How 45V is Shaping Green Hydrogen Production

Authored by Mikhail Sharov, Senior Analyst, Consulting Services, REsurety

Senior Analyst, Consulting Services

REsurety

Worth $18 billion in 2023, the annual U.S. hydrogen generation market is poised to expand to $31 billion by 2033. Hydrogen has myriad diverse commercial applications across varied industries: as a precursor to ammonia in fertilizer production, as an input for methanol fuel in shipping, in metals refining and processing, in fuel cells, and for direct process heat.

What is green hydrogen?

Today, most hydrogen is produced from fossil fuels (natural gas and/or coal as feedstocks). This results in a heavy carbon footprint for two reasons: greenhouse gases (GHG) released from the breakdown of the natural gas or coal itself, and CO2 released when burning fossil fuels for the high heat required of those processes.

Green hydrogen, on the other hand, is produced using electrolysis, splitting water into hydrogen and oxygen via an electrolyzer, and is powered by renewable energies. Naturally, the process of electrolysis does not produce GHGs – the only byproduct being oxygen. And since that electrolysis uses renewable electricity, it releases no energy-related emissions (unlike burning fossil fuels for process heat). As a result, growing momentum promises to make green hydrogen central to decarbonization of hard-to-abate sectors.

For this reason, green hydrogen is highly valued, and although its 2024 U.S. market size was approximately $270 million, this segment is expected to increase to ~$5 billion by 2033.

45V and H2 production lifecycle emissions

To incentivize the production of green hydrogen, the Inflation Reduction Act (IRA) created a subsidy for hydrogen in Section 45V of the bill. Section 45V establishes a tax credit for the production of green hydrogen, with the specific value of the tax credit determined by the amount of carbon dioxide equivalent (CO2e) emitted per kilogram of hydrogen produced.

In a world of “perfect” green hydrogen, 100% of the power would come from clean electricity such as that generated by solar photovoltaics and wind farms. In the real world of 45V, participation in the tax credit requires that a kilogram of hydrogen is produced with no more than 4 kgCO2e emitted. However, the most desirable level of credit (at $3.00/kg H2) is allotted to production with less than 0.45 kgCO2e per kilogram of hydrogen.

This highlights the importance of one of the main requirements of 45V: lifecycle greenhouse gases — an analysis of emissions over the entire course of production. For other hydrogen production methods, this would include the use of natural gas or coal for gasification, which results in a significant carbon footprint. Additionally, it must include the emissions generated by the source of electricity.

Let’s take a closer look at how easy (or difficult) such emissions levels are to achieve in a place such as Texas, which has a non-insignificant amount of solar and wind energy on the grid and is also one of the U.S.’s potential hydrogen hubs.

To understand the total lifecycle environmental impacts associated with hydrogen production, the DOE developed the 45VH2-GREET model. Using this model for an imagined hydrogen producer in ERCOT, we can estimate that by simply using the standard grid mix (including common, highly emitting gas and coal-fired plants), 20 kg of CO2e are produced per kg of hydrogen. Despite the electrolysis process itself producing no emissions, this is still a far cry from even the 4 kg needed to qualify for the low end of the 45V tax credit. Therefore, it is clear that renewable participation in the creation of green hydrogen is essential for any project to successfully take advantage of the tax credit. In fact, the GREET model shows that in ERCOT, over 98% of utilized energy must be clean (using solar or wind) to achieve the highest credit bracket.

How annual vs. hourly matching impacts green H2 calculations

Current accepted practice for carbon accounting (annual matching) allows a company to purchase and retire RECs from anywhere and anytime over the course of a year, and apply them at will to their electricity load and consumption also over the course of a year. Since hydrogen producers prefer to run electrolyzers at essentially steady state, this allows them to take excess solar generation from the daytime and apply it toward nighttime hydrogen production.

Starting in 2030, 45V requirements change that in a big way. The most contentious stipulation of 45V, known as hourly matching, will require producers to demonstrate that the clean energy they’re applying toward their hydrogen production was generated in the same hour as the electrolyzer’s electricity consumption. This is a dramatic and consequential shift that would render large portions of current clean energy procurement unusable toward 45V tax credits.

