Customers can now easily find forecasted metrics for their PPA and REC budgeting workflows

Authored by Tara Bartley, VP, Marketing, REsurety

VP, Marketing

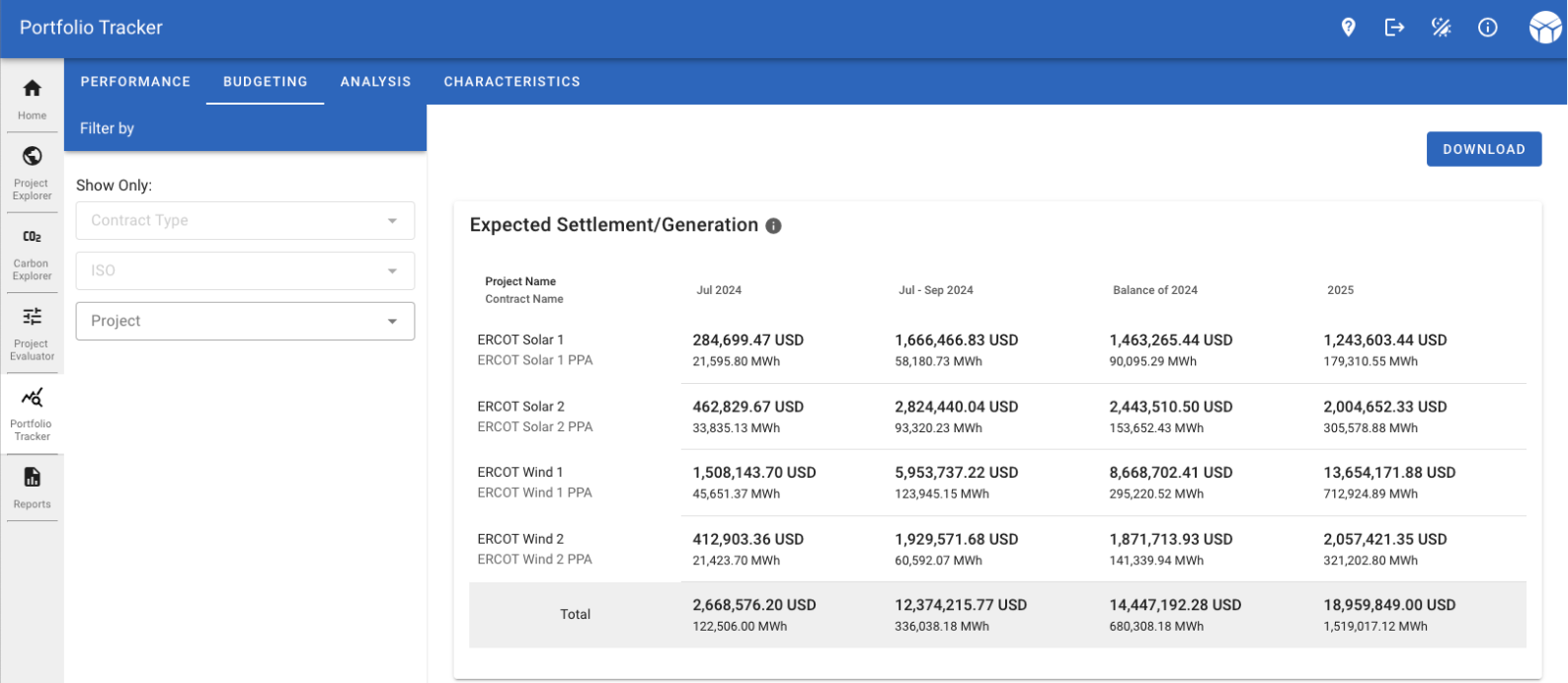

As part of the REsurety software platform, Portfolio Tracker was designed specifically for clean energy buyers and investors to forecast, audit, and explain the financial and environmental outcomes of clean energy projects and contracts. It was developed to analyze how wind and solar contracts are performing and what risks they hold; predict how settlement might occur going forward; and to track project and contract-specific carbon emissions and financial performance.

With today’s release of a new budgeting dashboard, customers can easily access forecasted settlement metrics for their contracts, including forecasts for the next month, quarter, the remainder of the current year, and for the following year. Long-term financial settlement forecasts, and forecasts for generation (and associated REC production), are available in the tool as well. Importantly, all of REsurety’s forecasts are Weather-Smart – meaning they take into account the wide range of future weather conditions that can have an immense impact on the price of power. Moreover, Portfolio Tracker automatically accounts for contract terms such as price floors, for example, applying them at the hourly level and aggregating settlement calculations to produce forecasts that are specific to individual renewable energy projects and contracts.*

The budgeting dashboard was designed with our customers’ renewable energy portfolio budgeting workflows foremost in mind and we are excited to help our customers hit their financial and sustainability goals with confidence. Get in touch to learn more about Portfolio Tracker.

*While Portfolio Tracker offers advanced forecasting and auditing capabilities, users should be aware that all projections are subject to uncertainties and potential inaccuracies.

Return to the blog post main menu.