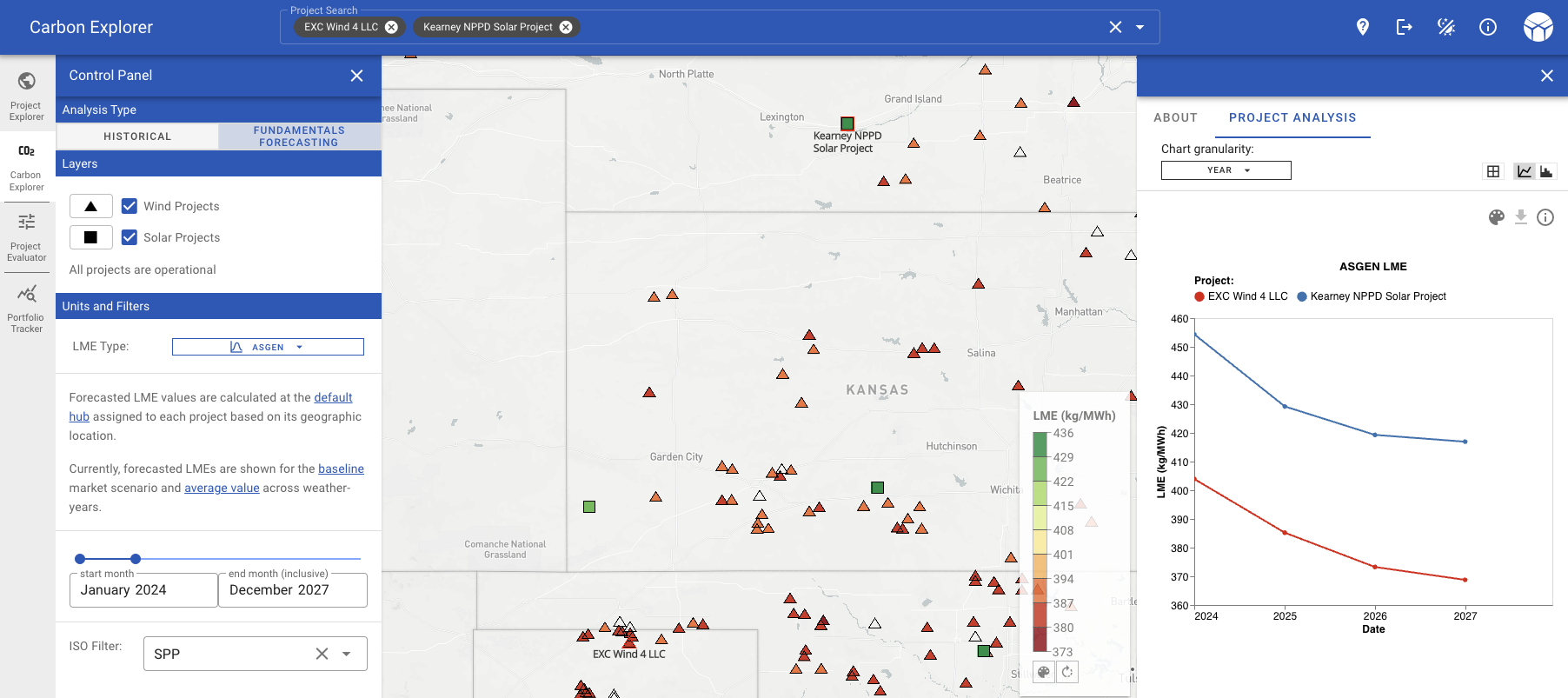

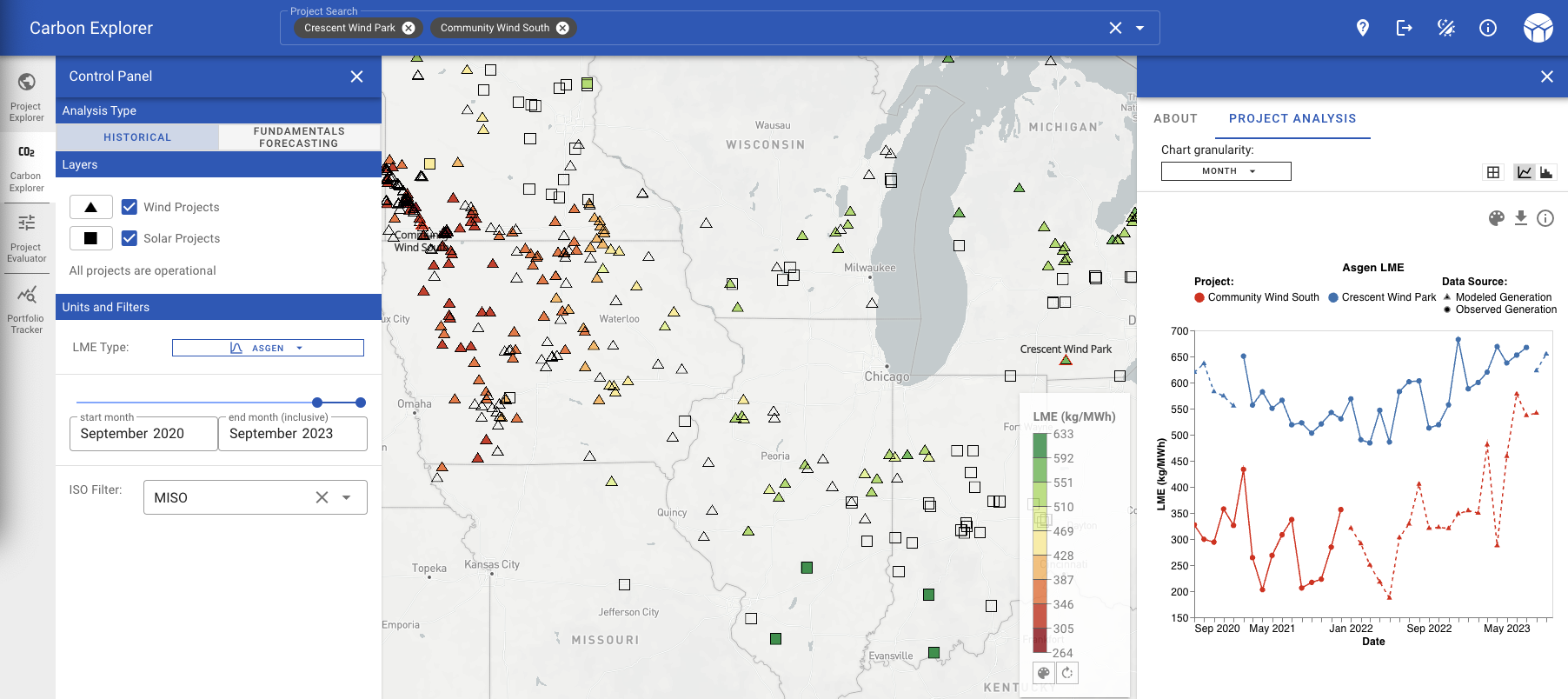

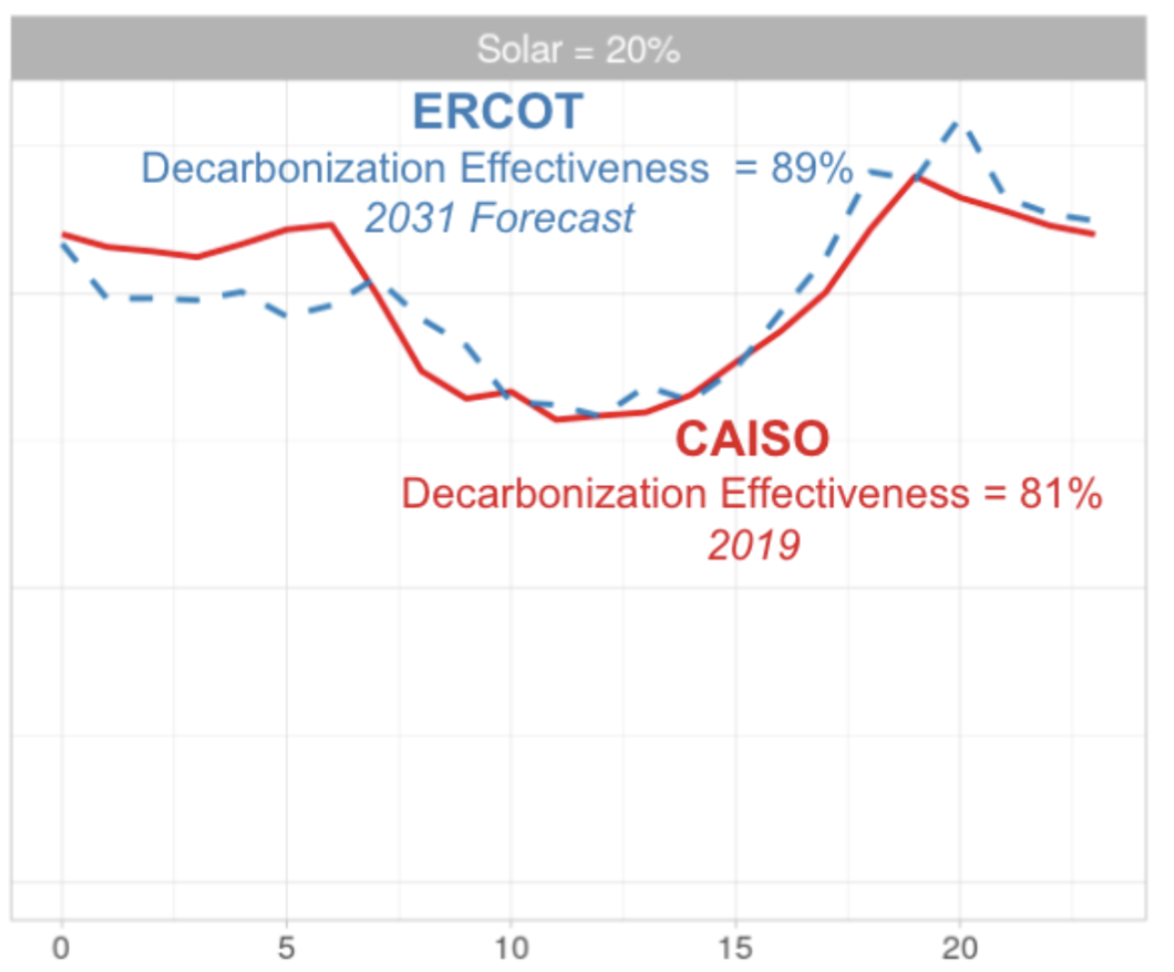

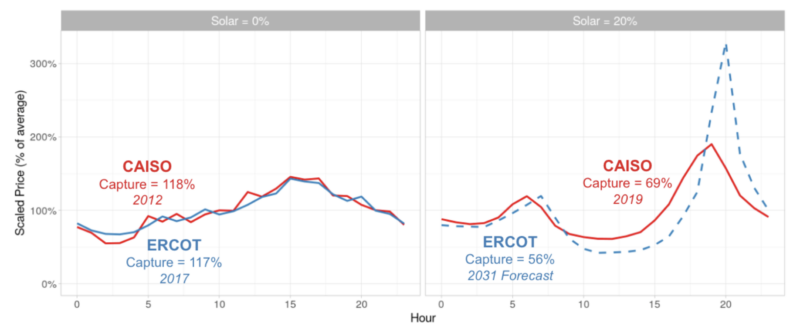

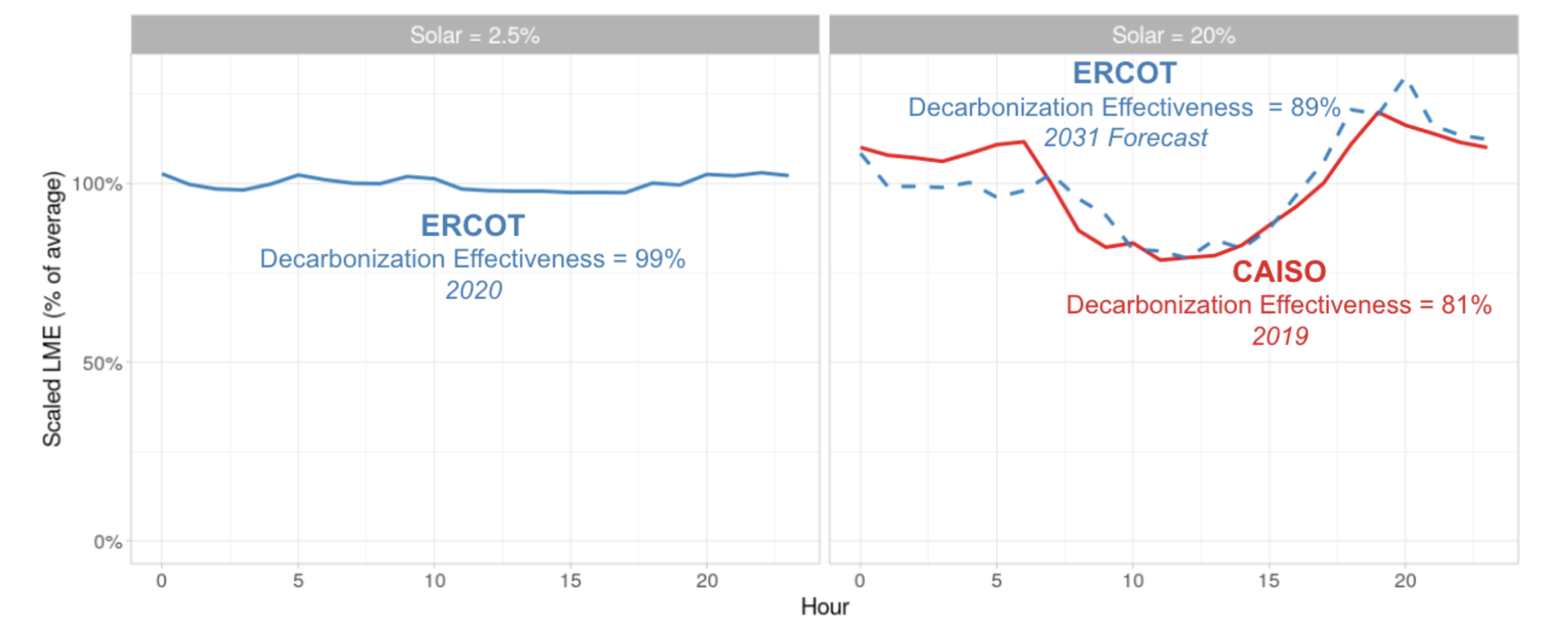

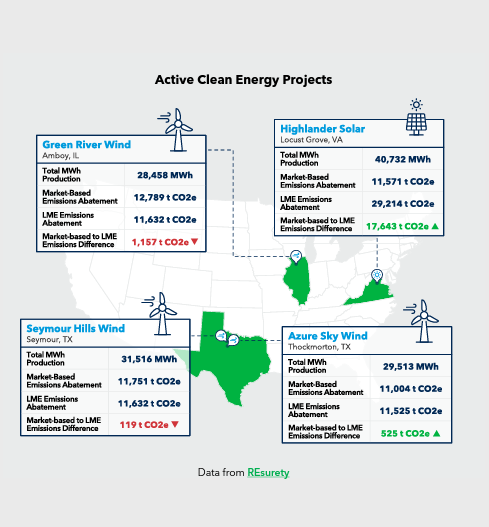

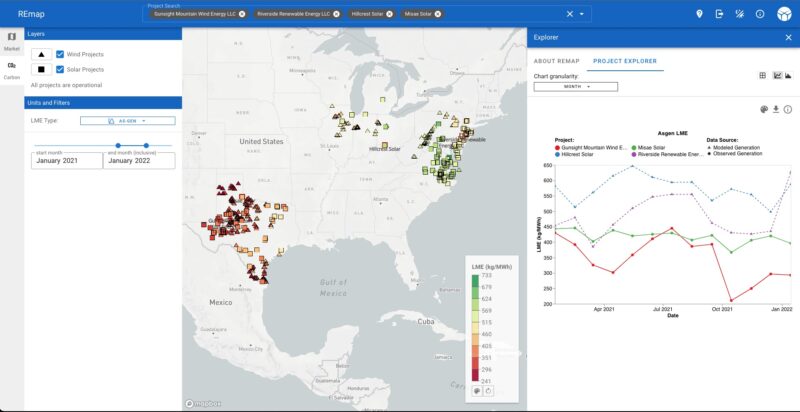

In order to calculate the GHG benefits of large-scale energy storage facilities, the consortium will leverage locational marginal emissions. This concept measures the tons of GHG emissions displaced through the charging and discharging of energy storage facilities on the grid at a specific location and point in time.

In addition to steering committee members Meta, REsurety and Broad Reach Power, the consortium includes a number of advisory committee members. These advisory members include leading