Risk Management

We develop customized risk mitigation and hedging strategies to fit your existing portfolio and risk appetite. We provide origination and best-in-class analytics to support renewable energy risk transfer contracts. We help you source opportunities and fully understand the risk profile and mitigation strategies before trading.

Portfolio Tracking and Forecasting

Understand the performance of your clean energy investments using Portfolio Tracker. Quickly understand how future events may impact the returns of your investment and identify opportunities to maximize returns or manage selective risks. Access high accuracy estimates of project and contract performance long before project data is typically provided.

![]()

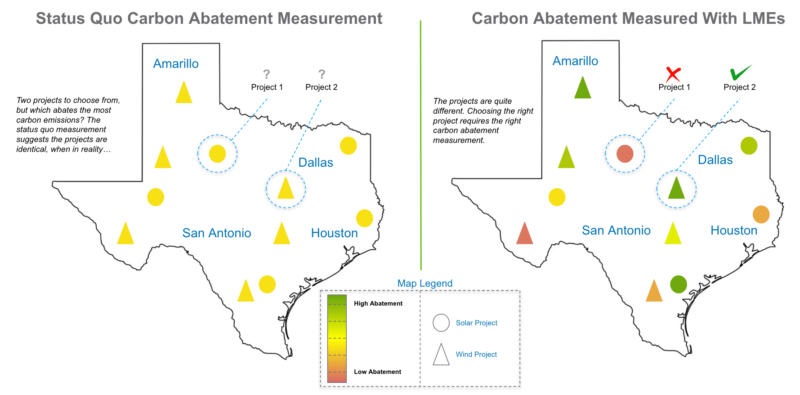

Carbon Impact

Measure the precise carbon impact of your investments in energy projects without relying on regional or market-wide averages. LMEs reflect the impact of transmission congestion on carbon emissions and can be used to support granular siting decisions as well as generation technology selection.

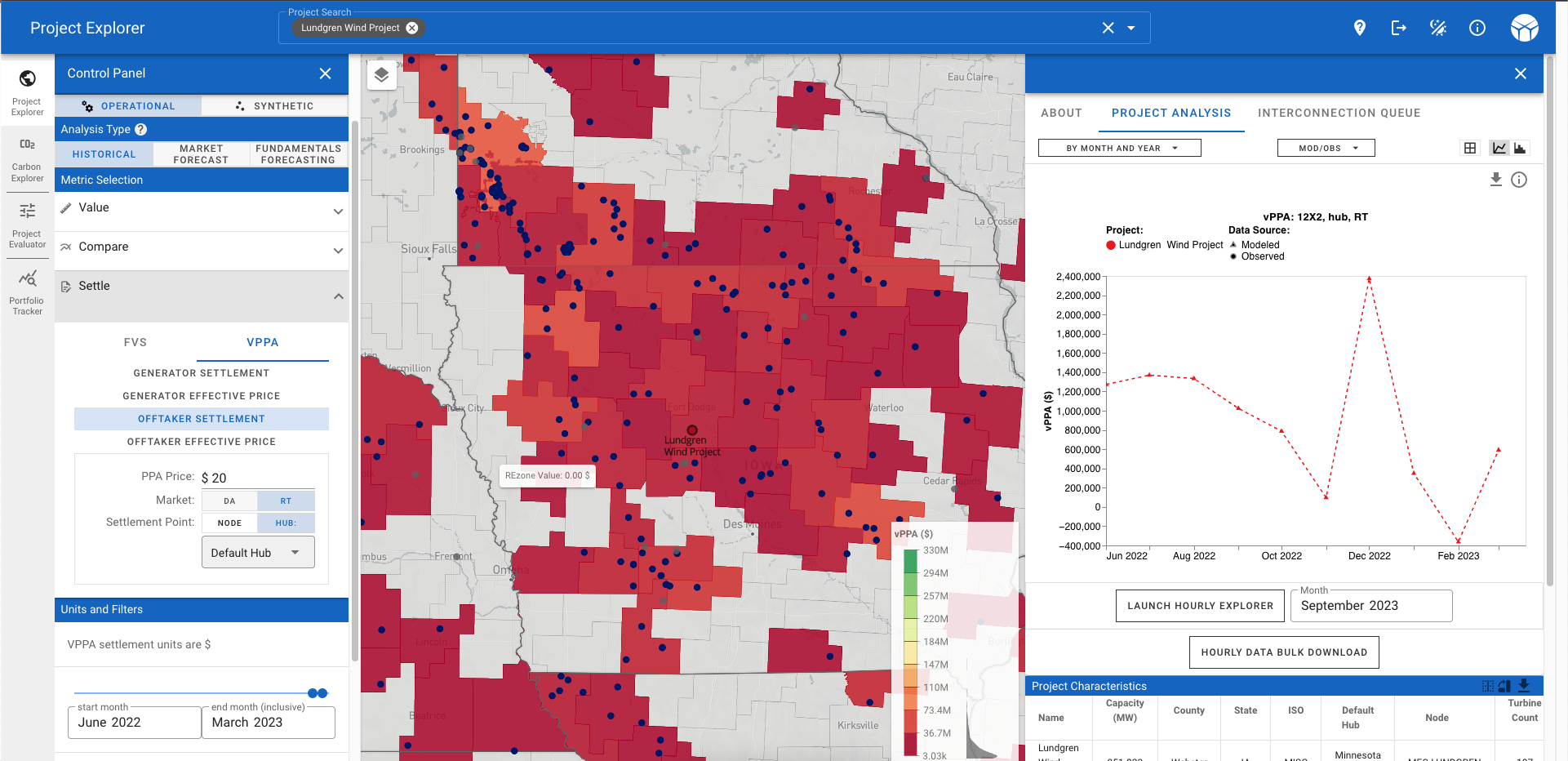

Market Analytics

Evaluate investment opportunities more quickly and accurately with Project Explorer, which offers data-driven, unparalleled visibility into renewable energy market performance and trends. From regional trend analysis to hourly project performance benchmarking, Project Explorer delivers the breadth and depth of analysis you need, quickly and accurately, all with a couple of clicks.