Authored by Aaron Perry, Director, Commodity Trading Advisory, REsurety

Director,

Commodity Trading Advisory

Virtual power purchase agreements (VPPAs) are a powerful and popular way for clean energy buyers to contract solar and wind energy. But recent market, regulatory, and policy shifts might expose buyers to more financial risk than they’ve seen in the past.

Price volatility has become the rule, not the exception — and for clean energy buyers, the stakes are rising. Now is a great time to examine your risk management strategy and understand what options you have to mitigate your exposure to power market volatility.

This article explains one such approach to gain more budget confidence: a settlement swap agreement (SSA).

How VPPAs work with SSAs

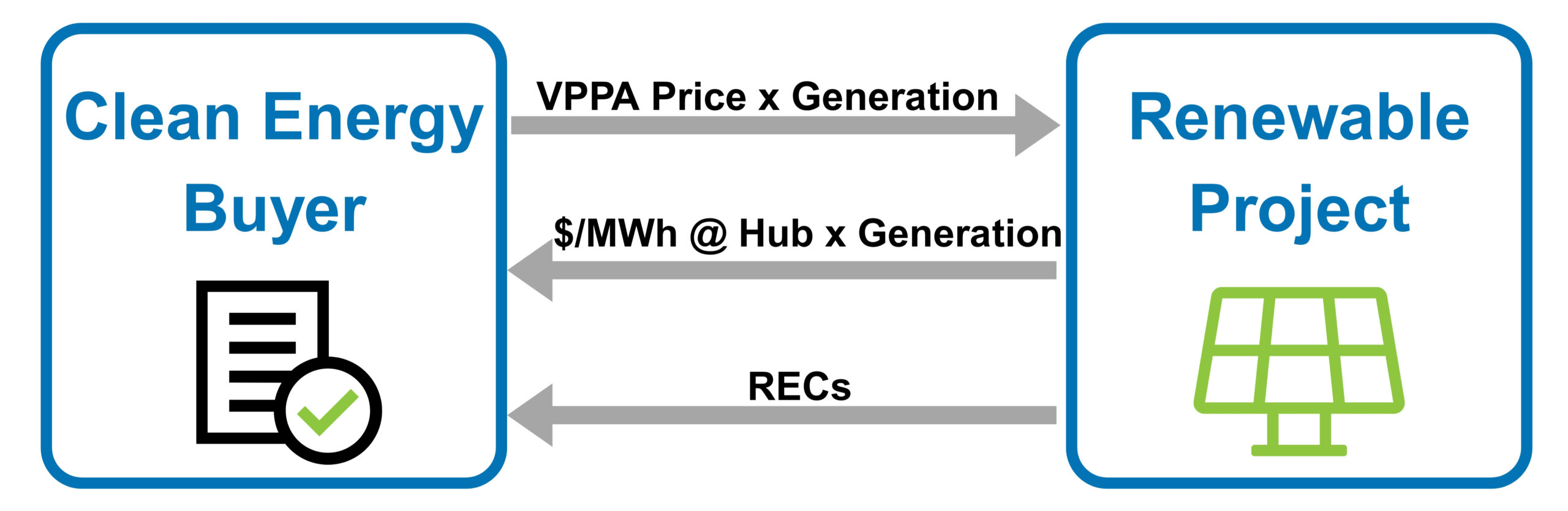

In a VPPA, the clean energy buyer doesn’t take physical delivery of the power. They pay a fixed price (aka strike price) per MWh generation, but the electricity gets sold into the local market. They receive the associated RECs and the wholesale market price as settled at a defined hub or node. This is also often known as a contract for differences (CfD).

The market price can fluctuate, exposing the buyer to volatility. Sometimes the difference between their VPPA strike price and the wholesale market price pays out in their favor; sometimes the reverse is true.

