October 23, 2024

Continually providing value to our customers

Authored by Ryan Gao, Senior Research Associate, REsurety

Senior Research Associate

Background

At REsurety, our Weather-Smart forecasts provide customers with hourly prices and carbon impact data over the coming 20 years. These hourly forecasts are provided across a variety of weather conditions based on the past 40 years as well as five different market fundamentals scenarios. As of the end of 2023, we have made Weather-Smart forecasts available across all seven deregulated ISOs in the United States. To assess the quality of our Weather-Smart forecasts, we put our forecasts through a reality check and compared how they were performing for the first half of 2024 against observed prices and market forwards. This comparison indicated that the forecasts are fundamentally sound and highlighted the importance of providing forecasts across a variety of weather and fundamentals scenarios. Specifically, the Q4 2023 Low Gas scenario forecast produced a very close price prediction, largely because the gas price inputs used for the first half of 2024 were very close to the realized gas prices. Overall, our forecasts provide a wide variety of weather conditions and different fundamental scenarios, which deliver immense value to our customers by reflecting the uncertainty inherent in price predictions.

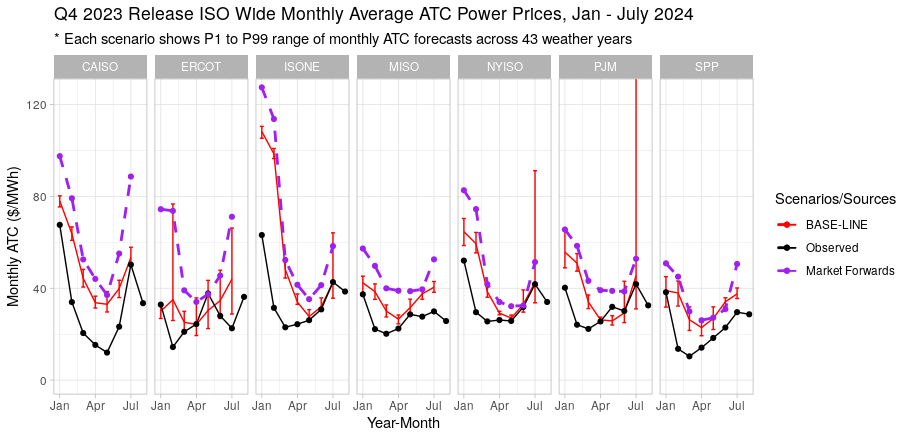

Monthly ATC Power Price Comparison

A closer look at the monthly around-the-clock (ATC), or average, power prices has shown that our forecasts in the Baseline fundamentals scenario, depicted in the red curves here, are lower than the OTC Global Holdings (OTCGH) power forwards, depicted in the purple curves. While REsurety’s Baseline predictions were lower than the OTCGH power forwards, both REsurety’s Weather-Smart forecasts and the OTCGH forwards were higher than the observed ATC prices during most months in the first half of 2024. However, our Baseline predictions are actually closer to the observed ATC prices. With that said, our forecasts were lower for a good reason. When considering why both our forecasts and the OTCGH power forwards were higher than the actual observed ATC prices, the biggest driver is gas prices. Back in 2023, the predicted gas prices for the first half of 2024 were significantly higher than what was actually realized. This was driven by a variety of factors including the geopolitical development in Europe and also the outlook for more extreme weather conditions based on what took place last year. However, actual gas prices were much lower than what was predicted back in 2023 due in part to the relative cooling of the geopolitical situation, and milder weather in the first half of 2024.

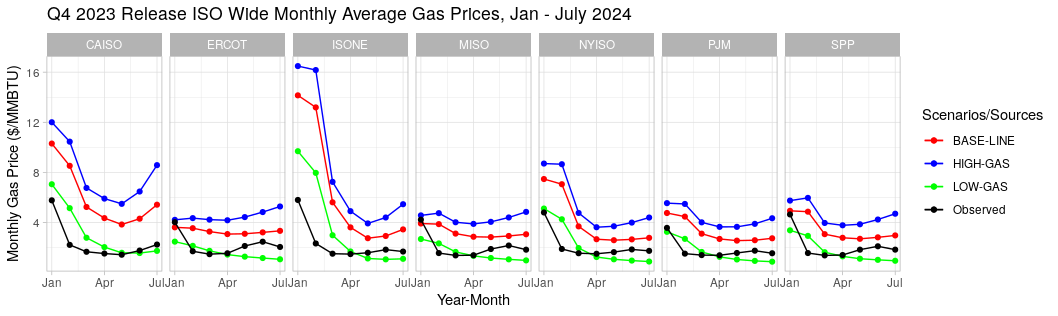

Monthly Gas Price Comparison

When looking at a view of the gas prices from OTCGH gas forwards back in the fourth quarter of 2023, we can see that the OTCGH gas forwards definitely indicated much higher prices than what were observed later. Again, our fundamentals-based forecasts provide predictions over a variety of gas scenarios besides the Baseline which is based on the OTCGH gas forwards. We provide a High Gas scenario, as shown in the blue curves, and a Low Gas scenario, shown in the green curves, in order to reflect the distribution of outcomes that can result due to different gas price assumptions. It is visible from the graph that the gas prices in the Low Gas scenario that we used back in Q4 2023 were very close to the observed prices in the first half of 2024.

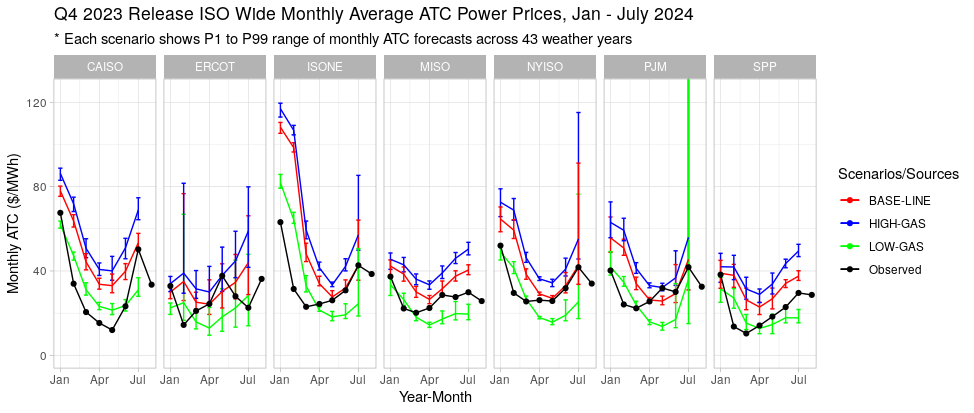

Our Forecasts on Different Gas Scenarios

With the gas prices assumed in Q4 2023, we can see across different scenarios that the Q4 2023 Low Gas scenario actually predicts power prices that are quite close to what was observed over the first half of 2024. Of course, it won’t always be clear which of our scenarios will provide the best prediction in each release of our Weather-Smart forecasts. But importantly, our forecasts provide a wide range of market fundamentals scenarios and weather conditions that enable our customers to better understand the risks related to gas prices and renewable build-out assumptions, as well as the range of variability across different weather conditions.

Conclusion

This most recent comparison increased our confidence in REsurety’s Weather-Smart forecasts. The fundamentals and weather scenarios we provide reflect the uncertainties in market fundamentals, and assist our customers in evaluating and managing the risks associated with their assessments of renewable projects. We at REsurety will continue to monitor the state of our Weather-Smart forecasts and keep our customers’ best interests and priorities in mind as we move forward.

Return to the blog post main menu.