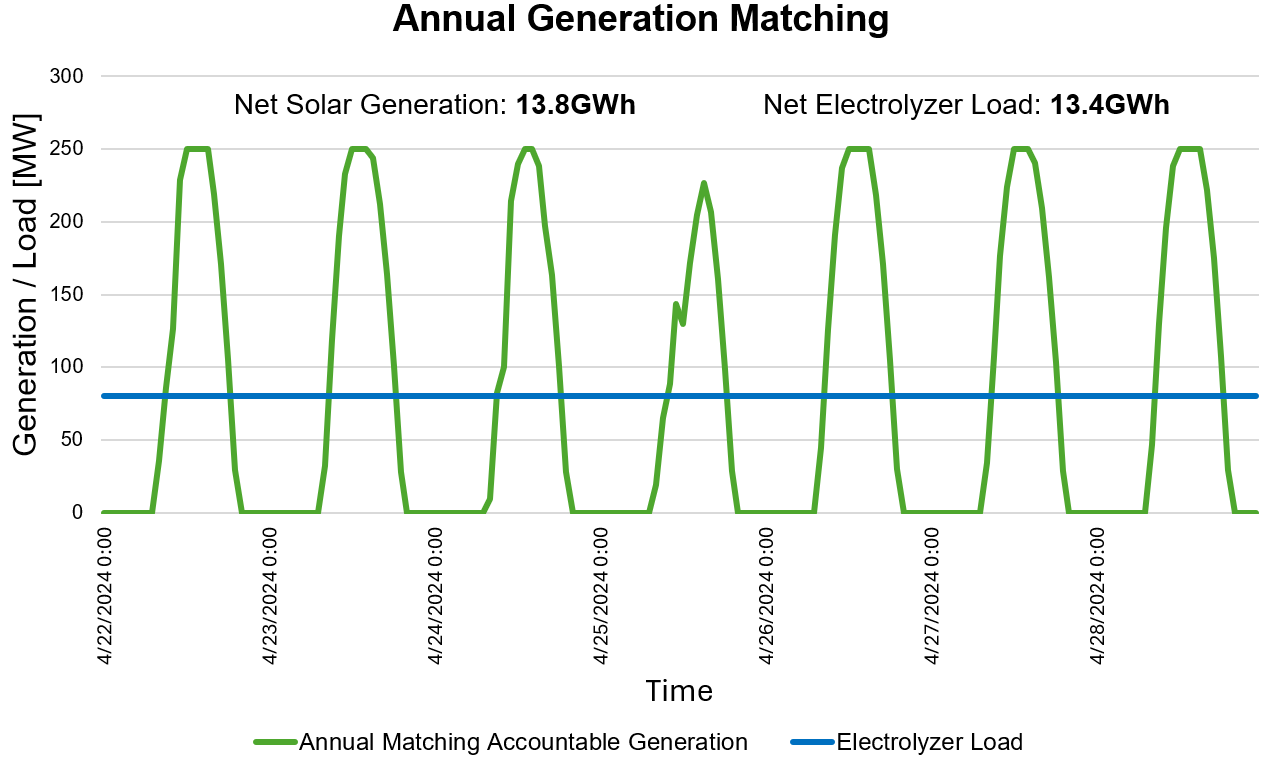

To illustrate the difference, consider a hypothetical green hydrogen project in ERCOT’s West Hub with an 80 MW electrolyzer and a power purchase agreement (PPA) with a 250 MW solar project.

Under an annual matching system, solar generation is sufficient to meet 100% of electrolyzer consumption and according to the 45VH2-GREET model, the total emissions of a kg of H2 is zero. This is great, as the electrolyzer will produce ~1.6MT H2 per hour and receive $3,000 per MT in 45V PTCs.