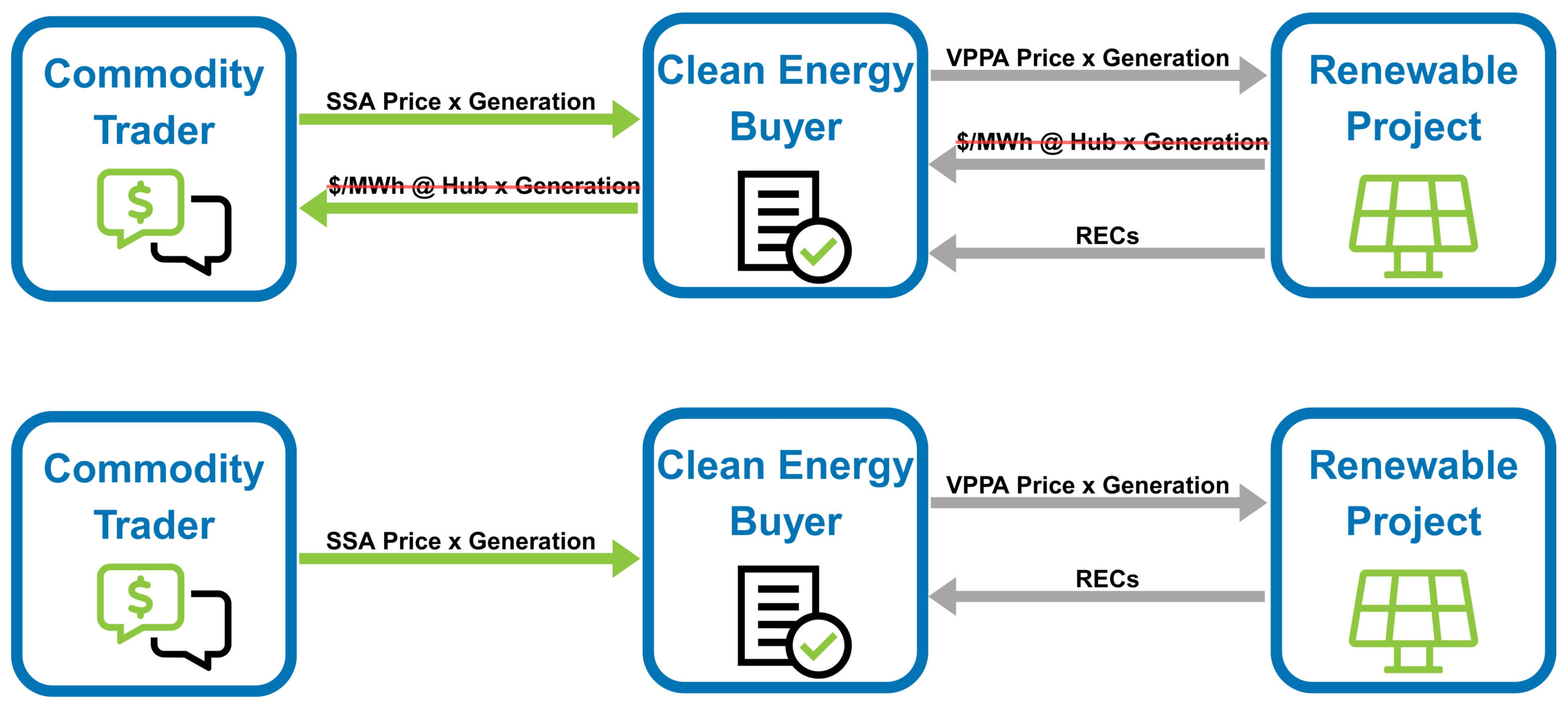

A settlement swap agreement (SSA), also known as a VPPA hedge, can help clean energy buyers reduce their exposure to this power market volatility and provide more confidence around their VPPA settlements.

Through an SSA, the clean energy buyer is able to pass the market price along to a third party, such as a commodity trader. In return, the buyer receives a fixed SSA price. Thus, they’ve offset a volatile portion of their VPPA and increased the stability of their cashflows.

With a VPPA and SSA both in place, a clean energy buyer effectively only needs to pay the difference between the VPPA price and the SSA price, while still receiving the environmental attributes from the clean energy project (i.e., RECs).

The buyer will still need to consider seasonal and weather-related variations in generation for budgeting, but the exposure to fluctuations in market price are removed.

What does an SSA look like in practice?

The price offered for an SSA will depend on the current market price for power at a project, which could be higher or lower than the VPPA price. If the SSA price is higher than the VPPA price, the buyer will receive revenue from the net of the two deals. If the SSA price is lower, then the buyer will pay out on net. Both of these scenarios are potentially beneficial, in that the settlements on a $/MWh basis are more consistent than the volatility and variability in power markets.