technology companies, emissions data providers, investors, storage developers and service providers, and non-governmental organizations among others.

Members include:

3Degrees Group, Inc., Akamai Technologies, Clearloop, Equilibrium Energy, Fluence, General Motors, GlidePath Power Solutions, Habitat Energy, HASI, Jupiter Power, Longroad Energy, Marathon Capital, Microsoft, Primergy Solar, Quinbrook Infrastructure Partners, RES Group, Rivian, Rowan Digital Infrastructure, Stem, Tabors Caramanis Rudkevich, TimberRock, UBS Asset Management, and WattTime.

The Energy Storage Solutions Consortium is also partnering with Perspectives Climate Group, the German consultancy dedicated to helping its clients achieve net zero GHG emissions and to developing practical solutions for accounting of emission reductions from innovative climate- friendly technologies.

About Meta Platforms, Inc.

Meta builds technologies that help people connect, find communities and grow businesses. When Facebook launched in 2004, it changed the way people connect. Apps like Messenger, Instagram and WhatsApp further empowered billions around the world. Now, Meta is moving beyond 2D screens toward immersive experiences like augmented and virtual reality to help build the next evolution in social technology. about.facebook.com

About REsurety

REsurety is the leading analytics company empowering the clean energy economy. Operating at the intersection of weather, power markets and financial modeling, we enable the industry’s decision-makers to thrive through best-in-class value and risk intelligence, and the tools to act on it. For more information, visit www.resurety.com or follow REsurety on LinkedIn.

About Broad Reach Power

Broad Reach Power is the leading utility-scale battery storage platform in the United States. Based in Houston, Broad Reach is backed by leading energy transition investors, EnCap Investments L.P., Apollo Global Management, Yorktown Partners and Mercuria Energy. The company owns a 21 GW portfolio of utility-scale battery storage and renewable power projects across the U.S., giving utilities, generators, and customers access to technological insight and tools for managing merchant power risk so they can better match supply and demand. For more information about the company, visit www.broadreachpower.com.

Media Contacts

Return to the press release main menu.