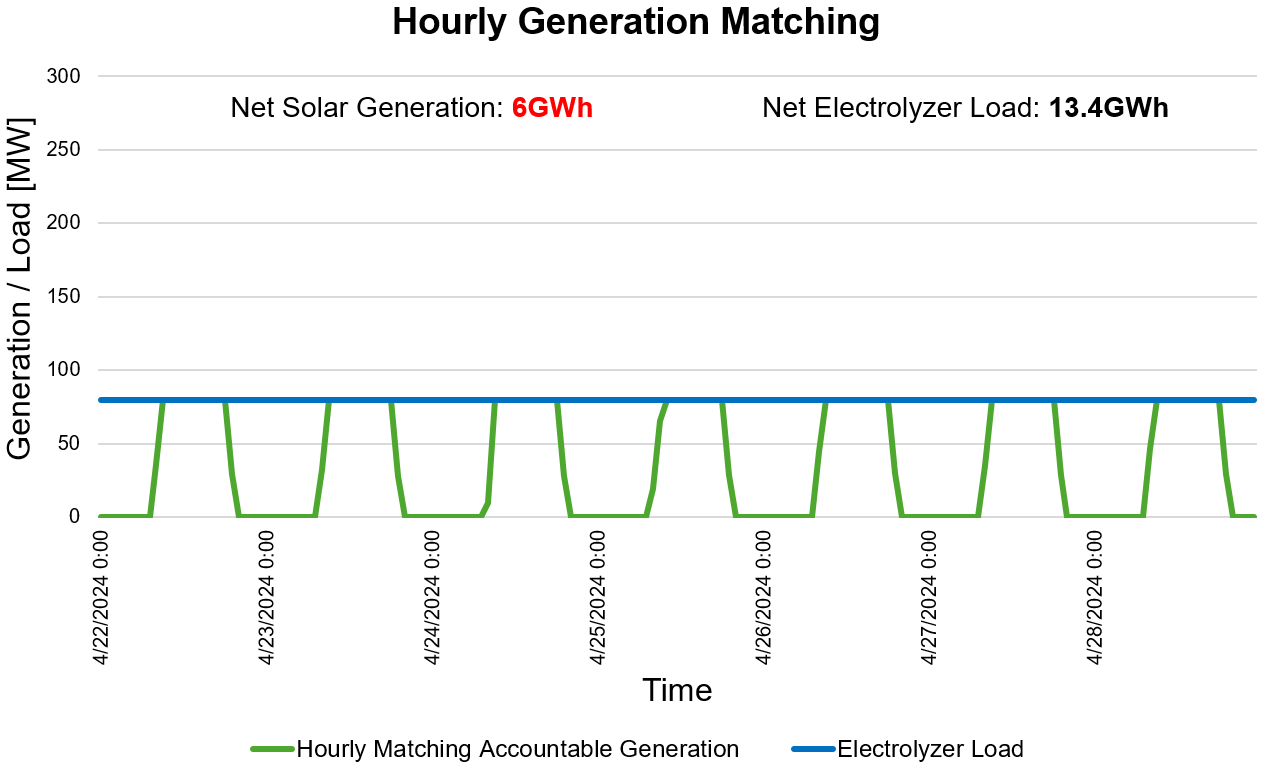

When switching to an hourly matching requirement, all overprocurement is non-applicable — resulting in only 41% of hours matching fully! Daytime solar generation exceeding the electrolyzer’s consumption is discarded. Meanwhile, the solar plant does not produce electricity overnight, therefore no tax credit could be claimed in those hours.

The necessity of rethinking procurement

As demonstrated, the change to hourly matching mandated by 45V requires a rethinking of procurement strategy for many hydrogen developers. In particular, developers will need to build a diverse procurement portfolio, because a mix of wind and solar will be required to match the electrolyzer consumption during both day and night.

A fine balancing act emerges between procuring enough clean energy to fuel the electrolyzer but cutting overprocurement as it will not apply to matching generation. One possible solution is creating a diverse portfolio of projects and limiting purchases to a fraction of each project’s capacity. This strategy would provide a wide base for consistent energy production while limiting overprocurement. Still, this is easier said than done and comes with high transaction costs and portfolio management overhead. In addition, even the most diverse portfolio will not guarantee 100% electrolyzer utilization due to the nature of intermittent renewable production.

We have created a simulated scenario in which a 100 MW electrolyzer will be powered by power purchase agreements from three different sources at varying contracted fractions. We encourage you to try to optimize this portfolio by modifying each project’s contracted fraction, balancing the electrolyzer’s load with overprocurement.

It is worth noting that although this particular simulation and blog post focus on 45V and green hydrogen, the same challenges faced by hydrogen producers would be faced by a broader set of market participants should the GHG Protocol require hourly matching, as is currently proposed in ongoing revisions.

Moving forward, hydrogen producers looking to take advantage of green hydrogen PTCs will require a more nuanced approach to procurement. Optimization solutions like the one explored in this article require large amounts of data for analysis and subject matter expertise because forecasting and portfolio management become increasingly important to project economics. This quickly becomes complex, requiring, for example, stochastic modeling of generation outages and curtailment, alongside expected variations due to different weather conditions at different project sites.

The hourly matching requirement undoubtedly increases the cost and complexity of purchasing clean electricity for electrolytic hydrogen. Therefore, producers should keep in mind resource type, procurement diversity, and stringent portfolio management when setting their strategies for green hydrogen production and 45V compliance.

To learn more or speak to a member of our team, please click the button below.

This article contains a collection of information related to REsurety, Inc. and the commodity interest derivatives services and other services that REsurety, Inc. provides. Any statements of fact in this article are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor do they purport to be complete. No responsibility is assumed with respect to any such statement, nor with respect to any expression of opinion which may be contained herein. The risk of loss in trading commodity interest derivatives contracts can be substantial. Each investor must carefully consider whether this type of investment is appropriate for them or their company. Please be aware that past performance is not necessarily indicative of future results. Image: iStock / Petmal.

Return to the blog post main menu.