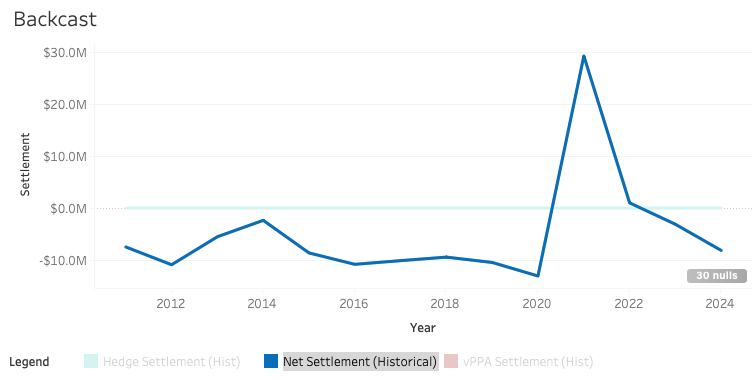

Let’s consider a hypothetical wind project in Texas with a $35/MWh VPPA. Over the past few years, annual settlement has varied between -$13M and $29M. Depending on natural gas prices — which are the primary driver of wholesale electricity market prices — forecasted settlement could vary anywhere from -$5M to $10M. (When natural gas prices are low, wholesale prices drop too, potentially putting the VPPA under water. When natural gas prices are high, electricity market prices also rise, putting the VPPA “in the money.”)

The figure immediately below shows REsurety’s historical back cast for the period 2011–2024, showing the -$13M to $29M spread. The notable spike in 2021 was the combined result of higher overall natural gas prices plus the impact of Winter Storm Uri, which saw ERCOT electricity market prices peak at $9,000/MWh.

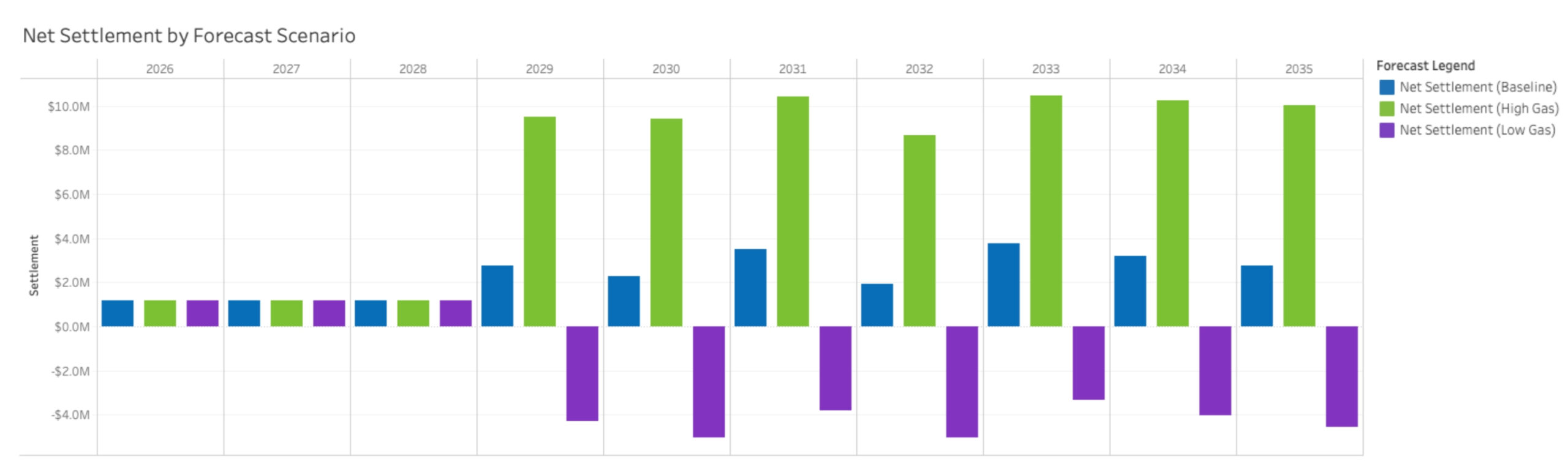

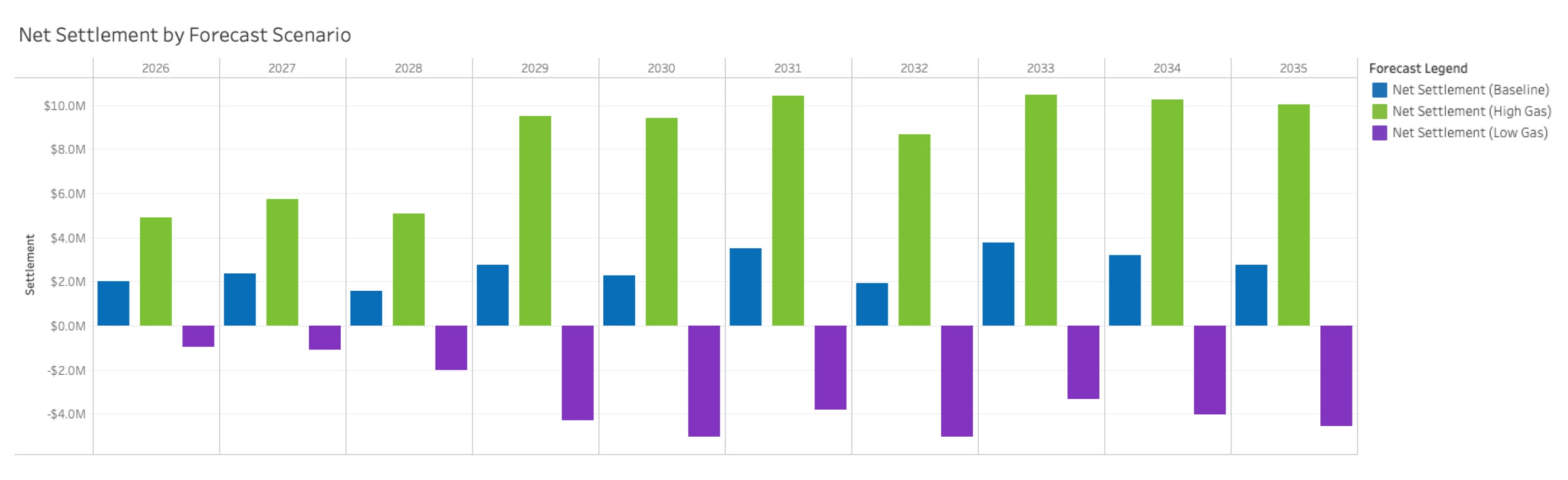

In the forecast graph below looking ahead at years 2026–2035, the blue column represents REsurety’s baseline case using projections about generation buildout and demand growth, as well as market natural gas prices. The green and purple columns represent high and low natural gas scenarios, respectively. The base case looks good, but if natural gas prices fall (and wholesale electricity market prices with them), it could leave the VPPA and clean energy buyer in the negative.

If a buyer wanted to hedge the next three years and was able to get an SSA for $37/MWh, they would “lock in” $2/MWh for the term of the hedge, or roughly $1.2M annually, assuming average project generation in each year.

If the buyer didn’t want to hedge the entire project, even at 50% of their contracted volume, the forecasted volatility would shrink to -$2M to $6M over the hedge term.

Finally, let’s say the buyer wanted to reduce their risk for the remaining term. Longer-term hedges can sometimes be more expensive, so let’s assume a $33/MWh hedge (instead of $37/MWh for the short-term hedge). In this case the buyer would “lock in” a -$2/MWh for the remainder of the VPPA term. This cost can be thought of as the implied cost of renewable energy certificates (RECs) as well as the cost of risk management.

What are my risks?

Like all financial instruments, an SSA isn’t risk-free. All of the examples provided in this article assume a simple structure for the swap portion of the VPPA. However, most VPPAs are more complex than that, with price floors, availability guarantees, basis provisions, damages provisions, and other terms that can impact the calculation of settlement or trigger payments.

The biggest risk of an SSA is that one of these terms can trigger payment if the VPPA isn’t matched (or back-to-backed) in the SSA. For instance, if the buyer signs an SSA with a $0/MWh price floor, but there is no price floor in the VPPA, then the buyer may be liable for payment under the VPPA but not receive the needed level of protection from the SSA.

Ensuring alignment between the VPPA and SSA is incredibly important prior to entering these contracts. REsurety aims to mitigate this risk by including the original VPPA in the SSA contract to help remove ambiguity and make the intent of the hedge clear. In cases where terms cannot be perfectly aligned, understanding what the gap is, and the impact is, is important to understanding whether this type of hedge is right for you.

How do you get started?

Explore the tool below, which allows you to simulate a 10-year VPPA and a hedge for a wind project in Texas to get a better intuitive understanding of the settlement swap agreement product. For the best user experience, please explore this tool directly on Tableau.

Considering this product for your risk management strategy? Reach out to us to explore how our solutions can integrate with your portfolio.

REsurety offers flexible options, including self-service settlement swap agreements via the CleanTrade platform or personalized assistance with back-to-backing and quote sourcing.

Use the scroll bar to navigate left and right

DISCLAIMER: This blog post contains information related to REsurety, Inc. and the commodity interest derivatives services and other services that REsurety, Inc. provides. Any statements of fact in this presentation are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor do they purport to be complete. No responsibility is assumed with respect to any such statement, nor with respect to any expression of opinion which may be contained herein. The risk of loss in trading commodity interest derivatives contracts can be substantial. Each investor must carefully consider whether this type of investment is appropriate for them or their company. Please be aware that past performance is not necessarily indicative of future results. Image: iStock/Petmal.

All information, publications, and reports, including this specific material, used and distributed by REsurety shall be construed as a solicitation. REsurety does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.